The yen rose for a third week against the US dollar, its longest stretch of gains since January, as US economic data signaling the recovery is sputtering boosted demand for currencies less likely to return a loss.

Japan’s currency advanced against all 16 of its most active counterparts, while those of commodity exporters including Canada and Norway were among the worst performers amid speculation the G20 nations will fail to agree this weekend on how to tackle Europe’s debt crisis. Reports next week may show US payrolls shrank and manufacturing growth slowed.

“The yen rally can be described as a safe-haven play,” said Hidetoshi Yanagihara, a currency trader in New York at Mizuho Corporate Bank. “The US economy is not performing well. Growth in the second quarter may have slowed more than people had thought, and that’s what the market is trying to price in.”

The yen gained 1.7 percent to ¥89.23 per US dollar, from ¥90.71 on June 18, and appreciated 1.8 percent to ¥110.41 per euro, from ¥112.40. The euro slipped 0.2 percent to US$1.2369, from US$1.2388 last week. Australia’s higher-yielding dollar slid 1.4 percent to ¥78.02, its first decline in three weeks.

Sterling gained for a third week against the US dollar amid optimism an emergency budget announced Tuesday by British Chancellor of the Exchequer George Osborne would cut the nation’s deficit and enable Britain to keep its top credit rating. The pound rose 1.6 percent to US$1.5063.

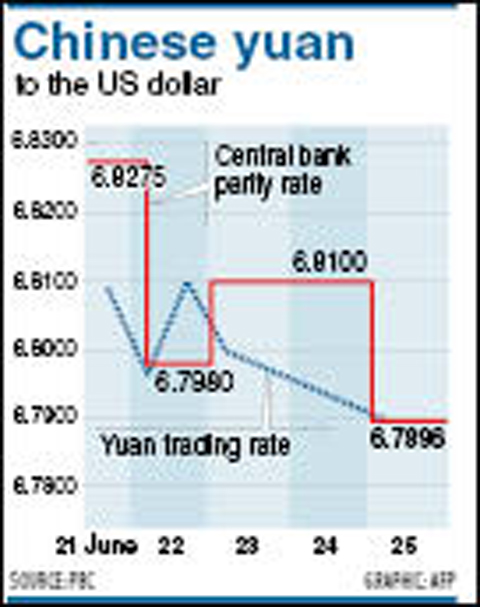

The yuan had its biggest weekly gain since December 2008, rising 0.5 percent to 6.7921 per US dollar, after the People’s Bank of China said last Saturday it would end a two-year peg to the dollar.

Asian currencies dropped this week, led by South Korea’s won, as concern Europe’s debt crisis will worsen outweighed the benefits to the region of China’s decision to end the yuan’s two-year peg.

The won declined 1 percent this week to close at 1,215.19 in Seoul, according to data compiled by Bloomberg. The Singapore dollar fell 0.6 percent in the past five days to S$1.3940, the Indian rupee weakened 0.2 percent to 46.2865 and the peso dropped 1.2 percent to 46.445 per dollar.

The New Taiwan dollar pared gains on Friday after the central bank intervened to check appreciation that might hurt exports. Bonds fell the most in eight months after the central bank raised interest rates.

The monetary authority intervened at the last minute of trading, as it has done every day for about two months now, according to a trader familiar with the matter who declined to be identified. The Taiwan dollar earlier rose as much as 0.6 percent after China set the yuan’s rate at a record high, helping boost the purchasing power of the nation’s biggest overseas market. Taiwan’s central bank on Thursday lifted its benchmark interest rate for the first time since 2008.

China “just fixed the yuan’s mid-point at a record high so the Taiwan dollar is stronger,” said Joanna Tan, a regional economist at Forecast Singapore Pte. “That would obviously bring out the yuan proxy trades.”

The NT dollar ended 0.1 percent higher at NT$32.180 against its US counterpart at 4pm on Friday, according to Taipei Forex Inc. The currency was little changed from a week earlier.

MORE VISITORS: The Tourism Administration said that it is seeing positive prospects in its efforts to expand the tourism market in North America and Europe Taiwan has been ranked as the cheapest place in the world to travel to this year, based on a list recommended by NerdWallet. The San Francisco-based personal finance company said that Taiwan topped the list of 16 nations it chose for budget travelers because US tourists do not need visas and travelers can easily have a good meal for less than US$10. A bus ride in Taipei costs just under US$0.50, while subway rides start at US$0.60, the firm said, adding that public transportation in Taiwan is easy to navigate. The firm also called Taiwan a “food lover’s paradise,” citing inexpensive breakfast stalls

TRADE: A mandatory declaration of origin for manufactured goods bound for the US is to take effect on May 7 to block China from exploiting Taiwan’s trade channels All products manufactured in Taiwan and exported to the US must include a signed declaration of origin starting on May 7, the Bureau of Foreign Trade announced yesterday. US President Donald Trump on April 2 imposed a 32 percent tariff on imports from Taiwan, but one week later announced a 90-day pause on its implementation. However, a universal 10 percent tariff was immediately applied to most imports from around the world. On April 12, the Trump administration further exempted computers, smartphones and semiconductors from the new tariffs. In response, President William Lai’s (賴清德) administration has introduced a series of countermeasures to support affected

CROSS-STRAIT: The vast majority of Taiwanese support maintaining the ‘status quo,’ while concern is rising about Beijing’s influence operations More than eight out of 10 Taiwanese reject Beijing’s “one country, two systems” framework for cross-strait relations, according to a survey released by the Mainland Affairs Council (MAC) on Thursday. The MAC’s latest quarterly survey found that 84.4 percent of respondents opposed Beijing’s “one country, two systems” formula for handling cross-strait relations — a figure consistent with past polling. Over the past three years, opposition to the framework has remained high, ranging from a low of 83.6 percent in April 2023 to a peak of 89.6 percent in April last year. In the most recent poll, 82.5 percent also rejected China’s

PLUGGING HOLES: The amendments would bring the legislation in line with systems found in other countries such as Japan and the US, Legislator Chen Kuan-ting said Democratic Progressive Party (DPP) Legislator Chen Kuan-ting (陳冠廷) has proposed amending national security legislation amid a spate of espionage cases. Potential gaps in security vetting procedures for personnel with access to sensitive information prompted him to propose the amendments, which would introduce changes to Article 14 of the Classified National Security Information Protection Act (國家機密保護法), Chen said yesterday. The proposal, which aims to enhance interagency vetting procedures and reduce the risk of classified information leaks, would establish a comprehensive security clearance system in Taiwan, he said. The amendment would require character and loyalty checks for civil servants and intelligence personnel prior to