Research In Motion Ltd (RIM) co-chief executive officer Jim Balsillie said the BlackBerry maker is reducing supply costs as surging growth provides him with leverage to press for bargains during the recession.

“Being a strong growth company in a challenging environment makes you an important customer,” Balsillie said in an interview at his office in Waterloo, Ontario.

That is probably helping RIM to elicit better terms from the companies that make equipment for its BlackBerry phones, he said.

PHOTO: AP

Shrinking expenses, coupled with fresh sources of revenue such as the App World application store, may help the device maker bolster profit margins and thrive in the worst global recession since World War II. RIM has offered discounts on the Storm and other new models to attract customers reluctant to spend as they wait out the slowdown.

This month, RIM said gross margin, the percentage of sales left after production costs, will expand this quarter, signaling the company is absorbing the impact of introductory offers. Before that, the stock had dropped about 12 percent over two months as investors fretted about the effect discounts would have on margins, following RIM’s February prediction that fourth-quarter profit would come in at the low end of targets.

“Their volumes are increasing by leaps and bounds, which has to increase their purchasing power,” said Nirav Parikh, senior vice president and equity analyst at TCW Group Inc in Los Angeles. “The margin step-down has already occurred and the stock has been punished duly.”

TCW has about US$110 billion in assets under management, including RIM shares.

RIM rose US$2.27, or 3.7 percent, to US$64.18 in NASDAQ Stock Market trading on Thursday Apple Inc., maker of the rival iPhone, climbed US$3.25 to US$119.57.

RIM’s five biggest suppliers account for almost 90 percent of its production costs, according to data from relationship-mapping software Connexiti. Electronics manufacturer Elcoteq SE makes up a third of RIM’s costs and relies on the company for 20 percent of annual sales.

“Markets are getting more difficult and everyone is trying to minimize costs,” Elcoteq spokesman Carsten Barth said. “We obviously always try to help our customers because if they are successful, we are successful.”

He declined to comment specifically on RIM.

Elcoteq, based in Luxembourg, is joined by Jabil Circuit Inc, an electronics maker, and by chipmakers Marvell Technology Group Ltd, Multi-Fineline Electronix Inc and Qualcomm Inc, according to Connexiti. Anaheim, California-based Multi-Fineline, which makes flexible circuit boards for RIM, also has experienced “pricing pressure” and is pushing back on its own suppliers, spokesman Lasse Glassen said.

“Our job is to continually offer our customers globally competitive pricing,” said Beth Walters, a spokeswoman for St Petersburg, Florida-based Jabil.

She declined to comment on the company’s relationship with RIM.

Marvell spokeswoman Diane Vanasse declined to comment, as did Qualcomm spokeswoman Emily Kilpatrick.

RIM and rivals such as Cupertino, California-based Apple are vying for subscribers as the pool of spending dwindles. Sales growth of smartphones are expected to slow to 3.4 percent this year, about one-sixth last year’s pace, with the overall market likely to drop 8.3 percent, research firm IDC said.

“BlackBerry adoption continues to be strong in light of tough macroeconomic headwinds,” said Shaw Wu, an analyst at Kaufman Bros LP in San Francisco, who rates the stock “hold.”

That shows the appeal of RIM’s e-mail technology, he said.

Sales in the three months through February jumped 84 percent from a year earlier, bolstered by premium models like the Storm and the Bold. Those should help fatten margins as the relative costs of developing and introducing those phones shrinks, Balsillie said.

Keeping profit margins high will be difficult given how fickle consumers constantly expect new devices, said Jonathan Goldberg, an analyst at Deutsche Bank Securities Inc.

“To keep consumers upgrading they have to stay on the Hit Parade or innovation treadmill indefinitely and that may prove to be beyond RIM’s abilities,” he said. “We see these issues creating margin pressure over time.”

San Francisco-based Goldberg rates the stock “hold.”

RIM expects to generate more cash through App World, which opened last week, and now offers about 1,000 programs. Application developers get 80 percent of the royalty from every download, while RIM will split the remaining 20 percent with its carrier partners.

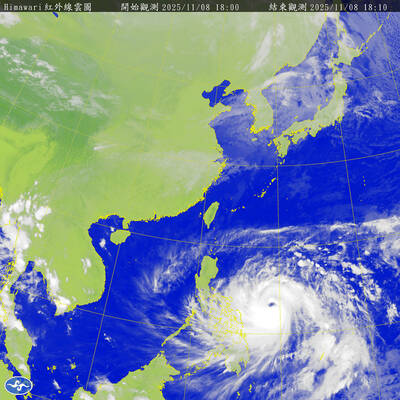

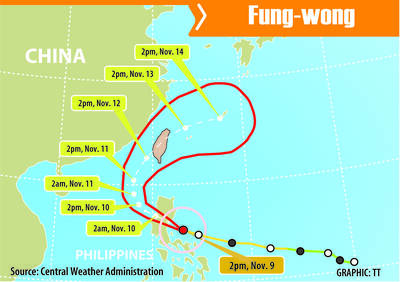

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

Taiwan’s exports soared to an all-time high of US$61.8 billion last month, surging 49.7 percent from a year earlier, as the global frenzy for artificial intelligence (AI) applications and new consumer electronics powered shipments of high-tech goods, the Ministry of Finance said yesterday. It was the first time exports had exceeded the US$60 billion mark, fueled by the global boom in AI development that has significantly boosted Taiwanese companies across the international supply chain, Department of Statistics Director-General Beatrice Tsai (蔡美娜) told a media briefing. “There is a consensus among major AI players that the upcycle is still in its early stage,”

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had