Investors reeling from a roller-coaster ride face a shortened trading week that is expected to see light trade and modest portfolio adjustments ahead of the New Year.

But analysts do not rule out a modest year-end rally to brighten up the mood in the US amid the financial turmoil.

“Right now, most traders are straining to see if Santa Claus shows up on Wall Street, as he normally does just ahead of Christmas, bringing a modest year-end rally,” DA Davidson & Co chief market strategist Frederic Dickson said.

“Looking ahead to next week, trading activity should lighten up as many on Wall Street begin to take extended year-end holiday vacations,” he said, citing possible cessation of selling pressure from year-end tax-loss selling and hedge fund redemptions.

“The professionals are deserting the ship today and they will leave instructions with their seconds in command not to take any big positions on either side,” Raymond James Equities strategist Jeff Stau said on Friday.

The market may react to updated numbers on the dwindling housing market and third-quarter GDP growth to be released by the government the coming week, Dickson said.

The market could also get a year-end boost if the US Treasury takes action to bring down home mortgage rates as expected.

“Stocks could head higher over the few remaining days of 2008 if the Treasury unveils a so-called Home Recovery Plan to lower mortgage rates and the Fed pegs the 10-year Treasury bond yield at 2 percent to facilitate this plan,” Ed Yardeni of Yardeni Research said.

“Then again, there have been so many rescue plans and liquidity facilities coming out of Washington over the past year that investors have become totally jaded about them,” he said.

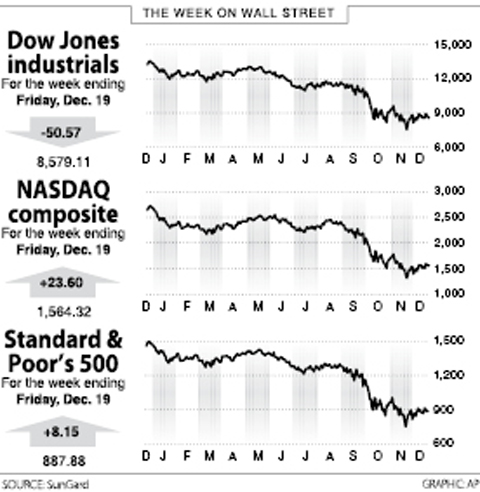

In the week to Friday, the Dow Jones Industrial Average fell 0.59 percent to 8,579.11 following a 2.19 percent drop in the prior week.

The tech-studded NASDAQ rose 1.53 percent to 1,564.32, while the broad-market Standard and Poor’s 500 was up 0.93 percent to 887.88.

The market opened the week with a mild drop on Monday, but the next day saw a massive rally on the back of an interest rate cut to nearly zero by the US Federal Reserve.

But the gains were virtually wiped out the next two days, largely as a result of a plunge in oil prices that hurt Exxon Mobil and other energy firms and a lowering by Standard and Poor’s of industrial giant General Electric’s credit outlook to negative.

Despite an early rally on Friday sparked by a US$13.4 billion government rescue of General Motors and Chrysler, share prices eased at the end of trading week on concerns that the deal could unravel.

Al Goldman at Wachovia Securities said the rally “ran out of fuel quickly as the market took a second look at the plan.”

He said the market pulled back after the United Auto Workers union “served notice it will fight to change terms which it says unfairly single out workers.”

CALL FOR SUPPORT: President William Lai called on lawmakers across party lines to ensure the livelihood of Taiwanese and that national security is protected President William Lai (賴清德) yesterday called for bipartisan support for Taiwan’s investment in self-defense capabilities at the christening and launch of two coast guard vessels at CSBC Corp, Taiwan’s (台灣國際造船) shipyard in Kaohsiung. The Taipei (台北) is the fourth and final ship of the Chiayi-class offshore patrol vessels, and the Siraya (西拉雅) is the Coast Guard Administration’s (CGA) first-ever ocean patrol vessel, the government said. The Taipei is the fourth and final ship of the Chiayi-class offshore patrol vessels with a displacement of about 4,000 tonnes, Lai said. This ship class was ordered as a result of former president Tsai Ing-wen’s (蔡英文) 2018

UKRAINE, NVIDIA: The US leader said the subject of Russia’s war had come up ‘very strongly,’ while Jenson Huang was hoping that the conversation was good Chinese President Xi Jinping (習近平) and US President Donald Trump had differing takes following their meeting in Busan, South Korea, yesterday. Xi said that the two sides should complete follow-up work as soon as possible to deliver tangible results that would provide “peace of mind” to China, the US and the rest of the world, while Trump hailed the “great success” of the talks. The two discussed trade, including a deal to reduce tariffs slapped on China for its role in the fentanyl trade, as well as cooperation in ending the war in Ukraine, among other issues, but they did not mention

HOTEL HIRING: An official said that hoteliers could begin hiring migrant workers next year, but must adhere to a rule requiring a NT$2,000 salary hike for Taiwanese The government is to allow the hospitality industry to recruit mid-level migrant workers for housekeeping and three other lines of work after the Executive Yuan yesterday approved a proposal by the Ministry of Labor. A shortage of workers at hotels and accommodation facilities was discussed at a meeting of the legislature’s Transportation Committee. A 2023 survey conducted by the Tourism Administration found that Taiwan’s lodging industry was short of about 6,600 housekeeping and cleaning workers, the agency said in a report to the committee. The shortage of workers in the industry is being studied, the report said. Hotel and Lodging Division Deputy Director Cheng

‘SECRETS’: While saying China would not attack during his presidency, Donald Trump declined to say how Washington would respond if Beijing were to take military action US President Donald Trump said that China would not take military action against Taiwan while he is president, as the Chinese leaders “know the consequences.” Trump made the statement during an interview on CBS’ 60 Minutes program that aired on Sunday, a few days after his meeting with Chinese President Xi Jinping (習近平) in South Korea. “He [Xi] has openly said, and his people have openly said at meetings, ‘we would never do anything while President Trump is president,’ because they know the consequences,” Trump said in the interview. However, he repeatedly declined to say exactly how Washington would respond in