The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel.

“Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform.

Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event.

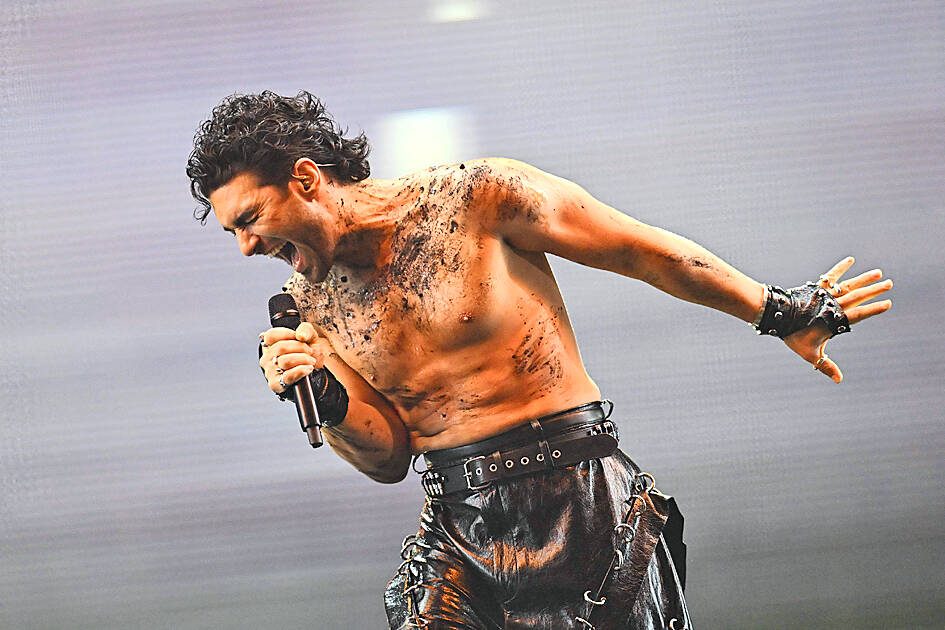

Photo: AFP

However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular.

“We’ve already passed 2023’s total activity and we’re not even at the final yet,” Huttunen said by e-mail on Friday. “If this trajectory holds, we’re on track to see a record-breaking Eurovision in terms of betting volume.”

On the OCS platform, “Eurovision ranks as the number one non-sporting event for betting — and in some cases it’s outperforming smaller sports competitions entirely,” he added.

Sweden, represented by Finnish comedy act KAJ, had been pegged by bookmakers as the runaway favorite this year, putting Sweden on course to win a record-breaking eighth Eurovision.

Their quirky number Bara Bada Bastu about sweating it out in a sauna, was “already odds-on (10/11) to win, which is incredibly rare,” Alex Apati, spokesman for the British Ladbrokes betting chain, told AFP.

OCS said its search data showed a 57 percent spike in betting-related searches just on Sweden.

Austria’s JJ had meanwhile been gaining traction for his operatic ballad Wasted Love, with his odds shortening to 9/4 and search volume increasing 44 percent over the past weekend, OCS said.

Bookmakers had France’s Louane, with her ballad Maman, in third position with a 10 percent shot at the title.

She is followed by C’est la vie by Claude of the Netherlands, and Finland’s leather-clad Erika Vikman and her Ich Komme song about falling into the trance of lust.

Thursday’s second semi-final, meanwhile, “definitely stirred things up,” Huttunen said, pointing to “a noticeable spike in bets on Armenia” and also a “surge of interest in Ukraine.”

“It’s clear viewers are reacting in real time,” Huttunen said.

For Ladbrokes, the UK’s act is “the most popular pick in our book in terms of bets placed,” Apati said in an e-mail.

“But at odds of 66/1, they’re incredibly unlikely to win this year,” he said. “They’re actually considerably more likely to finish with zero points (12/1), or in last place (3/1), than they are to win it.”

The betting interest meanwhile spreads far beyond simply trying to pick the winner.

“There’s a lot of interest in the top five,” Apati said. “This is because Sweden are priced so short, punters are looking for value elsewhere.”

“When the favourites are heavily tipped, savvy betters start looking for more interesting angles,” Huttunen said.

Bookmakers have received bets on anything from the top performer within a specific region, like the Baltics or Nordic countries, to the winning performance language.

The language aspect is particularly interesting, Huttunen said, “since it taps into the cultural and emotional side of Eurovision, especially as more countries embrace native-language entries again.”

After Eurovision removed the requirement for countries to perform in their native languages from 1999, most acts began performing in English, but there has been an increasing shift back towards native-language songs, with this year’s contest boasting artists performing in 20 different languages.

High volumes of bets show a “depth of engagement [that] tells us that fans aren’t just watching for entertainment,” Huttunen said. “Eurovision has evolved into an event that’s every bit as dynamic as traditional sport and betters are treating it that way.”

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,