Microsoft Corp’s board stood behind CEO Steve Ballmer on Thursday, defending its longtime leader after influential hedge fund manager David Einhorn touched off a debate by calling for his dismissal.

The fund manager, who made his name warning about Lehman Brothers Holdings Inc’s financial health before the investment bank’s collapse, accused Ballmer on Wednesday evening of being stuck in the past, launching the sharpest attack yet by a high-profile investor against the company’s leadership.

Einhorn’s comments, which echo what some investors have said for some years in private, caused a stir on Wall Street and helped Microsoft shares climb 2 percent on Thursday to US$24.67.

“His continued presence is the biggest overhang on Microsoft’s stock,” Einhorn told fellow fund managers at the annual Ira Sohn Investment Research Conference in New York.

Microsoft’s nine-person board, including chairman and co-founder Bill Gates, supports Ballmer, a source close to the board said on Thursday. Microsoft itself declined comment.

Gates, who co-founded the software company in 1975 and is still the largest shareholder with 6.6 percent of the company’s stock, is generally regarded as the one person who could make the decision to switch management.

“Bill Gates is a ruthless capitalist. If he wanted to, he’d walk Ballmer to the door himself,” said a fund manager at one of Microsoft’s largest shareholders, who asked to remain anonymous.

Gates, who spends most of his time on his philanthropic foundation, has given no indication he is considering a change. A representative declined comment on Thursday.

Other investors acknowledged Microsoft’s stock has suffered under Ballmer, but stopped short of calling for his ouster.

“I thought the board was firmly behind Steve and the only way Steve was going to leave was if Steve wanted to leave,” said Eric Jackson at hedge fund Ironfire Capital, which sold its position in Microsoft last autumn, -disappointed the company would not lift its dividend higher.

“I don’t see anybody else on the management team at Microsoft that I think would be much better than Ballmer,” Jackson said.

Whitney Tilson, founder and managing partner of T2 Partners LLC, which holds Microsoft stock, said Ballmer might be running out of steam.

“This dissatisfaction with Ballmer, with the company, is more than baked into the stock,” said -Tilson in an appearance on financial news channel CNBC. “When you’ve been the top dog so long, how do you become hungry again?”

Microsoft — the largest US company by market value in the late 1990s — has been overtaken by Apple Inc and International Business Machines Corp in market value and is no longer seen as a dominating force in technology after a failure to capitalize on Internet and mobile markets.

Before Thursday’s gain, the stock had been down 6 percent in the past two weeks after Microsoft agreed to pay US$8.5 billion for Internet phone service Skype, a move that mystified many investors.

Einhorn said it was time for Microsoft to consider strategic alternatives for its money-losing online business, which has so far failed to win share from Google Inc.

“Clearly, some people are calling for a change,” said Sid Parakh, analyst with McAdams Wright -Ragen. “If you look at the financial performance, that’s been fine. But I think the issue is broader than that.”

“If you look at search, mobile, tablet, these are areas they should have been investing in, and they have — but they weren’t able to get it right,” he added.

“If there was any reason to believe the board was not with Steve, it would be a different situation. But the board seems to be behind Steve,” Parakh said.

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

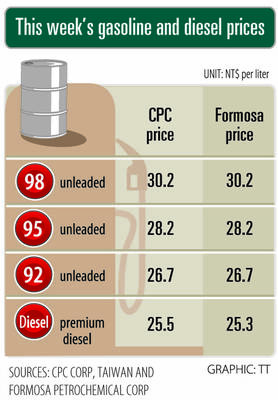

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01