Finance ministers meeting in London next month will speak against any premature end to stimulus programs and press on with reforms of the global financial system, Australian Treasurer Wayne Swan said yesterday.

Ministers from the G20 industrial and emerging nations will meet on Sept. 4. Discussions last week with some of those attending showed that there were still concerns about the fragility of the global recovery, Swan said.

“All of them underscored the importance of fully implementing our commitments to support jobs and growth,” he said in a weekly economic newsletter. “Ministers will be committed to implementing reforms to the global financial system and ensuring we support recovery in developing countries.”

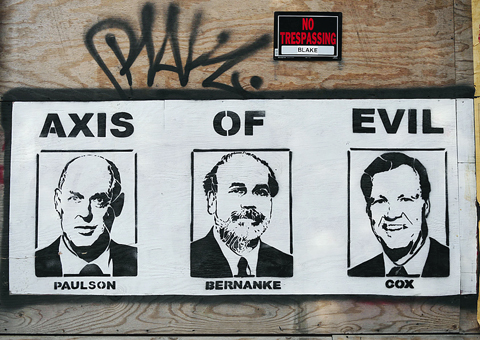

PHOTO: AFP

World leaders pledged more than US$1 trillion in emergency economic support and tighter regulation of hedge funds, banks and credit-rating companies at the G20 meeting in April. They will gather again next month in Pittsburgh, Pennsylvania, after a meeting of their finance ministers.

Australia distributed A$12 billion (US$10 billion) in cash handouts to households this year and pledged a further A$22 billion to upgrade roads, railways, ports and hospitals to help keep its economy afloat.

Earlier this month, the central bank reversed a forecast 1 percent economic contraction this year, instead predicting GDP would expand 0.5 percent this year and grow 2.25 percent next year.

The strength of Australia’s financial system, assisted by the government’s banking guarantees, has been an important factor in the strong performance of the economy, Swan said yesterday.

Credit has continued to flow, allowing businesses to keep operating and keep employing people, he said.

Small businesses face “tough conditions” and it is important the government maintains its tax breaks and stimulus measures to help keep them afloat through the global recession.

“There are still so many challenges presented to us by the global recession and the job of supporting employment in our economy is far from finished,” he said.

MORE VISITORS: The Tourism Administration said that it is seeing positive prospects in its efforts to expand the tourism market in North America and Europe Taiwan has been ranked as the cheapest place in the world to travel to this year, based on a list recommended by NerdWallet. The San Francisco-based personal finance company said that Taiwan topped the list of 16 nations it chose for budget travelers because US tourists do not need visas and travelers can easily have a good meal for less than US$10. A bus ride in Taipei costs just under US$0.50, while subway rides start at US$0.60, the firm said, adding that public transportation in Taiwan is easy to navigate. The firm also called Taiwan a “food lover’s paradise,” citing inexpensive breakfast stalls

TRADE: A mandatory declaration of origin for manufactured goods bound for the US is to take effect on May 7 to block China from exploiting Taiwan’s trade channels All products manufactured in Taiwan and exported to the US must include a signed declaration of origin starting on May 7, the Bureau of Foreign Trade announced yesterday. US President Donald Trump on April 2 imposed a 32 percent tariff on imports from Taiwan, but one week later announced a 90-day pause on its implementation. However, a universal 10 percent tariff was immediately applied to most imports from around the world. On April 12, the Trump administration further exempted computers, smartphones and semiconductors from the new tariffs. In response, President William Lai’s (賴清德) administration has introduced a series of countermeasures to support affected

CROSS-STRAIT: The vast majority of Taiwanese support maintaining the ‘status quo,’ while concern is rising about Beijing’s influence operations More than eight out of 10 Taiwanese reject Beijing’s “one country, two systems” framework for cross-strait relations, according to a survey released by the Mainland Affairs Council (MAC) on Thursday. The MAC’s latest quarterly survey found that 84.4 percent of respondents opposed Beijing’s “one country, two systems” formula for handling cross-strait relations — a figure consistent with past polling. Over the past three years, opposition to the framework has remained high, ranging from a low of 83.6 percent in April 2023 to a peak of 89.6 percent in April last year. In the most recent poll, 82.5 percent also rejected China’s

PLUGGING HOLES: The amendments would bring the legislation in line with systems found in other countries such as Japan and the US, Legislator Chen Kuan-ting said Democratic Progressive Party (DPP) Legislator Chen Kuan-ting (陳冠廷) has proposed amending national security legislation amid a spate of espionage cases. Potential gaps in security vetting procedures for personnel with access to sensitive information prompted him to propose the amendments, which would introduce changes to Article 14 of the Classified National Security Information Protection Act (國家機密保護法), Chen said yesterday. The proposal, which aims to enhance interagency vetting procedures and reduce the risk of classified information leaks, would establish a comprehensive security clearance system in Taiwan, he said. The amendment would require character and loyalty checks for civil servants and intelligence personnel prior to