Electricity rates are to remain unchanged at NT$2.6253 per kilowatt-hour for the next six months, the Ministry of Economic Affairs said yesterday following a meeting of its electricity price review committee.

Electricity rates have not been altered in the four meetings since September 2018, and the committee decided to keep the rates unchanged until March 31 next year, before it holds its next twice-yearly meeting, the ministry said.

Saying that price stability is the overriding consideration of the committee, Deputy Minister of Economic Affairs Tseng Wen-sheng (曾文生) told reporters at a news conference that the body opted not to lower electricity prices, despite slumping crude oil prices.

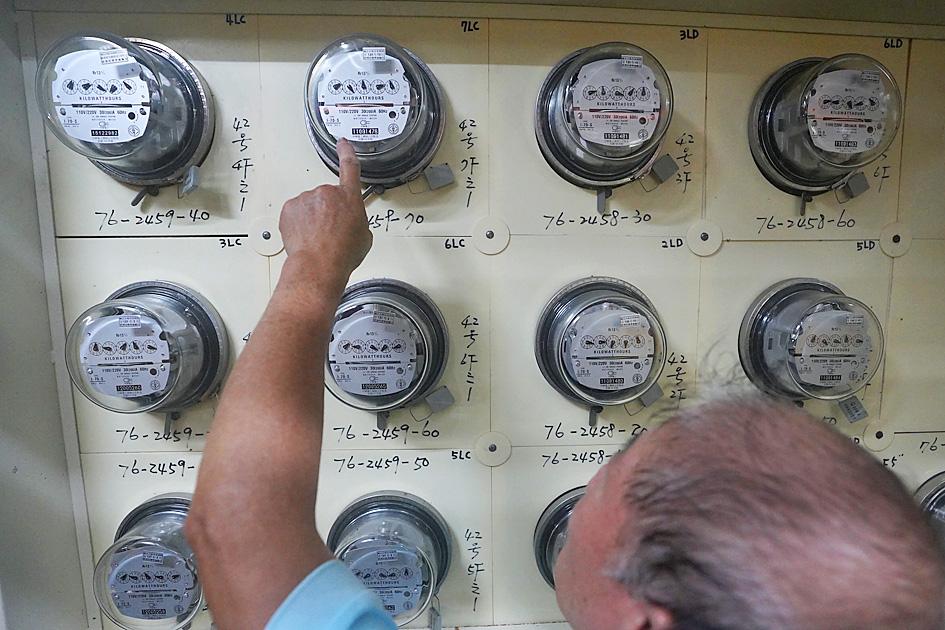

Photo: CNA

“While oil prices have fallen considerably, the US Energy Information Administration expects crude oil prices to rise to US$50 a barrel in 2021, compared with US$42 a barrel this year,” Tseng said.

Taiwan Power Co’s (Taipower, 台電) nuclear power back-end operational costs were another factor affecting the review of electricity rates, the ministry said.

Taipower would earmark NT$24.2 billion (US$820.73 million) for its Nuclear Power Back-end Operations Fund this year to pay for the decommissioning of nuclear power plants, Tseng said.

The operational costs swelled from NT$335.3 billion in a 2008 estimate to NT$472.9 billion in a 2017 estimate, he said.

“We need to make up the difference as quickly as possible from an accounting perspective,” he added.

After taking into account those factors, and comprehensively considering the price stability policy and the steady operation of Taipower, the committee decided to maintain the stability of electricity prices, Tseng said.

Meanwhile, if Taipower this year posts “a reasonable profit” of 5 percent of its revenue, the surplus would go to the energy price stabilization fund, which was established by the government to ameliorate the effects of short-term fluctuations in electricity prices on the economy, Tseng said.

There is currently NT$10.8 billion in the fund, he said.

Taipower, the nation’s largest electricity supplier and monopoly grid operator, is expected to be in the black this year, the ministry said.

The company reported a pretax profit of NT$8 billion in the first seven months of this year, up from a loss of NT$28.2 billion in the same period last year, according to the company’s Web site.

Tseng declined to make predictions about possible electricity rates, saying that there are too many uncertainties to take into account.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the