Venezuela’s currency has lost so much value that people simply throw away their small bills — they are virtually worthless anyway.

Enter Wilmer Rojas, 25, who scoops them up off the street, uses an origami-like folding technique, a needle and thread to make handbags with an eye to selling them — maybe even abroad, where people have real money.

Rojas can use as many as 800 bills to make such a purse. If you add up the face value of all that money, it is enough to buy only half a kilogram of rice. Rojas and his wife have three kids to feed, and another is on the way.

Photo :AFP

“People throw them away because they are no good to buy anything. No one even accepts them anymore,” Rojas told reporters outside a subway station, where he also sells coffee and cigarettes in addition to his unusual bag-weaving work.

Meanwhile, inflation in the oil-rich, cash-poor economy churns on and on: Since August last year, the bolivar has lost 87 percent of its value against the euro. Inflation this year is forecast by the IMF to come in at a staggering 13,000 percent.

With two, five and 10-bolivar notes, “you can’t even buy a piece of candy,” Rojas said, explaining how he used 400 such bills to make a smaller handbag.

Rojas then pointed to a queen’s crown he made out of bolivar notes.

“Here there are about 50,000 bolivars [US$2], which is maybe enough for a pack of cigarettes,” he said.

Rojas said he learned his craft from another makeshift artist.

“You can use magazine paper or newspaper pulp, but currency notes are better because they are not worth anything, they are all the same size and you don’t have to waste time cutting them,” Rojas said.

He hopes to start selling his creations soon, but he fears that Venezuela’s economic crisis might foil his plans.

“Here, people barely have enough to put food on the table and are not going to shell out money for something that required a lot of work,” he said.

In downtown Caracas, other hungry artisans are selling woven bags like these. They get as much as 300,000 bolivars for one of them. That would buy 1 kilogram of meat.

That Venezuela’s currency is being used as play money is the ultimate expression of how much value it has lost, economist Tamara Herrera said.

With 1,000 two-bolivar notes that nobody wants, Jose Leon, a 26-year-old designer, began a protest on Instagram in 2016 that featured doctored notes and the hashtag #venezueladevaluada, or devalued Venezuela.

Deadpool, the anti-hero in the Marvel comics, was the inspiration for his first work on currency notes, using his face to replace that of independence hero Simon Bolivar.

Leon has also drawn the faces of Star Wars characters over that of Bolivar and other famous Venezuelans pictured on the notes.

Leon’s customers live abroad and pay him up to US$20 per piece of “money art.”

“With a bit of Wite-Out and some pens, I can raise the value of the currency by nearly 5,000 percent,” Leon said at his workshop in San Cristobal, a city on Venezuela’s border with Colombia.

Leon is doing well with his art, but Rojas is still struggling to make money — in the meantime, he is using notes to make a carnival costume for his daughter.

“These things are no good for buying anything. At least I am putting them to good use rather than throwing them away,” Rojas said.

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

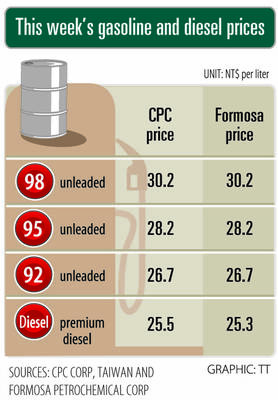

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

UNCERTAINTIES: The world’s biggest chip packager and tester is closely monitoring the US’ tariff policy before making any capacity adjustments, a company official said ASE Technology Holding Inc (日月光投控), the world’s biggest chip packager and tester, yesterday said it is cautiously evaluating new advanced packaging capacity expansion in the US in response to customers’ requests amid uncertainties about the US’ tariff policy. Compared with its semiconductor peers, ASE has been relatively prudent about building new capacity in the US. However, the company is adjusting its global manufacturing footprint expansion after US President Donald Trump announced “reciprocal” tariffs in April, and new import duties targeting semiconductors and other items that are vital to national security. ASE subsidiary Siliconware Precision Industries Co (SPIL, 矽品精密) is participating in Nvidia