Swiss pharmaceuticals giant Roche yesterday announced it had launched a takeover bid for Illumina, a US company that specializes in life sciences.

Roche said it had made “multiple efforts” to start talks with Illumina to negotiate a deal, but the US firm had not been willing to enter “substantive discussions.”

“Roche has therefore decided to promptly commence a tender offer to purchase all of the outstanding shares of common stock of Illumina for US$44.50 per share in cash,” a company statement said.

This offer was “full and fair value” for the company, Roche chief executive Severin Schwan said in a statement.

“It is our strong preference to enter into a negotiated transaction with Illumina, and we remain willing to engage in a constructive dialogue with Illumina to jointly develop an optimal strategy for maximizing the value of our combined business,” Schwan added.

PREMIUM

The statement said that the offer represented a 64 percent premium over Illumina’s stock price on Dec. 21 last year and put the value of the San Diego-based company at US$5.7 billion.

A brief statement from Illumina acknowledged that Roche had made an “unsolicited offer” for the company.

It said the board of directors would “thoroughly review” the proposal and make a recommendation “in due course,” adding that it had asked share holders to take no action in the meantime.

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

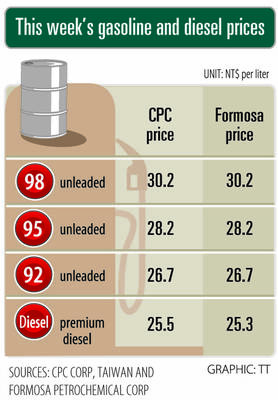

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01