Taipei Bank (

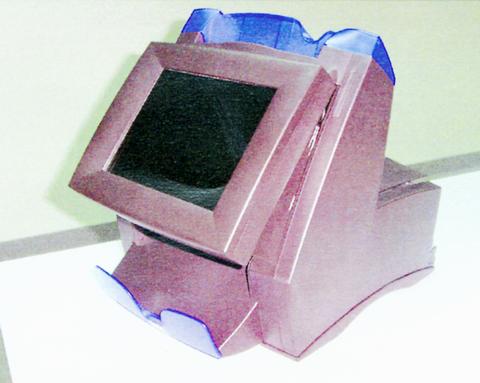

The Altura terminal, designed by the US company GTECH, is the first of a network of nearly 5,000 computer terminals that the bank plans to set up around the country.

PHOTO COURTESY OF TAIPEI BANK

"The computerized lottery will be available by next January," said president of Taipei Bank Jesse Ding (丁予康).

The idea -- based on the US lottery system -- allows participants to enter a six-digit number of their own choosing, or they can have the computer select a number for them.

If all six digits match the winning number, the participant wins the jackpot. The chances of winning are estimated to be one in 5.3 million, and the grand prize of up to NT$50 million will grow in size if there is no winner for a few weeks.

"The Ministry of Finance might set a ceiling for the jackpot," Ding said.

The computerized system is said to be different from the current "2-in-1" instant lottery and the invoice lottery in that the winnings will be cumulative. Any prize money not collected during a given week will be rolled over to the following week. So despite its decreased odds, the computerized lottery is expected to be more enticing than the 2-in-1.

The bank reportedly envisions weekly drawings. At the time of the drawing, 42 balls representing potential numbers will be scrambled in a machine. Six of the balls will then be drawn at random to produce the winning numbers.

The government sees the venture as an opportunity for big profit.

"Thirty-five percent of revenue generated from the lottery will be used for social welfare programs. If we could generate NT$100 billion in revenue [in the next few years], the government could get NT$35 billion from it," Ding said.

The computer terminals will be set up in two stages, Taipei Bank said in a statement.

The Lottery Technology Service Corp (

In the plan's second stage, "the total number of terminals, currently set at 4,999, will be set up according to the application needs of distributors," said Richard Yang (楊瑞東), vice president and general manager of Taipei Bank's lottery department.

"The GTECH's computer lottery system is a hacker-proof system," said Theresa Sun (孫德萍) Lottery Technology Service's director of public relations. The company is a joint venture of GTECH and Acer.

The computerized lottery will replace the traditional lottery. The Taipei Bank will give priority to Aborigines, single parents and the disabled when it hires people to man the booths.

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

RISING: Strong exports, and life insurance companies’ efforts to manage currency risks indicates the NT dollar would eventually pass the 29 level, an expert said The New Taiwan dollar yesterday rallied to its strongest in three years amid inflows to the nation’s stock market and broad-based weakness in the US dollar. Exporter sales of the US currency and a repatriation of funds from local asset managers also played a role, said two traders, who asked not to be identified as they were not authorized to speak publicly. State-owned banks were seen buying the greenback yesterday, but only at a moderate scale, the traders said. The local currency gained 0.77 percent, outperforming almost all of its Asian peers, to close at NT$29.165 per US dollar in Taipei trading yesterday. The

MARKET LEADERSHIP: Investors are flocking to Nvidia, drawn by the company’s long-term fundamntals, dominant position in the AI sector, and pricing and margin power Two years after Nvidia Corp made history by becoming the first chipmaker to achieve a US$1 trillion market capitalization, an even more remarkable milestone is within its grasp: becoming the first company to reach US$4 trillion. After the emergence of China’s DeepSeek (深度求索) sent the stock plunging earlier this year and stoked concerns that outlays on artificial intelligence (AI) infrastructure were set to slow, Nvidia shares have rallied back to a record. The company’s biggest customers remain full steam ahead on spending, much of which is flowing to its computing systems. Microsoft Corp, Meta Platforms Inc, Amazon.com Inc and Alphabet Inc are

UNCERTAINTIES: The world’s biggest chip packager and tester is closely monitoring the US’ tariff policy before making any capacity adjustments, a company official said ASE Technology Holding Inc (日月光投控), the world’s biggest chip packager and tester, yesterday said it is cautiously evaluating new advanced packaging capacity expansion in the US in response to customers’ requests amid uncertainties about the US’ tariff policy. Compared with its semiconductor peers, ASE has been relatively prudent about building new capacity in the US. However, the company is adjusting its global manufacturing footprint expansion after US President Donald Trump announced “reciprocal” tariffs in April, and new import duties targeting semiconductors and other items that are vital to national security. ASE subsidiary Siliconware Precision Industries Co (SPIL, 矽品精密) is participating in Nvidia