Four major tech companies, including Apple Inc and Google Inc, have agreed to pay a total of US$324 million to settle a lawsuit accusing them of conspiring to hold down salaries in Silicon Valley, sources familiar with the deal said, just weeks before a high-profile trial had been scheduled to begin.

Tech workers filed a class action lawsuit against Apple, Google, Intel Corp and Adobe Systems Inc in 2011, alleging they conspired to refrain from soliciting one another’s employees to avert a salary war.

The workers planned to ask for US$3 billion in damages at the trial, according to court filings. That could have tripled to US$9 billion under antitrust law.

The case has been closely watched due to the potentially high damages award and the opportunity to peek into the world of Silicon Valley’s elite. The case was based largely on e-mails in which Apple’s late cofounder, Steve Jobs, former Google CEO Eric Schmidt and some of their Silicon Valley rivals hatched plans to avoid poaching each other’s prized engineers.

In one e-mail exchange after a Google recruiter solicited an Apple employee, Schmidt told Jobs that the recruiter would be fired, court documents show. Jobs then forwarded Schmidt’s note to a top Apple human resources executive with a smiley face.

Another exchange shows Google’s human resources director asking Schmidt about sharing its no-cold call agreements with competitors.

Schmidt, now Google’s executive chairman, advised discretion.

“Schmidt responded that he preferred it be shared ‘verbally, since I don’t want to create a paper trail over which we can be sued later,’” he said, according to a court filing.

The human resources director agreed.

The companies had acknowledged entering into some no-hire agreements, but disputed the allegation that they had conspired to drive down wages. Moreover, they argued that the employees should not be allowed to sue as a group.

Rich Gray, a Silicon Valley antitrust expert in private practice, said the companies had an incentive to avoid trial because their executives’ e-mails would make them look extremely unsympathetic to a jury. However, the plaintiff attorneys risked an appeals court saying the engineers could not sue as a group at all.

“An appellate court could say: ‘Hey we just don’t buy that,’” Gray said.

Trial had been scheduled to begin at the end of next month on behalf of roughly 64,000 workers.

Spokespeople for Apple, Google and Intel declined to comment. An Adobe representative said that the company denies it engaged in any wrongdoing, but settled “in order to avoid the uncertainties, cost and distraction of litigation.”

An attorney for the plaintiffs, Kelly Dermody of Lieff Cabraser Heimann & Bernstein, in a statement called the deal “an excellent resolution.”

The four companies in 2010 settled a US Department of Justice probe by agreeing not to enter into such no-hire deals in the future. They had since been fighting the civil antitrust class action.

The plaintiffs and the companies will disclose principal terms of the settlement by May 27, according to the court filing on Thursday, though it is unclear whether that will spell out what each company will pay.

Some Silicon Valley companies refused to enter into no-hire agreements. Facebook chief operating officer Sheryl Sandberg, for instance, rebuffed an entreaty from Google in 2008 that they refrain from poaching each other’s employees.

Additionally, Apple’s Jobs threatened Palm with a patent lawsuit if Palm did not agree to stop soliciting Apple employees. However, then-Palm chief executive Edward Colligan told Jobs that the plan was “likely illegal,” and that Palm was not “intimidated” by the threat.

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

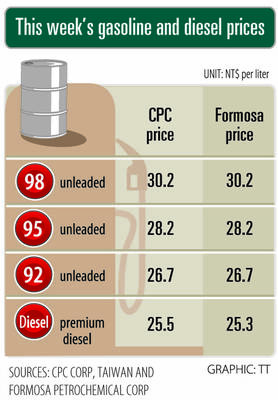

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01