The US Federal Reserve sent out signals on Wednesday that the US economy will have to muddle through its crisis without further rate cuts, even as the central bank slashed its forecast for growth this year.

In minutes released from its April 29 to April 30 policy meeting, the Fed said its decision to cut rates by a quarter point was “a close call” and that the “substantial easing” since last September, plus other measures, would help underpin economic activity.

At that meeting, the Federal Open Market Committee (FOMC), led by chairman Ben Bernanke, voted 8-2 to cut the federal funds base lending rate by a quarter point to 2 percent, the latest in a series of rate cuts since September aimed at firing up lagging growth.

But the panel stated that “it was no longer appropriate for the statement to emphasize the downside risks to growth,” the minutes said.

The minutes also said that “several members noted that it was unlikely to be appropriate to ease policy ... unless economic and financial developments indicated a significant weakening of the economic outlook.”

“The prevailing message of the minutes for the stock market is that we have very likely seen the end of this rate-cutting cycle,” said Patrick O’Hare at Briefing.com. “You can never say never, but that thinking helps explain why there was a sharp move lower [in the stock market] immediately following their release.”

Wall Street’s main indexes tumbled more than 1.6 percent. Losses accelerated after the Fed release, which came along with an updated economic outlook in which the central bank also made a sharp downward revision for growth to a range of 0.3 percent to 1.2 percent, from its prior forecast of 1.3 percent to 2 percent.

The new outlook, part of the Fed’s new policy for more frequent updates, was roughly in line with many private economist forecasts for sluggish growth which would put the world’s biggest economy on the brink of recession.

The US economy expanded at a tepid 0.6 percent pace in the past two quarters, with some analysts expecting a recession from the horrific slump in housing and the related credit squeeze.

“Participants viewed activity as likely to be particularly weak in the first half of 2008; some rebound was anticipated in the second half of the year,” the Fed statement said.

Fed governor Kevin Warsh made the point more emphatically in a Washington speech as the minutes were released.

“The Federal Reserve has employed the hammer with considerable force in the last nine months, lowering the federal funds rate by 3.25 percentage points, with wide-ranging implications for the economy,” Warsh said. “But now, policymakers may be well-served encouraging a new financial architecture to emerge, aided, in part, by the actions we have taken. Even if the economy were to weaken somewhat further, we should be inclined to resist expected, reflexive calls to trot out the hammer again.”

Brian Bethune, economist at Global Insight, said he believes the Fed has not closed the door to rate cuts, but will not act soon.

“While this suggests that the Fed is on hold for several months, the key issue that will emerge by September is the outlook for growth [in] 2009,” Bethun said.

“From our vantage point it looks very likely like the FOMC will have to lower its [economic] forecast band for 2009 when these forecasts are updated for the September and December meetings of the FOMC,” he said. “In view of these late-2008 expected downward revisions to the Fed’s central tendency forecast for 2009, Global Insight believes that there is a strong likelihood that the Fed will move to lower rates by about 50 basis points in the final months of 2008.”

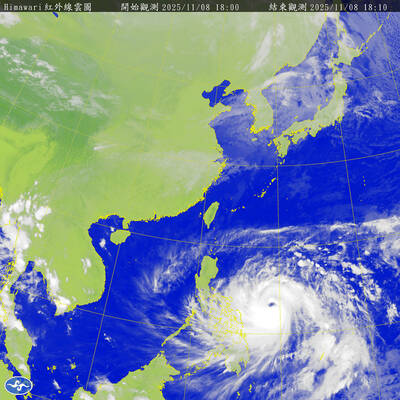

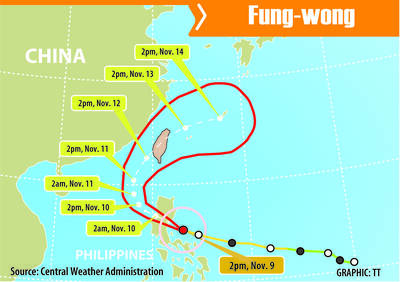

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city