As the value of bitcoin soars and concerns rise about the energy-intensive process needed to obtain it, cryptocurrency entrepreneurs in the US believe they have found a solution in flared natural gas.

Profitably creating, or mining, bitcoin and other cryptocurrencies requires masses of computers dedicated to solving deliberately complicated equations — an endeavor that globally consumes more electricity than entire nations, but for which these start-ups say the jets of flaming gas placed next to oil wells are perfect power sources.

“I think the market is enormous,” said Sergii Gerasymovych, CEO of EZ Blockchain, which has six different data centers powered off natural gas in the US states of Utah and New Mexico, as well as in Canada.

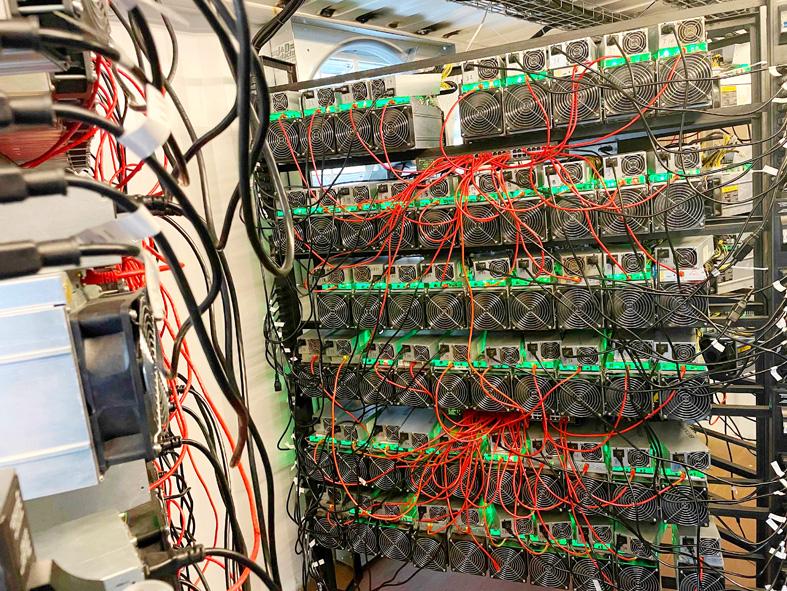

Photo: AFP / Matt Lohstroh / handout

Across the country, companies like EZ Blockchain are setting up shipping containers where racks containing hundreds of computers mine cryptocurrency, fueled by natural gas from oil wells that otherwise would be burned in the open.

Interest in their work has grown over the past year. Bitcoin and other cryptocurrencies like ethereum and dogecoin have seen meteoric price spikes since the COVID-19 pandemic turned the global economy on its head and mainstream companies began to embrace the technology.

A backlash has formed against the digital assets’ energy usage, fueled by concerns it relies on carbon-emitting power sources that contribute to climate change.

Photo: AFP / Matt Lohstroh/ handout

This week, Tesla Inc boss Elon Musk criticized bitcoin’s power consumption, particularly of energy produced from coal, and said he would no longer accept the cryptocurrency as payment for his electric vehicles.

While entrepreneurs in the fledgling industry say that using natural gas that is otherwise wasted represents a solution to these concerns, its ability to actually cut emissions remains to be seen, said Tony Scott, managing director of analysis at oil and gas research firm BTU Analytics.

“In the grand scheme of things and relative to other load, yes, it’s small,” Scott said. “They are creating economic value; they’re not necessarily significantly changing the emissions profiles.”

Huge numbers of processors worldwide are dedicated to the task of mining bitcoin. The activity uses 149.6 terawatt-hours per year, according to the Cambridge Bitcoin Energy Consumption Index (CBECI). That is slightly less than all the electricity consumed by Egypt.

As the most popular cryptocurrency, bitcoin is undoubtedly valuable, trading at about US$50,000 in the middle of this month from less than US$10,000 a year earlier, giving miners incentive to find the cheapest source of power to increase their margins.

Enter flared natural gas. Oil producers flare natural gas if they cannot find a way to process it, which, with prices low and pipelines complicated to build, can be the case worldwide.

“Miners tend to be based around areas where there tends to be surplus power. What is new ... is this whole concept of taking gas flaring,” said Jason Deane, bitcoin analyst at Quantum Economics.

Flaring combusts many of the greenhouse gases in natural gas, but the International Energy Agency said that the approximately 150 billion cubic meters of natural gas flared worldwide in 2019 put out about the same amount of carbon dioxide as Italy.

Using flared gas to power the application-specific integrated circuits that mine bitcoin does not end emissions entirely, but is more efficient than flaring it and puts energy that is otherwise wasted to use.

“We come in, they’re making zero for their gas, we say: ‘Hey, we’ll come in [and] take the gas off your hands, give you a little something,’” Giga Energy Solutions cofounder Matt Lohstroh said.

“We’ll be able to reduce your emissions you’re putting out, combust it, create economic value on our end,” he added.

Natural gas’s edge is in the cost of power. CBECI estimates that the average global power cost for bitcoin mining is about US$0.05 per kilowatt hour. Lohstroh said that natural gas power could bring the kilowatt hour cost to below US$0.018.

Interest has grown in diverting flared gas to cryptocurrency mining, and not just because the digital assets are growing in value.

“There’s more scrutiny on issuing new flare permits and I think these producers are realizing that,” said Britt Swann, who is leading holding company Ecoark’s expansion into cryptocurrency mining.

“They are willing to play ball and figure out a way to use that gas without necessarily wanting any value for it,” Swann said.

Where companies differ is over what to do with bitcoin and other digital assets once they get it.

Ecoark intends to convert it into dollars, but Lohstroh plans to hold the bitcoin he mines, which he believes will one day underpin a new global financial system.

“No need to sell the most valuable asset in the world that’s underpriced,” he said.

RUN IT BACK: A succesful first project working with hyperscalers to design chips encouraged MediaTek to start a second project, aiming to hit stride in 2028 MediaTek Inc (聯發科), the world’s biggest smartphone chip supplier, yesterday said it is engaging a second hyperscaler to help design artificial intelligence (AI) accelerators used in data centers following a similar project expected to generate revenue streams soon. The first AI accelerator project is to bring in US$1 billion revenue next year and several billion US dollars more in 2027, MediaTek chief executive officer Rick Tsai (蔡力行) told a virtual investor conference yesterday. The second AI accelerator project is expected to contribute to revenue beginning in 2028, Tsai said. MediaTek yesterday raised its revenue forecast for the global AI accelerator used

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) has secured three construction permits for its plan to build a state-of-the-art A14 wafer fab in Taichung, and is likely to start construction soon, the Central Taiwan Science Park Bureau said yesterday. Speaking with CNA, Wang Chun-chieh (王俊傑), deputy director general of the science park bureau, said the world’s largest contract chipmaker has received three construction permits — one to build a fab to roll out sophisticated chips, another to build a central utility plant to provide water and electricity for the facility and the other to build three office buildings. With the three permits, TSMC

TEMPORARY TRUCE: China has made concessions to ease rare earth trade controls, among others, while Washington holds fire on a 100% tariff on all Chinese goods China is effectively suspending implementation of additional export controls on rare earth metals and terminating investigations targeting US companies in the semiconductor supply chain, the White House announced. The White House on Saturday issued a fact sheet outlining some details of the trade pact agreed to earlier in the week by US President Donald Trump and Chinese President Xi Jinping (習近平) that aimed to ease tensions between the world’s two largest economies. Under the deal, China is to issue general licenses valid for exports of rare earths, gallium, germanium, antimony and graphite “for the benefit of US end users and their suppliers

Dutch chipmaker Nexperia BV’s China unit yesterday said that it had established sufficient inventories of finished goods and works-in-progress, and that its supply chain remained secure and stable after its parent halted wafer supplies. The Dutch company suspended supplies of wafers to its Chinese assembly plant a week ago, calling it “a direct consequence of the local management’s recent failure to comply with the agreed contractual payment terms,” Reuters reported on Friday last week. Its China unit called Nexperia’s suspension “unilateral” and “extremely irresponsible,” adding that the Dutch parent’s claim about contractual payment was “misleading and highly deceptive,” according to a statement