Hiwin Technologies Co (上銀科技), a leading supplier of ball screws, linear guideways and industrial robots, yesterday forecast its core business would remain soft this quarter, but said it expects business to fare better next quarter, driven by increasing orders for industrial automation and robots.

“Shipments for Hiwin’s machine tools started to slow down last quarter due to overall weakness in the industry, and it is likely that the soft demand will persist throughout the remainder of this year and extend to the first half of next year,” Hiwin chairman Eric Chuo (卓永財) told reporters following an earnings conference in Taipei.

In the second quarter, Hiwin’s net income jumped 30.48 percent annually to NT$428 million (US$13.18 million), but plunged 16.89 percent from a quarter earlier, with earnings per share (EPS) of NT$1.6, missing the market’s consensus estimate of from NT$1.9 to NT$2.1.

Gross margin fell to a nine-quarter low of 35.9 percent last quarter, compared with the previous year’s 39.3 percent and prior quarter’s 39.2 percent, company data showed.

Chuo said China’s slowing economic growth and rising competition from Japan have suppressed global demand for Taiwan’s machine tool products, including Hiwin’s.

While industrial robots only accounted for 7 percent of the company’s total revenue of NT$4.32 billion last quarter, Chuo said this segment is to be Hiwin’s main growth driver this year.

“The machine tool segment is soft, but the demand for industrial automation and robots is getting stronger. I expect the robust demand for industrial robots to offset the weak demand for machine tool in the fourth quarter,” Chuo said.

He said the demand for single-axis robots used in the production process of smartphones was relatively soft in the first half of the year, mainly due to international smartphone brands’ requesting their handset assemblers to use older models of single-axis robots to cut costs.

However, demand for Hiwin’s multiple-axis robots used in various industries, such as pharmaceuticals and food processing, increased strongly in the past few months, he said.

“Some applications for industrial robots surprised me. I’ve never thought about using industrial robots to cut chicken fillets. The demand in the food industry is particularly strong,” Chuo said.

In an effort to expand production capacity for industrial robots, Chuo said the company is renovating its existing research and development center to a manufacturing plant.

On the back of the promising business of industrial automation, Chuo said he expects Hiwin’s annual revenue to hit a record level this year, growing at least 5 percent from last year’s NT$15.08 billion.

In the first seven months this year, cumulative revenue totaled NT$9.28 billion, up 17.5 percent from the same period last year.

However, Daiwa Capital Markets Inc is concerned about industrial automation demand in the second half amid the sluggish demand in China.

“We are concerned that Hiwin’s industrial robotics business will not be able to offset the weakness in industrial automation, as the robotics business is likely to account for less than 10 percent of its total sales in the second half of 2015,” Daiwa said in a note yesterday, cutting its 12-month share price target on Hiwin to NT$152 from NT$204.

Hiwin shares dropped 3.14 percent to NT$169.5 in Taipei trading yesterday.

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

Meta Platforms Inc offered US$100 million bonuses to OpenAI employees in an unsuccessful bid to poach the ChatGPT maker’s talent and strengthen its own generative artificial intelligence (AI) teams, OpenAI CEO Sam Altman has said. Facebook’s parent company — a competitor of OpenAI — also offered “giant” annual salaries exceeding US$100 million to OpenAI staffers, Altman said in an interview on the Uncapped with Jack Altman podcast released on Tuesday. “It is crazy,” Sam Altman told his brother Jack in the interview. “I’m really happy that at least so far none of our best people have decided to take them

PLANS: MSI is also planning to upgrade its service center in the Netherlands Micro-Star International Co (MSI, 微星) yesterday said it plans to set up a server assembly line at its Poland service center this year at the earliest. The computer and peripherals manufacturer expects that the new server assembly line would shorten transportation times in shipments to European countries, a company spokesperson told the Taipei Times by telephone. MSI manufactures motherboards, graphics cards, notebook computers, servers, optical storage devices and communication devices. The company operates plants in Taiwan and China, and runs a global network of service centers. The company is also considering upgrading its service center in the Netherlands into a

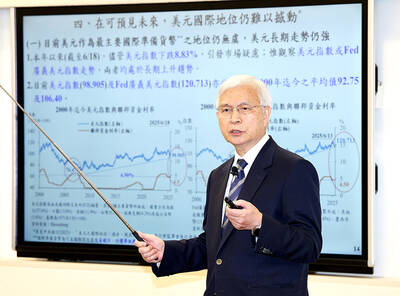

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”