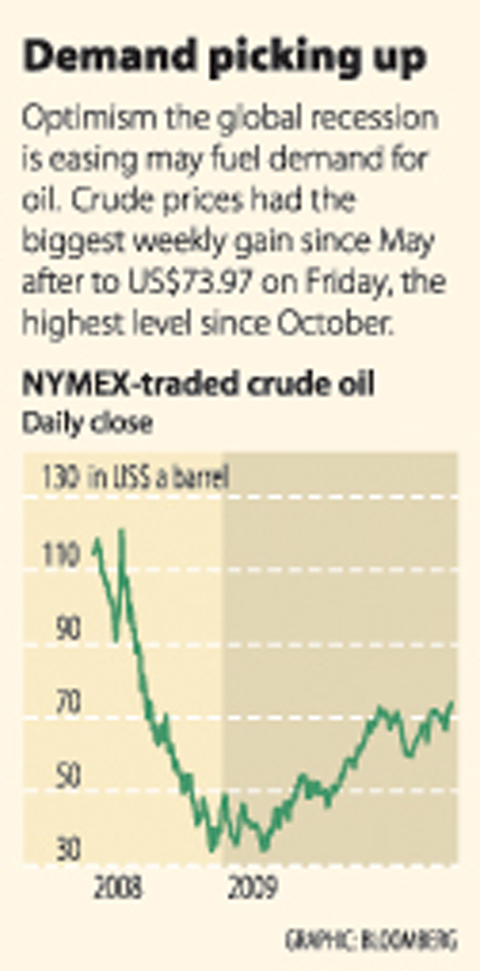

World oil prices surged this week to the highest level so far this year as investor sentiment was driven by tumbling US crude reserves, the weak US dollar and encouraging economic data.

“Crude oil is ... poised for a weekly gain on optimism the prospects for a global economic recovery have improved,” BetOnMarkets analyst David Evans said.

OIL: The price of New York oil on Friday soared to US$74.72 — a level last seen on Oct. 20 last year.

“It’s the dollar ... and supportive [US energy inventories] data from Wednesday,” VTB Capital analyst Andrey Kryuchenkov said when questioned about the latest move higher.

The European single currency leapt as high as US$1.4376 on Friday after a key survey showed the eurozone economy stabilized this month, ending a lengthy run of business contraction.

New York crude has now soared by as much as 10 percent in value this week amid rising European and US stock markets.

By Friday on London’s InterContinental Exchange Brent North Sea crude for delivery in October rallied to US$74.32 a barrel, from US$73.74 the September contract a week earlier.

On the New York Mercantile Exchange (NYMEX), light sweet crude for October jumped to US$73.97 a barrel, compared with US$71.43 for the September contract one week earlier.

PRECIOUS METALS: Gold weakened as the dollar fell in value.

“The current gold price level is essentially determined by the US dollar and cannot be explained via fundamentals” of supply and demand, Commerzbank analyst Eugen Weinberg said.

By late Friday on the London Bullion Market, gold retreated to US$952.50 an ounce from US$953.50 a week earlier.

Silver slid to US$14.01 an ounce from US$14.98.

On the London Platinum and Palladium Market, platinum eased to US$1,239 an ounce at the late fixing on Friday from US$1,267.

Palladium slipped to US$275 an ounce from US$277.50.

BASE METALS: By Friday on the London Metal Exchange, copper for delivery in three months sank to US$6,105 a tonne from US$6,373 a week earlier. Three-month aluminum dipped to US$1,925 a tonne from US$2,040.

GRAINS AND SOYA: Prices retreated across the board. By Friday on the Chicago Board of Trade, maize for delivery in December fell to US$3.24 a bushel from US$3.27 a week earlier.

November-dated soyabean meal — used in animal feed — eased to US$9.73 from US$9.81.

Wheat for December slipped to US$5.02 a bushel from US$5.09.

MORE VISITORS: The Tourism Administration said that it is seeing positive prospects in its efforts to expand the tourism market in North America and Europe Taiwan has been ranked as the cheapest place in the world to travel to this year, based on a list recommended by NerdWallet. The San Francisco-based personal finance company said that Taiwan topped the list of 16 nations it chose for budget travelers because US tourists do not need visas and travelers can easily have a good meal for less than US$10. A bus ride in Taipei costs just under US$0.50, while subway rides start at US$0.60, the firm said, adding that public transportation in Taiwan is easy to navigate. The firm also called Taiwan a “food lover’s paradise,” citing inexpensive breakfast stalls

TRADE: A mandatory declaration of origin for manufactured goods bound for the US is to take effect on May 7 to block China from exploiting Taiwan’s trade channels All products manufactured in Taiwan and exported to the US must include a signed declaration of origin starting on May 7, the Bureau of Foreign Trade announced yesterday. US President Donald Trump on April 2 imposed a 32 percent tariff on imports from Taiwan, but one week later announced a 90-day pause on its implementation. However, a universal 10 percent tariff was immediately applied to most imports from around the world. On April 12, the Trump administration further exempted computers, smartphones and semiconductors from the new tariffs. In response, President William Lai’s (賴清德) administration has introduced a series of countermeasures to support affected

CROSS-STRAIT: The vast majority of Taiwanese support maintaining the ‘status quo,’ while concern is rising about Beijing’s influence operations More than eight out of 10 Taiwanese reject Beijing’s “one country, two systems” framework for cross-strait relations, according to a survey released by the Mainland Affairs Council (MAC) on Thursday. The MAC’s latest quarterly survey found that 84.4 percent of respondents opposed Beijing’s “one country, two systems” formula for handling cross-strait relations — a figure consistent with past polling. Over the past three years, opposition to the framework has remained high, ranging from a low of 83.6 percent in April 2023 to a peak of 89.6 percent in April last year. In the most recent poll, 82.5 percent also rejected China’s

PLUGGING HOLES: The amendments would bring the legislation in line with systems found in other countries such as Japan and the US, Legislator Chen Kuan-ting said Democratic Progressive Party (DPP) Legislator Chen Kuan-ting (陳冠廷) has proposed amending national security legislation amid a spate of espionage cases. Potential gaps in security vetting procedures for personnel with access to sensitive information prompted him to propose the amendments, which would introduce changes to Article 14 of the Classified National Security Information Protection Act (國家機密保護法), Chen said yesterday. The proposal, which aims to enhance interagency vetting procedures and reduce the risk of classified information leaks, would establish a comprehensive security clearance system in Taiwan, he said. The amendment would require character and loyalty checks for civil servants and intelligence personnel prior to