The Bank of Japan (BOJ) stepped closer to currency intervention yesterday than at any time in the last five years by checking exchange rates with commercial banks as the yen rallied to a 14-year high against the dollar.

Still, market sources said intervention was highly unlikely in the short term and that authorities were instead aiming to temper the sentiment driving the yen higher.

While the central bank made its presence known in the market, Japanese Finance Minister Hirohisa Fujii raised the prospect of a G7 joint statement on currencies to cool the yen’s rally.

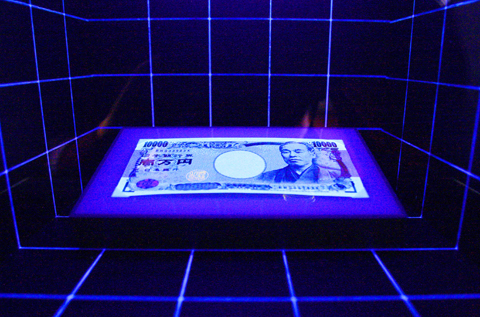

PHOTO: REUTERS

The dollar slumped to a low of ¥84.82 as investors shunned riskier assets after news about Dubai’s debt problems, but it pared its losses after Fujii’s comments because his rhetoric was sharper than it had been on Thursday.

G7 countries issued a statement in October last year when the yen rallied against other major currencies, so traders and analysts said a joint statement was possible.

But joint intervention was extremely unlikely, they said. Such action might send the wrong signal at a time when the G7 wants to encourage China to let the yuan rise by maintaining flexible currency markets.

Unilateral intervention by Japan was also unlikely because the yen’s rise is largely the result of the dollar’s broad weakness, and the BOJ would not have enough financial firepower to reverse the dollar’s decline.

The mere threat of joint action though was enough to curb the yen’s gains against the dollar, traders said.

“I would respond flexibly to a joint statement on currencies,” Fujii told reporters after a Cabinet meeting.

Fujii said he was also flexible about contacting currency authorities in the US and Europe, adding that he was very nervous about currency moves and it was possible Japan could respond.

He declined to comment on intervention, saying he was not in a position to use the word due to commitments with other G7 countries on currency flexibility.

Market sources said the government and the Bank of Japan had checked dollar-yen rates with commercial banks, going beyond their usual practice of market contact than at any time since authorities intervened earlier this decade to curb yen strength from harming exports.

That intervention came to a stop in March 2004 after authorities dumped ¥35 trillion over 15 months.

During that period, the finance ministry and the BOJ often checked rates as a prelude to intervention.

“The Bank of Japan may have wanted to make its presence felt,” a trader said of yesterday’s rate checking.

The dollar has been in a long-term decline. Against a basket of major currencies it hit a 15-month low on Thursday.

“I would not be surprised if the G7 or the Group of 20 issues a statement to prevent the dollar from weakening further, although it is unclear if they will act now or wait until a G7 meeting in February,” said Koji Fukaya, a senior currency strategist at Deutsche Securities in Tokyo. “But the statement would unlikely be the kind issued in October last year, because the current situation stems from a weak dollar.”

The yen has risen 5.3 percent since the end of last year. In trade-weighted terms, its rise is also modest with the currency well below highs hit in January.

“I have not heard of intervention at this point but in the future there will be various options and if necessary I’ll talk to ministers involved,” Japanese National Strategy Minister Naoto Kan told reporters.

The dollar’s decline against major currencies has been more pronounced, and traders say its slump against the yen is more a symptom of worries that low US interest rates are fostering economic bubbles and that chances of a Dubai debt default are reigniting financial turmoil.

“I can’t see what purpose dollar/yen intervention would serve,” said Hideki Amikura, executive director of foreign exchange services at Nomura Trust & Banking Co in Tokyo.

MORE VISITORS: The Tourism Administration said that it is seeing positive prospects in its efforts to expand the tourism market in North America and Europe Taiwan has been ranked as the cheapest place in the world to travel to this year, based on a list recommended by NerdWallet. The San Francisco-based personal finance company said that Taiwan topped the list of 16 nations it chose for budget travelers because US tourists do not need visas and travelers can easily have a good meal for less than US$10. A bus ride in Taipei costs just under US$0.50, while subway rides start at US$0.60, the firm said, adding that public transportation in Taiwan is easy to navigate. The firm also called Taiwan a “food lover’s paradise,” citing inexpensive breakfast stalls

TRADE: A mandatory declaration of origin for manufactured goods bound for the US is to take effect on May 7 to block China from exploiting Taiwan’s trade channels All products manufactured in Taiwan and exported to the US must include a signed declaration of origin starting on May 7, the Bureau of Foreign Trade announced yesterday. US President Donald Trump on April 2 imposed a 32 percent tariff on imports from Taiwan, but one week later announced a 90-day pause on its implementation. However, a universal 10 percent tariff was immediately applied to most imports from around the world. On April 12, the Trump administration further exempted computers, smartphones and semiconductors from the new tariffs. In response, President William Lai’s (賴清德) administration has introduced a series of countermeasures to support affected

CROSS-STRAIT: The vast majority of Taiwanese support maintaining the ‘status quo,’ while concern is rising about Beijing’s influence operations More than eight out of 10 Taiwanese reject Beijing’s “one country, two systems” framework for cross-strait relations, according to a survey released by the Mainland Affairs Council (MAC) on Thursday. The MAC’s latest quarterly survey found that 84.4 percent of respondents opposed Beijing’s “one country, two systems” formula for handling cross-strait relations — a figure consistent with past polling. Over the past three years, opposition to the framework has remained high, ranging from a low of 83.6 percent in April 2023 to a peak of 89.6 percent in April last year. In the most recent poll, 82.5 percent also rejected China’s

PLUGGING HOLES: The amendments would bring the legislation in line with systems found in other countries such as Japan and the US, Legislator Chen Kuan-ting said Democratic Progressive Party (DPP) Legislator Chen Kuan-ting (陳冠廷) has proposed amending national security legislation amid a spate of espionage cases. Potential gaps in security vetting procedures for personnel with access to sensitive information prompted him to propose the amendments, which would introduce changes to Article 14 of the Classified National Security Information Protection Act (國家機密保護法), Chen said yesterday. The proposal, which aims to enhance interagency vetting procedures and reduce the risk of classified information leaks, would establish a comprehensive security clearance system in Taiwan, he said. The amendment would require character and loyalty checks for civil servants and intelligence personnel prior to