European stocks failed to stage a recovery on Friday, posting their worst week since a market correction last February as a new sell-off hit bourses across the globe, amid worries about protectionism and fast-rising US interest rates.

Euro zone stocks initially jumped one percent, but rapidly shed all of their gains despite Wall Street opening higher.

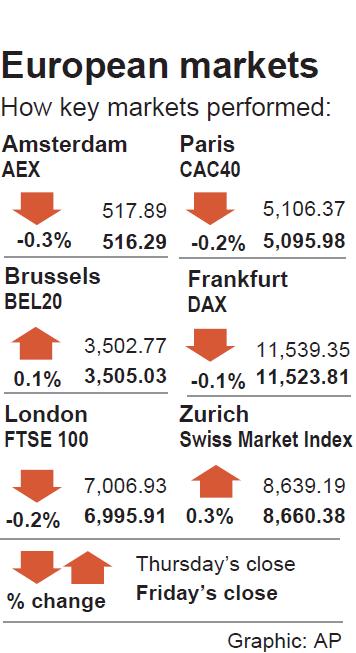

All major bourses closed in negative territory and the STOXX 600 benchmark fell 0.3 percent to 358.95 recording a weekly loss of 4.6 percent.

That is just below the 5.1 percent fallback experienced last February when a sudden scare about rising inflation and interest rates caused a global market correction.

UK shares fared similarly, with the FTSE 100 closing down 0.16 percent at 6,995.91 points, posting a weekly loss of 4.4 percent.

OUTPERFORMED

There is “a rotten trend” in Europe, a trader complained, saying that US shares have outperformed their European peers since the beginning of the year with fiscal cuts by US President Donald Trump’s administration boosting earnings.

Europe lags far behind the US in terms of earnings growth, and stronger results will be critical in luring back some of the billions that have been pulled out of European stocks this year.

Third-quarter results are beginning to trickle in from European firms as Wall Street banks formally kicked off the earnings season.

Tech stocks — the worst hit by this week’s sudden drop — made a modest comeback, up 0.5 percent, along with the growth-sensitive auto sector.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,