Australia’s central bank hiked interest rates by 25 basis points for a second successive month yesterday, saying the improving economic outlook and expected growth in Asia justified the move.

Reserve Bank of Australia (RBA) governor Glenn Stevens said the bank had decided to up the official cash rate to 3.5 percent, its highest level since February, citing “noticeably better” conditions for Australia’s major regional trading partners.

“Growth in China has been very strong, which is having a significant impact on other economies in the region and on commodity markets,” Stevens said. “For Australia’s trading partner group, growth in 2010 is likely to be close to trend.”

PHOTO: BLOOMBERG

Australia last month became the first advanced economy to raise interest rates since the global financial meltdown, declaring the risk of a recession over and lifting rates from 50-year lows.

The interest rate rise comes after the government on Monday sharply lifted its economic forecasts, flagging growth of 1.5 percent instead of a 0.5 percent contraction and indicating that unemployment would peak at a relatively modest 6.75 percent.

The central bank aggressively slashed the rate from 7.25 percent in September last year to a 49-year low of 3 percent, while the government injected stimulus of more than A$70 billion (US$63 billion) into the economy.

Stevens said economic conditions had been stronger than expected and measures of confidence had improved thanks to the stimulus measures, while private investment appeared not be as weak as forecast.

Housing and public infrastructure spending were accelerating, and Stevens said there were early signs of an improvement in labor market conditions.

Growth was likely to be close to trend and inflation near the official target of 2 percent to 3 percent, while unemployment was likely to peak at a “considerably lower level” than what was previously forecast.

“With the risk of serious economic contraction in Australia now having passed, the Board’s view is that it is prudent to lessen gradually the degree of monetary stimulus that was put in place when the outlook appeared to be much weaker,” Stevens said.

The result was in line with market expectations of a modest rise, following the release of the lowest inflation figures in 10 years last week.

Analysts said Stevens’ tempered remarks pointed to a likely pause in further increases to the cash rate until next year.

“The specific language ... could possibly suggest the RBA believes it has done enough for the time being, possibly pausing over December and January before reassessing the appropriateness of the cash rate in February,” IG Markets analyst Cameron Peacock said.

The RBA had never in its history raised rates for three consecutive months, CommSec economist Savanth Sebastian said.

“I think there’s a good chance they will pause in December and come back in February to do the rest of their work,” Sebastian said.

Taiwan is projected to lose a working-age population of about 6.67 million people in two waves of retirement in the coming years, as the nation confronts accelerating demographic decline and a shortage of younger workers to take their place, the Ministry of the Interior said. Taiwan experienced its largest baby boom between 1958 and 1966, when the population grew by 3.78 million, followed by a second surge of 2.89 million between 1976 and 1982, ministry data showed. In 2023, the first of those baby boom generations — those born in the late 1950s and early 1960s — began to enter retirement, triggering

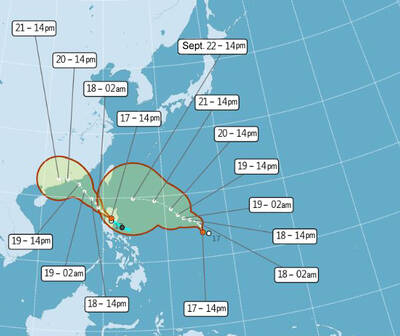

One of two tropical depressions that formed off Taiwan yesterday morning could turn into a moderate typhoon by the weekend, the Central Weather Administration (CWA) said yesterday. Tropical Depression No. 21 formed at 8am about 1,850km off the southeast coast, CWA forecaster Lee Meng-hsuan (李孟軒) said. The weather system is expected to move northwest as it builds momentum, possibly intensifying this weekend into a typhoon, which would be called Mitag, Lee said. The radius of the storm is expected to reach almost 200km, she said. It is forecast to approach the southeast of Taiwan on Monday next week and pass through the Bashi Channel

NO CHANGE: The TRA makes clear that the US does not consider the status of Taiwan to have been determined by WWII-era documents, a former AIT deputy director said The American Institute in Taiwan’s (AIT) comments that World War-II era documents do not determine Taiwan’s political status accurately conveyed the US’ stance, the US Department of State said. An AIT spokesperson on Saturday said that a Chinese official mischaracterized World War II-era documents as stating that Taiwan was ceded to the China. The remarks from the US’ de facto embassy in Taiwan drew criticism from the Ma Ying-jeou Foundation, whose director said the comments put Taiwan in danger. The Chinese-language United Daily News yesterday reported that a US State Department spokesperson confirmed the AIT’s position. They added that the US would continue to

The number of Chinese spouses applying for dependent residency as well as long-term residency in Taiwan has decreased, the Mainland Affairs Council said yesterday, adding that the reduction of Chinese spouses staying or living in Taiwan is only one facet reflecting the general decrease in the number of people willing to get married in Taiwan. The number of Chinese spouses applying for dependent residency last year was 7,123, down by 2,931, or 29.15 percent, from the previous year. The same census showed that the number of Chinese spouses applying for long-term residency and receiving approval last year stood at 2,973, down 1,520,