The direction of the embattled Fiat conglomerate took an abrupt turn Friday with the death of the company's patriarch, Giovanni Agnelli, potentially opening the door to faster and more sweeping change, especially for the company's floundering auto business.

Agnelli's death came just a few hours before members of the Agnelli family, which founded Fiat and still controls it, were scheduled to gather here to review the family holding company's annual results for last year.

At a hurried 50-minute meeting Friday, the family designated Umberto Agnelli, Giovanni's younger brother, to take over as president of the holding company, Giovanni Agnelli & Compagnie. Through it and several other layers of holding companies, the family controls roughly one-third of Fiat's shares, along with a far-flung archipelago of other investments around the world. Family members at the meeting also agreed to propose a capital increase of 250 million euros (US$270 million) for the family holding company.

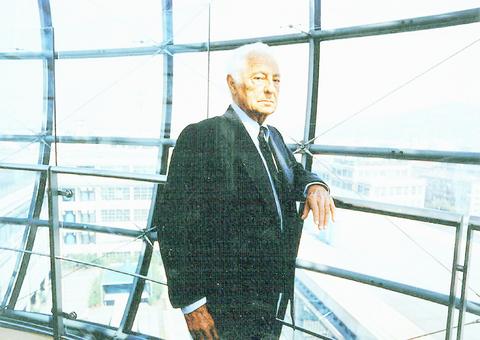

PHOTO: NY TIMES

In a statement afterward, the family said Umberto Agnelli, 68, had been asked to declare himself available to take on executive responsibilities at Fiat, and that he had agreed. A person close to the family said that this meant the family would propose Umberto Agnelli to succeed Paolo Fresco as chairman of Fiat. Fresco has said he would retire this summer when he turns 70; the next Fiat general shareholders' meeting is in May.

The decisions were notable because Fiat has been struggling to work off a considerable debt and to overhaul its biggest and best-known business, Fiat Auto Holdings, which has been unprofitable since the late 1990s and may have lost more than US$1 billion last year.

The steps were immediately interpreted by the financial markets as signs that Fiat may now rapidly reduce its stake in Fiat Auto or pull out of it altogether, if buyers can be found for it.

In trading on the Milan exchange, shares in Fiat reacted by shooting up more than 5 percent, but they settled back to close with a slight loss at 8.096 euros (US$8.77). Shares in the two major holding companies, known by their Italian initials IFI and IFIL, through which the Agnelli family company controls Fiat, posted gains.

"There is no doubt that Gianni was regarded as a force for continuity regarding the group's plans," said John Lawson of Salomon Smith Barney. "No doubt the assumption is that under Umberto, the rest of the family has less of an emotional attachment to some of old Fiat."

As Gianni's health failed in recent months, Umberto Agnelli assumed greater responsibility for the family's business affairs, but Gianni's influence was still strongly felt.

In recent weeks, Fresco, with the advice of investment bankers, has been hammering out plans to spin off Fiat Auto from the remainder of the group and then bring in new investors to pump some 5 billion euros in fresh capital into the auto company. People with knowledge of the discussions said the final plan may include provisions to inject fresh capital into two other large Fiat businesses, the farm and construction equipment maker Case New Holland and the truck maker Iveco.

The developments are being followed with intense interest at General Motors, which took a 20-percent stake in Fiat Auto in 2000 and gave Fiat the option of requiring GM to buy the rest of it starting next year, called a put option. Fresco met last week with GM's chief executive, Richard Wagoner, and its chief financial officer, John Devine, to lay out Fiat's plans, but he received no commitment from them.

Part of Fiat's plans call for GM to contribute to the planned capital increase in exchange for a cancellation or postponement of the put option. But GM is unlikely to be eager to inject capital directly into Fiat's auto business. American accounting rules would oblige GM to adjust its own reported earnings to reflect a portion of Fiat Auto's losses if GM's ownership rose above 20 percent, though a capital increase would not necessarily enlarge GM's stake.

It is not clear that Fiat could force GM's hand by exercising the put option. Many analysts believe such a move would be tied up in litigation. One difficulty would be determining a fair value for Fiat Auto, a process that would involve negotiations with four investment banks, according to the terms of the option.

GM gave an early indication of its diminishing assessment of Fiat's auto business when it wrote down the value of its stake on its own books by 90 percent, from US$2.4 billion down to US$220 million, in the third quarter of last year.

"I think they would have a hard time exercising the put and making it stick," Stephen Girsky, an analyst at Morgan Stanley, said of Fiat.

Even so, having Umberto Agnelli rather than Gianni Agnelli in charge at Fiat "changes quite a lot, it is quite a big change," said an analyst in London who follows the company. He and others expect Umberto to be much more willing than his brother to move Fiat quickly away from the car business. But the analyst said, "The devil is going to be in the detail."

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

UNCERTAINTIES: The world’s biggest chip packager and tester is closely monitoring the US’ tariff policy before making any capacity adjustments, a company official said ASE Technology Holding Inc (日月光投控), the world’s biggest chip packager and tester, yesterday said it is cautiously evaluating new advanced packaging capacity expansion in the US in response to customers’ requests amid uncertainties about the US’ tariff policy. Compared with its semiconductor peers, ASE has been relatively prudent about building new capacity in the US. However, the company is adjusting its global manufacturing footprint expansion after US President Donald Trump announced “reciprocal” tariffs in April, and new import duties targeting semiconductors and other items that are vital to national security. ASE subsidiary Siliconware Precision Industries Co (SPIL, 矽品精密) is participating in Nvidia