After taking a breather from a stunning three-month run, Wall Street turns its attention in the coming week to the US Federal Reserve for signs that could revive the rally.

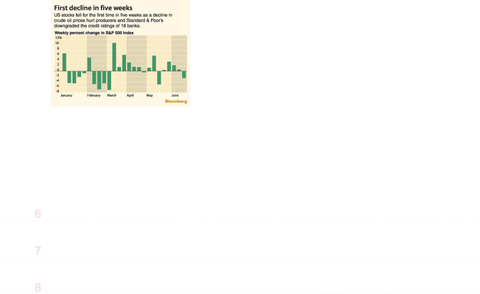

In the week to Friday, the blue-chip Dow Jones Industrial Average slumped 2.95 percent to 8,539.73, ending a four-week winning streak.

The technology-heavy NASDAQ lost 1.69 percent for the week to 1,827.47, while the broad-market Standard & Poor’s 500 index shed 2.64 percent to 921.23.

Despite the pullback in the past week, the market’s snapback of some 40 percent from lows in March suggests Wall Street believes the danger of an economic depression has passed, but the shape of recovery remains unclear.

As a result, the Federal Reserve’s two-day policy meeting takes on new importance, with the central bank’s comments likely to offer clues on timing and strength of an economic recovery.

Gregory Drahuschak at Janney Montgomery Scott said the market would scrutinize the statement on Wednesday from the Federal Open Market Committee.

“Rates are not likely to be changed but we suspect there could be some language in the policy statement suggesting that the Fed is contemplating pulling back on some of its stimulus,” he said.

“There is increasing evidence that the recession is ending and that a return to positive growth is imminent,” said Dean Maki, economist at Barclays Capital. “Given this backdrop, the Fed is likely to sound more upbeat on growth prospects than its April statement.”

But Maki said the Fed “will likely want to balance this upbeat view with some rhetoric emphasizing headwinds still facing the economy, and it will likely aim to convince investors that tightening is not imminent.”

The market is now struggling to get a handle on whether the economy will see a strong “V-shaped” recovery or a more sluggish one.

“We believe the stock market is now trying to figure out what the economic recovery will be like and how much growth we will see in 2010,” said Al Goldman at Wells Fargo Advisors.

Goldman said a strong economic recovery was “unlikely” amid a soft labor market and weak consumer spending.

But he argues that the rally has not yet run out steam.

“We believe the market will be higher by year-end because of a still-positive risk/reward ratio for stocks and prospects for a decent but modest economic recovery next year,” he said.

Fred Dickson, chief market strategist at DA Davidson & Co, said the market needed a pullback after the hefty gains but sees this as “short and shallow” but added the market may be bracing for quarterly earnings reports starting in July.

“Our biggest near-term worry is that second quarter earnings news may disappoint anxious investors,” he said.

Economist Benjamin Tal at CIBC World Markets argues that the stock market may have rallied too far and needs to digest the gains of the past three months.

“The stock market is probably ahead of itself,” he said.

“All indicators and common sense suggest that this recovery will be muted. After all, the US housing market is yet to find its footing, consumers are in a bad mood and deleveraging is king. Savings, not consumption, will be the new ‘in,’” Tal said.

“But the signals from stocks, commodities and bond markets suggest that while the next several quarters will be lackluster, the medium-term outlook could be brighter than many currently suspect,” he added.

Bonds were mixed over the week as some fears about inflation and rate hikes eased.

The yield on the 10-year Treasury bond was marginally higher at 3.789 percent from 3.788 percent a week earlier while that on the 30-year bond declined to 4.522 percent from 4.633 percent. Bond yields and prices move in opposite directions.

MORE VISITORS: The Tourism Administration said that it is seeing positive prospects in its efforts to expand the tourism market in North America and Europe Taiwan has been ranked as the cheapest place in the world to travel to this year, based on a list recommended by NerdWallet. The San Francisco-based personal finance company said that Taiwan topped the list of 16 nations it chose for budget travelers because US tourists do not need visas and travelers can easily have a good meal for less than US$10. A bus ride in Taipei costs just under US$0.50, while subway rides start at US$0.60, the firm said, adding that public transportation in Taiwan is easy to navigate. The firm also called Taiwan a “food lover’s paradise,” citing inexpensive breakfast stalls

TRADE: A mandatory declaration of origin for manufactured goods bound for the US is to take effect on May 7 to block China from exploiting Taiwan’s trade channels All products manufactured in Taiwan and exported to the US must include a signed declaration of origin starting on May 7, the Bureau of Foreign Trade announced yesterday. US President Donald Trump on April 2 imposed a 32 percent tariff on imports from Taiwan, but one week later announced a 90-day pause on its implementation. However, a universal 10 percent tariff was immediately applied to most imports from around the world. On April 12, the Trump administration further exempted computers, smartphones and semiconductors from the new tariffs. In response, President William Lai’s (賴清德) administration has introduced a series of countermeasures to support affected

CROSS-STRAIT: The vast majority of Taiwanese support maintaining the ‘status quo,’ while concern is rising about Beijing’s influence operations More than eight out of 10 Taiwanese reject Beijing’s “one country, two systems” framework for cross-strait relations, according to a survey released by the Mainland Affairs Council (MAC) on Thursday. The MAC’s latest quarterly survey found that 84.4 percent of respondents opposed Beijing’s “one country, two systems” formula for handling cross-strait relations — a figure consistent with past polling. Over the past three years, opposition to the framework has remained high, ranging from a low of 83.6 percent in April 2023 to a peak of 89.6 percent in April last year. In the most recent poll, 82.5 percent also rejected China’s

PLUGGING HOLES: The amendments would bring the legislation in line with systems found in other countries such as Japan and the US, Legislator Chen Kuan-ting said Democratic Progressive Party (DPP) Legislator Chen Kuan-ting (陳冠廷) has proposed amending national security legislation amid a spate of espionage cases. Potential gaps in security vetting procedures for personnel with access to sensitive information prompted him to propose the amendments, which would introduce changes to Article 14 of the Classified National Security Information Protection Act (國家機密保護法), Chen said yesterday. The proposal, which aims to enhance interagency vetting procedures and reduce the risk of classified information leaks, would establish a comprehensive security clearance system in Taiwan, he said. The amendment would require character and loyalty checks for civil servants and intelligence personnel prior to