US stocks may have started the New Year with a bang, but experts see major headwinds for the market as the new administration of US president-elect Barack Obama moves rapidly to eject the economy from prolonged recession.

All three key stock indices shot up at least 6 percent in the week to Friday as investors banked on Obama, who takes over from US President George W. Bush on Jan. 20, to push ahead with a mammoth plan to stimulate growth in the world’s largest economy.

“Mr Obama’s stimulus plan will be a major focal point for the market in January,” Patrick O’Hare of Briefing.com said.

“No one knows for certain right now what it will end up looking like, but one thing is certain at this point: it will be big in terms of its cost,” he said.

Obama is scheduled to meet lawmakers tomorrow to finalize an infrastructure-based stimulus package that media reports say ranges from US$850 billion to US$1 trillion in a bid to pump prime the US economy, reeling from its worst crisis since the Great Depression.

Nigel Gault, chief economist at IHS Global Insight, cautioned that any stimulus plan based on spending to boost infrastructure would take time to revitalize the economy.

“But how quickly can the funds actually be spent?” he asked. “Infrastructure spending is a key part of the package, and it cannot be turned on and off like a faucet. We assume that the funds will take much longer than two years to spend out.”

But Gault said that combined with the Federal Reserve’s vigorous easing of interest rates, the stimulus package should help stabilize the economy in the second half of this year and promote some recovery during next year.

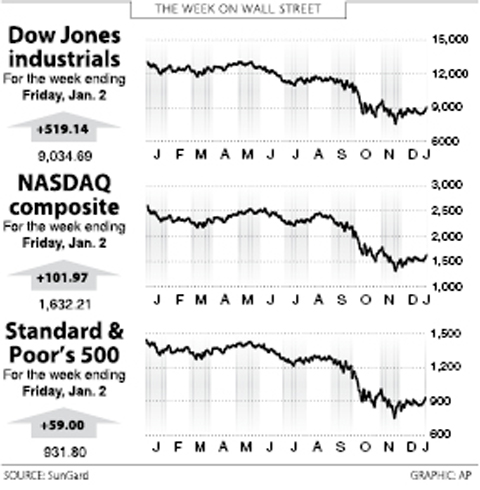

The Dow Jones Industrial Average surged a hefty 6.09 percent for the holiday-shortened week to finish Friday at 9,034.69, its highest close since Nov. 5.

The tech-studded NASDAQ leapt 6.66 percent to 1,632.21 and the broad-market Standard & Poor’s 500 index advanced 6.75 percent to 931.80 for the week.

Experts cautioned that the advances of the key indices came amid very low trading volume as many investors were still on holiday.

Only twice in the past seven sessions has trading volume on the New York Stock Exchange exceeded 1 billion shares.

Trading in the week ahead could be dictated by a series of new economic data to be released, including last month’s vehicle and retail sales figures and the widely watched employment report for the month, experts said. Economists expect that the US shed jobs for the 12th straight month last month while investors will closely watch to see if holiday retail sales were as poor as some retailers had suggested.

The number of companies to announce their quarterly earnings results will also start to pick up the coming week.

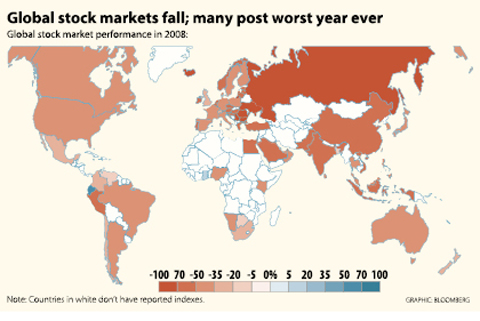

“Next week’s indicators will constitute yet another stark reminder of how forces in the economy reached maximum negative amplitude at the end of 2008,” analysts at Global Insight said in a report.

The bond market, which had greatly benefited from the financial and economic uncertainty, fell the past week.

The 10-year Treasury bond yield rose to 2.416 percent from 2.137 percent the previous week and that on the 30-year Treasury bond was up to 2.815 percent from 2.613 percent.

Bond yields and prices move in opposite directions.

CALL FOR SUPPORT: President William Lai called on lawmakers across party lines to ensure the livelihood of Taiwanese and that national security is protected President William Lai (賴清德) yesterday called for bipartisan support for Taiwan’s investment in self-defense capabilities at the christening and launch of two coast guard vessels at CSBC Corp, Taiwan’s (台灣國際造船) shipyard in Kaohsiung. The Taipei (台北) is the fourth and final ship of the Chiayi-class offshore patrol vessels, and the Siraya (西拉雅) is the Coast Guard Administration’s (CGA) first-ever ocean patrol vessel, the government said. The Taipei is the fourth and final ship of the Chiayi-class offshore patrol vessels with a displacement of about 4,000 tonnes, Lai said. This ship class was ordered as a result of former president Tsai Ing-wen’s (蔡英文) 2018

‘SECRETS’: While saying China would not attack during his presidency, Donald Trump declined to say how Washington would respond if Beijing were to take military action US President Donald Trump said that China would not take military action against Taiwan while he is president, as the Chinese leaders “know the consequences.” Trump made the statement during an interview on CBS’ 60 Minutes program that aired on Sunday, a few days after his meeting with Chinese President Xi Jinping (習近平) in South Korea. “He [Xi] has openly said, and his people have openly said at meetings, ‘we would never do anything while President Trump is president,’ because they know the consequences,” Trump said in the interview. However, he repeatedly declined to say exactly how Washington would respond in

WARFARE: All sectors of society should recognize, unite, and collectively resist and condemn Beijing’s cross-border suppression, MAC Minister Chiu Chui-cheng said The number of Taiwanese detained because of legal affairs by Chinese authorities has tripled this year, as Beijing intensified its intimidation and division of Taiwanese by combining lawfare and cognitive warfare, the Mainland Affairs Council (MAC) said yesterday. MAC Minister Chiu Chui-cheng (邱垂正) made the statement in response to questions by Democratic Progressive Party (DPP) Legislator Puma Shen (沈柏洋) about the government’s response to counter Chinese public opinion warfare, lawfare and psychological warfare. Shen said he is also being investigated by China for promoting “Taiwanese independence.” He was referring to a report published on Tuesday last week by China’s state-run Xinhua news agency,

‘NOT SUBORDINATE’: Only Taiwanese can decide the nation’s future, and people preserving their democratic way of life is not a provocation, President William Lai said Taiwan does not want China’s “one country, two systems,” and must uphold its freedom and democracy as well as resolve to defend itself, President William Lai (賴清德) said yesterday, rejecting Beijing’s latest bid to bring the country under Chinese control. The president made the remarks while attending a commissioning ceremony for Taiwan’s first battalion of M1A2T Abrams tanks in Hsinchu County’s Hukou Township (湖口). The tanks are made by General Dynamics, a major US defense contractor. China this week said it “absolutely will not” rule out using force over Taiwan, striking a much tougher tone than a series of articles in state media