A major Chinese maker of bitcoin mining machines yesterday argued against an indiscriminate crackdown on cryptocurrency mining in China, saying that the business helps make better use of electricity, and contributes to employment and the local economy.

Canaan Inc (嘉楠耘智) chief executive officer Zhang Nangeng (張楠賡) told an earnings conference call that although fossil-fuel powered cryptomining activities hamper Beijing’s greenhouse gas reduction efforts, those powered by clean energy should be spared from the crackdown.

“For-profit miners prefer regions with low electricity prices that indicate oversupply, and likely energy waste,” Zhang said. “Bitcoin miners also help create jobs in impoverished regions and contribute to fiscal coffers.”

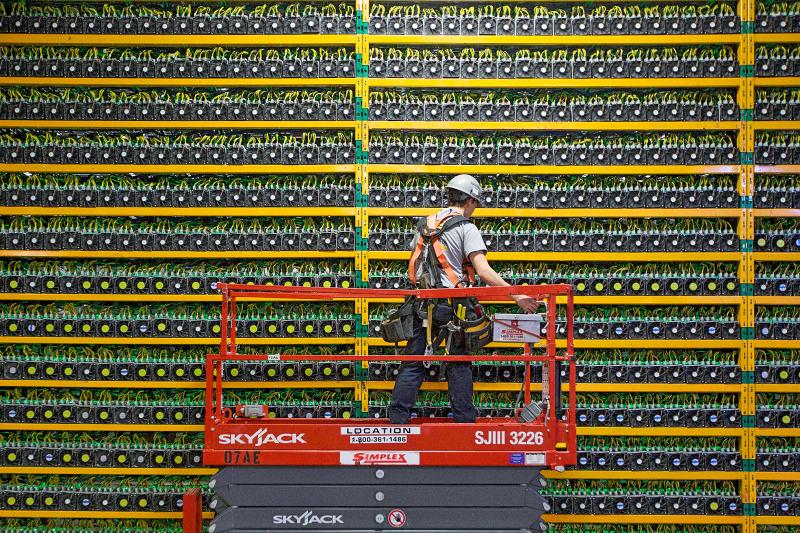

Photo: AFP

Zhang’s comments came after the Chinese State Council last month ordered a crackdown on energy-intensive bitcoin mining and trading, and Inner Mongolia, a major mining center, proposed measures to root out the practice.

Energy regulators in southwest Sichuan — a province rich in hydropower — yesterday met local power generators to probe cryptomining in China’s second-biggest bitcoin production hub.

Bitcoin and other cryptocurrencies are created or “mined” by high-powered computers competing to solve complex mathematical puzzles in an energy-intensive process that often relies on fossil fuels, particularly coal.

NASDAQ-listed Canaan makes machines, or rigs, to mine bitcoins.

Zhang said that policy uncertainty is prodding domestic miners to move overseas, and causing some clients to hold off placing new orders for mining equipment.

Beijing’s crackdown is also prompting some miners to “undersell” mining equipment, helping knock down prices, Zhang said.

Spot prices of bitcoin mining machines are down 20 to 30 percent from about a month ago, hurt by falling bitcoin prices.

To reduce business uncertainty, Canaan is accelerating overseas expansion, securing long-term contracts and setting up its own offshore bitcoin mining business, Zhang said.

Canaan, which on Tuesday reported a nearly 500 percent surge in first-quarter sales to 402.8 million yuan (US$63.1 million), said that overseas markets now contribute to 78.4 percent of its total revenue.

That compares with just 4.9 percent in the first quarter of last year.

Orders from overseas clients, including Canada’s Hive Blockchain Technologies Ltd and Core Scientific Inc, accounted for more than 70 percent of total orders, it said.

Canaan is also expanding into bitcoin mining itself, having set up an office in Singapore, and is preparing to launch a cryptomining business in Kazakhstan.

“Just as it took a long time for bitcoin to be recognized by the market, there will also be a [long] process for bitcoin, and cryptomining, to be recognized by [Chinese] regulators,” Zhang said.

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said second-quarter revenue is expected to surpass the first quarter, which rose 30 percent year-on-year to NT$118.92 billion (US$3.71 billion). Revenue this quarter is likely to grow, as US clients have front-loaded orders ahead of US President Donald Trump’s planned tariffs on Taiwanese goods, Delta chairman Ping Cheng (鄭平) said at an earnings conference in Taipei, referring to the 90-day pause in tariff implementation Trump announced on April 9. While situations in the third and fourth quarters remain unclear, “We will not halt our long-term deployments and do not plan to

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar