The government’s Triple Stimulus Vouchers helped boost Taiwan’s retail sector last year amid the COVID-19 pandemic, the Ministry of Economic Affairs said yesterday as it unveiled the final tally for the program.

The ministry’s statistics showed that 23.32 million people in Taiwan, or 99 percent of the population, participated in the program, claiming either paper or digital vouchers.

The ministry said that 99.6 percent of the vouchers, or NT$64.28 billion (US$2.25 billion), were redeemed by vendors.

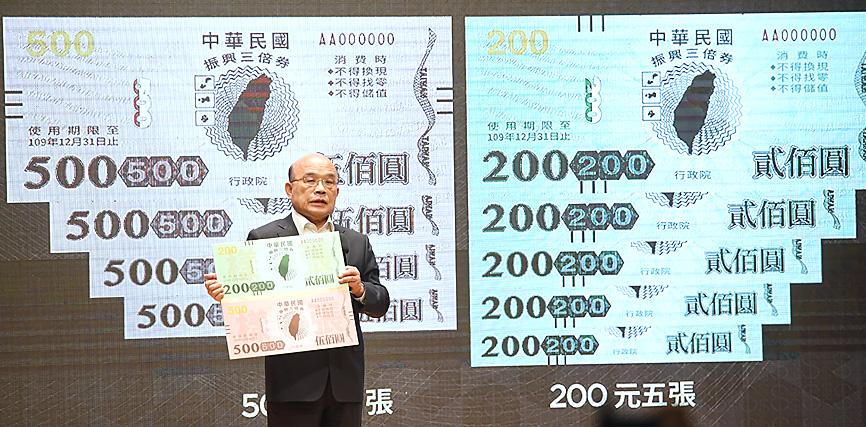

Photo: Liu Hsin-de, Taipei Times

Administration of the vouchers program, including printing and distribution, cost more than NT$2 billion, it said.

Department of Commerce Deputy Director-General Chen Mi-shun (陳秘順) said that the retail sector made a remarkable recovery after the launch of the program in the middle of July last year, which put NT$3,000 of vouchers in the pockets of eligible people.

“After five consecutive months of negative growth, the retail sector’s sales returned to positive territory in July last year, and there were record sales in the sector from August to November,” Chen said.

As the savings rate in Taiwan, is high, a cash stimulus would have gone into bank accounts or other investments, he said.

Marginalized and low-income groups received the vouchers without having to pay, he said.

“We designed the program to minimize the substitution effect and maximize the multiplication effect,” Chen said. “Once the vouchers were spent, those who received them could use them again.”

The substitution effect is when people used the vouchers on something they would have purchased without the program.

However, an informal survey showed that most used the vouchers to treat themselves.

“I got some nicer tea bags than I would have otherwise, and my boyfriend and I went out for a fancy meal,” a woman surnamed Huang (黃) said. “We were more willing to spend the vouchers.”

Others surveyed said that they took advantage of the vouchers to buy a new camera at a discount with a voucher-only deal or on convenience store gift cards.

Donovan Watson, an English teacher living in New Taipei City’s Sindian District (新店), went to Zara and bought clothing on an impulse.

Watson said that he was surprised, but appreciative that foreigners who are permanent residents were included in a later round of the program.

National Central University economist Dachran Wu (吳大任) said that the program had a positive effect and was one of the factors that helped the turnaround in the retail sector.

“After being cooped up for COVID-19 and with no way to leave the country, everybody wanted some revenge shopping,” Wu said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.