Gilead Sciences Inc yesterday said that it would charge the US government and other developed countries US$390 per vial for its coronavirus-fighting drug remdesivir, or about US$2,340 for a typical five-day course of treatment.

Gilead said in a statement that it would offer this price to developed countries around the world, to create a one-price model that would avoid the need for country-by-country negotiations, which could slow down access.

“We wanted to make sure that nothing gets in the way of remdesivir getting to patients,” Gilead chief executive officer Daniel O’Day said in an interview.

The price “will make sure all patients around the world have access to this medicine,” O’Day said.

The US$390 per vial price is for government entities. Once supply is less tight and Gilead starts selling the drug in normal distribution channels, the list price for private insurance companies and other commercial payers in the US would be US$520 a vial, or US$3,120 for a five-day course.

Remdesivir is one of the first widely used drugs for COVID-19. It received an emergency-use authorization from US regulators last month, after a big trial found the medicine sped recovery by about four days in hospitalized patients.

Hundreds of treatments and vaccines are in development worldwide as researchers race to find ways to halt a global pandemic that has infected more than 10 million people and killed more than 500,000.

Gilead had promised to donate its supply of the drug until the end if this month, but what the company would charge after the donation runs out has been furiously debated.

The drugmaker’s pricing decision is consequential because it sets a precedent for how much future medicines for COVID-19 might cost.

The company said that it could have charged more based on the value the medicine provides, the typical approach drugmakers use in setting pricing for new and innovative therapies.

Remdesivir could save US$12,000 per patient by getting people out of the hospital faster, but it went with a lower price to make sure that all developed countries could afford it, Gilead said.

Some estimates have found that remdesivir would be cost-effective at as much as US$4,500 for a treatment course.

Other advocates, including consumer-rights group Public Citizen, have said that the drug should just cost US$1 a day based on calculations that it could be manufactured at scale by generic drugmakers for that amount.

In the interview, O’Day said that US$1 per day was “not a realistic price point.”

Six vials of remdesivir are used during a five-day treatment, but a minority of patients need 10 days of treatment, or 11 vials, which would bring the total cost up to US$4,290.

Pricing of the drug was a balancing act, O’Day said.

On the one hand, a pandemic is raging and there is no cure. On the other, the company is a for-profit entity that has invested enormously in manufacturing large quantities of the medicine quickly, as well as developing new, easier-to-administer versions, he said.

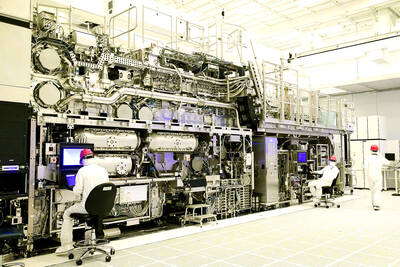

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

Apple Inc has closed in on an agreement with OpenAI to use the start-up’s technology on the iPhone, part of a broader push to bring artificial intelligence (AI) features to its devices, people familiar with the matter said. The two sides have been finalizing terms for a pact to use ChatGPT features in Apple’s iOS 18, the next iPhone operating system, said the people, who asked not to be identified because the situation is private. Apple also has held talks with Alphabet Inc’s Google about licensing its Gemini chatbot. Those discussions have not led to an agreement, but are ongoing. An OpenAI

INSATIABLE: Almost all AI innovators are working with the chipmaker to address the rapidly growing AI-related demand for energy-efficient computing power, the CEO said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reported about 60 percent annual growth in revenue for last month, benefiting from rapidly growing demand for artificial intelligence (AI) and high-performance computing applications. Revenue last month expanded to NT$236.02 billion (US$7.28 billion), compared with NT$147.9 billion in April last year, the second-highest level in company history, TSMC said in a statement. On a monthly basis, revenue surged 20.9 percent, from NT$195.21 billion in March. As AI-related applications continue to show strong growth, TSMC expects revenue to expand about 27.6 percent year-on-year during the current quarter to between US$19.6 billion and US$20.4 billion. That would

‘FULL SUPPORT’: Kumamoto Governor Takashi Kimura said he hopes more companies would settle in the prefecture to create an area similar to Taiwan’s Hsinchu Science Park The newly elected governor of Japan’s Kumamoto Prefecture said he is ready to ensure wide-ranging support to woo Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to build its third Japanese chip factory there. Concerns of groundwater shortages when TSMC’s two plants begin operations in the prefecture’s Kikuyo have spurred discussions about the possibility of tapping unused dam water, Kumamoto Governor Takashi Kimura said in an interview on Saturday. While Kimura said talks about a third plant have yet to occur, Bloomberg had reported TSMC is already considering its third Japanese fab — also in Kumamoto — which would make more advanced chips. “We are