Global interest rates are too low and pose a rapidly growing risk to financial stability and economic growth, the Bank for International Settlements (BIS) said on Sunday.

In its strongest warning yet that policy normalization should come sooner rather than later, the BIS said economic growth across the world is uneven, debt burdens in many areas are high and rising, and the explosion of credit growth shows financial imbalances are building up again.

The Switzerland-based BIS said a major contributory factor has been the pursuit of “excessively low” interest rates in response to the 2007-2008 global financial crisis and the deflation scare triggered by last year’s plunge in global oil prices.

However, keeping rates anchored at these historic, ultra-low levels threatens to inflict “serious damage” on the financial system and exacerbate market volatility, as well as limiting policymakers’ response to the next recession when it comes.

“Risk-taking in financial markets has gone on for too long and the illusion that markets will remain liquid under stress has been too pervasive,” the BIS said in its 85th annual report.

“The likelihood of turbulence will increase further if current extraordinary conditions are spun out. The more one stretches an elastic band, the more violently it snaps back,” it added.

BIS Monetary and Economic Department head Claudio Borio described the state of the global economy and financial system as one of “too much debt, too little growth and too low interest rates.”

The first US interest rate hike in almost a decade is now on the horizon and when the US Federal Reserve does move, it is likely to mark a turn in the global monetary policy tide. No fewer than 29 central banks have eased policy to some degree this year to boost growth, ward off the threat of deflation, or both.

The most notable of these has been the European Central Bank’s 1.1 trillion euro (US$1.22 trillion) “quantitative easing” program of bond buying, launched in March and due to run through to September next year.

In strong language for the usually reserved BIS, it said extraordinarily loose monetary policy on a global level can cause “pervasive mispricing” in asset markets, and that stocks and some corporate bond markets are now “quite stretched.”

“In some jurisdictions, monetary policy is already testing its outer limits, to the point of stretching the boundaries of the unthinkable,” the BIS said.

A return to more normal policies would be “bumpy,” not least because low rates have given rise to a “faulty debt-fueled global growth model” — precisely what caused the crisis in the first place.

Central banks have carried the burden of ensuring the post-crisis recovery for too long, the BIS said. Now longer-term policies to secure the stability of the global economy and financial system must be put in place, it said.

The leeway to do this opened up by the 60 percent plunge in oil prices between June last year and January is an opportunity governments should not pass up, the BIS said.

“Nothing is inevitable about this,” it added. A failure on the part of governments, central banks and financial regulators to adopt more “prudent” policies would risk “entrenching instability and chronic weakness.”

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

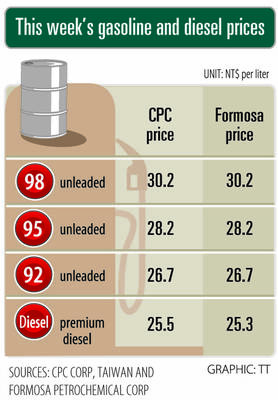

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

UNCERTAINTIES: The world’s biggest chip packager and tester is closely monitoring the US’ tariff policy before making any capacity adjustments, a company official said ASE Technology Holding Inc (日月光投控), the world’s biggest chip packager and tester, yesterday said it is cautiously evaluating new advanced packaging capacity expansion in the US in response to customers’ requests amid uncertainties about the US’ tariff policy. Compared with its semiconductor peers, ASE has been relatively prudent about building new capacity in the US. However, the company is adjusting its global manufacturing footprint expansion after US President Donald Trump announced “reciprocal” tariffs in April, and new import duties targeting semiconductors and other items that are vital to national security. ASE subsidiary Siliconware Precision Industries Co (SPIL, 矽品精密) is participating in Nvidia