European stocks posted a fourth straight weekly decline, sending the Dow Jones STOXX 600 Index to its lowest level since 1996, on concern more credit losses and the deepening recession will wipe out profits at financial firms.

HSBC Holdings PLC tumbled 27 percent after saying it plans to raise £12.5 billion (US$17.6 billion) in a rights offer. Aviva PLC plummeted 43 percent as the biggest UK insurer reported a full-year loss. Banks and insurers were the worst-performing groups among 19 industries in the STOXX 600, dropping 18 percent each.

The STOXX 600 slid 7.8 percent this week to 159.52, the lowest level since November 1996. The gauge has declined 20 percent this year as companies from Daimler AG to Anglo American PLC reported earnings that disappointed investors and government measures failed to ease concern the economy will deteriorate.

“The news flow is still going in the same direction,” Romain Boscher, head of equities at Groupama Asset Management in Paris, which oversees about US$17 billion in stocks, said in a Bloomberg Television interview. “The problem is earnings are collapsing and companies must face recapitalizations. Each new capital increase is weighing on the market. We can’t exclude the possibility that stocks will reach new lows.”

The STOXX 600 rose one day this week, adding 3.9 percent on Wednesday on optimism China would broaden efforts to boost growth in the world’s third-largest economy.

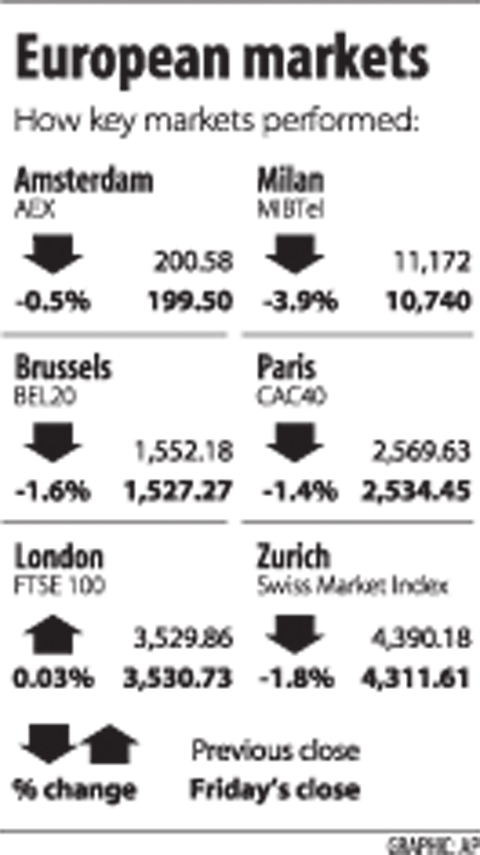

National benchmark indexes dropped in all of the 18 western European markets. Germany’s DAX Index fell 4.6 percent. France’s CAC 40 declined 6.2 percent as Credit Agricole SA sank, and the UK’s FTSE 100 lost 7.8 percent as Lloyds Banking Group PLC slid. Italy’s S&P/MIB tumbled 16 percent to the lowest level on record, led by banks including UniCredit SpA.

Goldman Sachs Group Inc predicted the global economy will shrink 0.6 percent this year after previously estimating it would contract 0.2 percent.

Berkshire Hathaway Inc chairman Warren Buffett said the US economy will be “in shambles” this year and perhaps longer, before recovering from the reckless lending that caused the worst “freefall” he ever saw in the financial system.

“We believe that the market still has more bad news to absorb with regard to corporate earnings, as a result of the economic outlook,” said Sebastian Paris-Horvitz, strategist at AXA Investment Managers in Paris. “We expect a decrease in corporate earnings in excess of 30 percent in both Europe and the United States.”

UniCredit, which makes more than a fifth of its revenue in eastern Europe, sank 28 percent. Swedbank AB, the largest bank in the Baltic countries, tumbled 22 percent.

European banks may need to raise as much as 40 billion euros (US$50.7 billion) of additional capital by next year because of loan losses in central and eastern Europe, JPMorgan Chase & Co analysts wrote in a report this week.

MORE VISITORS: The Tourism Administration said that it is seeing positive prospects in its efforts to expand the tourism market in North America and Europe Taiwan has been ranked as the cheapest place in the world to travel to this year, based on a list recommended by NerdWallet. The San Francisco-based personal finance company said that Taiwan topped the list of 16 nations it chose for budget travelers because US tourists do not need visas and travelers can easily have a good meal for less than US$10. A bus ride in Taipei costs just under US$0.50, while subway rides start at US$0.60, the firm said, adding that public transportation in Taiwan is easy to navigate. The firm also called Taiwan a “food lover’s paradise,” citing inexpensive breakfast stalls

TRADE: A mandatory declaration of origin for manufactured goods bound for the US is to take effect on May 7 to block China from exploiting Taiwan’s trade channels All products manufactured in Taiwan and exported to the US must include a signed declaration of origin starting on May 7, the Bureau of Foreign Trade announced yesterday. US President Donald Trump on April 2 imposed a 32 percent tariff on imports from Taiwan, but one week later announced a 90-day pause on its implementation. However, a universal 10 percent tariff was immediately applied to most imports from around the world. On April 12, the Trump administration further exempted computers, smartphones and semiconductors from the new tariffs. In response, President William Lai’s (賴清德) administration has introduced a series of countermeasures to support affected

CROSS-STRAIT: The vast majority of Taiwanese support maintaining the ‘status quo,’ while concern is rising about Beijing’s influence operations More than eight out of 10 Taiwanese reject Beijing’s “one country, two systems” framework for cross-strait relations, according to a survey released by the Mainland Affairs Council (MAC) on Thursday. The MAC’s latest quarterly survey found that 84.4 percent of respondents opposed Beijing’s “one country, two systems” formula for handling cross-strait relations — a figure consistent with past polling. Over the past three years, opposition to the framework has remained high, ranging from a low of 83.6 percent in April 2023 to a peak of 89.6 percent in April last year. In the most recent poll, 82.5 percent also rejected China’s

PLUGGING HOLES: The amendments would bring the legislation in line with systems found in other countries such as Japan and the US, Legislator Chen Kuan-ting said Democratic Progressive Party (DPP) Legislator Chen Kuan-ting (陳冠廷) has proposed amending national security legislation amid a spate of espionage cases. Potential gaps in security vetting procedures for personnel with access to sensitive information prompted him to propose the amendments, which would introduce changes to Article 14 of the Classified National Security Information Protection Act (國家機密保護法), Chen said yesterday. The proposal, which aims to enhance interagency vetting procedures and reduce the risk of classified information leaks, would establish a comprehensive security clearance system in Taiwan, he said. The amendment would require character and loyalty checks for civil servants and intelligence personnel prior to