A newly revived Wall Street faces a fresh test of momentum in the coming week with a wave of corporate results that may indicate whether the latest rebound is for real.

The results and profit guidance will be scrutinized for signs of whether companies are able to remain profitable in the face of a housing meltdown and credit squeeze that is weighing on economic growth.

The blue-chip Dow Jones Industrial Average rallied 3.57 percent to 11,496.57 in the week to Friday, bouncing back from four weeks of heavy losses.

The tech-rich NASDAQ climbed 1.95 percent for the week to 2,282.78 and the broad-market Standard & Poor’s 500 index added 1.71 percent to 1,260.68.

The market saw a strong snapback after four moribund weeks, managing to overcome fears about a collapse at Fannie Mae and Freddie Mac, the mortgage finance giants which underpin trillions of dollars in the mortgage market.

Actions by the US Federal Reserve to open credit to Fannie and Freddie and statements of support from the US Treasury eased fears about a new financial shock, helping the stock market recover.

Economist Ethan Harris at Lehman Brothers said the response to the crisis was encouraging.

“The good news is that now monetary, fiscal and regulatory authorities are taking action to prevent a deeper shock to the economy,” he said. “Fannie Mae and Freddie Mac are at the heart of a functioning US housing and financial market.”

Yet analysts are still cautious on whether the stock market move is sustainable.

“It was a nice bounce in stocks, but it’s too early to declare ‘Morning in America,’” said Douglas Porter, economist at BMO Capital Markets.

“A theme through the rest of earnings season may be that nonfinancials are now grappling with the tag team of lofty energy costs and weak economic growth. After a two-year slide, the US housing sector has not quite hit bottom yet, and will require a prolonged period of healing. At least for now, though, it appears the market has moved past another point of extreme bearishness,” he said.

The rebound was led by the banking sector, which some analysts say may have hit bottom after posting tens of billions of dollars of losses from bets on US real estate.

Despite hefty losses for some banks and more big writedowns, the results for the big US banks have been generally better than expected on Wall Street.

“Investors should feel at least slightly relieved that while several global or major money center national banks delivered lousy earnings, the mortgage or credit market related write-offs weren’t nearly as bad as expected and appear to be lessening,” said Fred Dickson, market strategist at DA Davidson & Co.

“Analysts appeared to have overestimated the losses of these banks or misjudged the ability of the banks to offset some of the write-offs with income from fees and normal lending activities. Predictably, short-sellers of these banks moved to partially cover their positions and natural buyers stepped in once the earnings reports hit the tape,” he said.

Another key for Wall Street was a big drop in oil prices, which tumbled below US$130 in the past week, well off records of about IS$147 a barrel.

“Oil more than any other single item could be a positive catalyst for the market as lower energy costs would help to relieve pressure on consumers,” said Gregory Drahuschak, analyst at Janney Montgomery Scott.

“Long term, we have major doubts that the price of crude oil can slide precipitously, but crude at US$100 would not be shocking, which would have a significantly positive effect on stocks,” he said.

In the coming week, the market will focus on quarterly reports from big financial firms including Bank of America and Wachovia. Also on tap are quarterly results from key firms like Apple, Yahoo and Boeing.

On the economic calendar are reports on new and existing home sales and orders for durable manufactured goods.

Bonds fell on the shift to equities. The yield on the 10-year Treasury bond rose to 4.081 percent from 3.940 percent a week earlier and that on the 30-year bond climbed to 4.662 from 4.517 percent. Bond yields and prices move in opposite directions.

DEMOGRAPHICS: Robotics is the most promising answer to looming labor woes, the long-term care system and national contingency response, an official said Taiwan is to launch a five-year plan to boost the robotics industry in a bid to address labor shortages stemming from a declining and aging population, the Executive Yuan said yesterday. The government approved the initiative, dubbed the Smart Robotics Industry Promotion Plan, via executive order, senior officials told a post-Cabinet meeting news conference in Taipei. Taiwan’s population decline would strain the economy and the nation’s ability to care for vulnerable and elderly people, said Peter Hong (洪樂文), who heads the National Science and Technology Council’s (NSTC) Department of Engineering and Technologies. Projections show that the proportion of Taiwanese 65 or older would

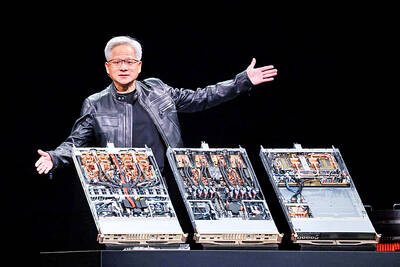

Nvidia Corp yesterday unveiled its new high-speed interconnect technology, NVLink Fusion, with Taiwanese application-specific IC (ASIC) designers Alchip Technologies Ltd (世芯) and MediaTek Inc (聯發科) among the first to adopt the technology to help build semi-custom artificial intelligence (AI) infrastructure for hyperscalers. Nvidia has opened its technology to outside users, as hyperscalers and cloud service providers are building their own cost-effective AI chips, or accelerators, used in AI servers by leveraging ASIC firms’ designing capabilities to reduce their dependence on Nvidia. Previously, NVLink technology was only available for Nvidia’s own AI platform. “NVLink Fusion opens Nvidia’s AI platform and rich ecosystem for

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it is building nine new advanced wafer manufacturing and packaging factories this year, accelerating its expansion amid strong demand for high-performance computing (HPC) and artificial intelligence (AI) applications. The chipmaker built on average five factories per year from 2021 to last year and three from 2017 to 2020, TSMC vice president of advanced technology and mask engineering T.S. Chang (張宗生) said at the company’s annual technology symposium in Hsinchu City. “We are quickening our pace even faster in 2025. We plan to build nine new factories, including eight wafer fabrication plants and one advanced

‘WORLD’S LOSS’: Taiwan’s exclusion robs the world of the benefits it could get from one of the foremost practitioners of disease prevention and public health, Minister Chiu said Taiwan should be allowed to join the World Health Assembly (WHA) as an irreplaceable contributor to global health and disease prevention efforts, Minister of Foreign Affairs Lin Chia-lung (林佳龍) said yesterday. He made the comment at a news conference in Taipei, hours before a Taiwanese delegation was to depart for Geneva, Switzerland, seeking to meet with foreign representatives for a bilateral meeting on the sidelines of the WHA, the WHO’s annual decisionmaking meeting, which would be held from Monday next week to May 27. As of yesterday, Taiwan had yet to receive an invitation. Taiwan has much to offer to the international community’s