US Federal Reserve Chairman Ben Bernanke's plan to increase transparency may have little short-term sway over investors who see financial carnage that will force the Fed to cut interest rates further.

Bernanke was to give a speech yesterday in which Fed watchers expected him to outline the results of a one-and-a-half year review of communications strategy. Officials have considered increasing their economic forecasts to four times a year, from two, and extending their horizon for projections to three years, said a person familiar with the matter.

Traders are betting the Fed is underestimating the fallout from the housing slump and bank writedowns of assets pummeled by subprime mortgage defaults. Investors ignored Bernanke when he said last week the risks between economic growth and inflation are "roughly" balanced, anticipating rate reductions at the next two Fed meetings.

"The market is unlikely to change its views on the basis on whatever the Fed might put out or what commentary they might have," said Charles Lieberman, a former New York Fed economist who's now chief investment officer of Advisors Capital Management LLC in Paramus, New Jersey. "The market's going to have to see some better data in order to basically join the Fed."

Bernanke was scheduled to speak on "Federal Open Market Committee Communications" at the Cato Institute in Washington yesterday morning, a research group holding an annual monetary-policy conference.

Bernanke, 53, set up a subcommittee headed by Vice Chairman Donald Kohn last year to review how the Fed communicates policy objectives. While officials said the discussions included setting a target for the inflation rate, the changes Bernanke is likely to announce will fall short of that objective, analysts said. The Fed chief favored a target when he served as Fed governor.

FORECASTS

The Fed currently releases forecasts for economic growth, unemployment and inflation in the coming two years in February and July. Moving to four annual reports suggests the central bank may release updated predictions before Bernanke's semiannual testimony to Congress in February.

New forecasts would offer Fed officials a chance to reinforce their message that growth will accelerate by the middle of next year. Bernanke told lawmakers at a Nov. 8 hearing the Fed already anticipates growth will "slow noticeably" this quarter.

Investors are betting policy makers will have to add to their 0.75 percentage point of cuts in the benchmark interest rate to avoid a recession.

Futures contracts on the Chicago Board of Trade indicate an 82 percent chance the FOMC will cut the overnight lending rate between banks by a quarter point to 4.25 percent on Dec. 11. A fourth reduction at the Jan. 29 to. Jan. 30 meeting, to 4 percent, carries a 53 percent probability.

"The long-run forecasts don't really tell you about near-term policy," said Peter Kretzmer, senior economist at Bank of America Corp in New York, who used to work at the Fed.

INFLATION

While the Fed may stop short of introducing an inflation target, it could offer insight into the desired range by adding forecasts for price changes in three years' time. That's because, as Bernanke said last week, "in all but the shortest of terms, the Federal Reserve's policy determines how much inflation there is."

Moving to a full-fledged numerical goal may have proved unpalatable to Democrats, who have a majority in Congress. House Financial Services Committee Chairman Barney Frank of Massachusetts and other legislators have opposed a target, arguing it would diminish the Fed's so-called dual mandate. The central bank is also charged with attaining full employment.

The Fed can get around that by "having the inflation forecast go out far enough so the endpoint is the implicit target," said Ethan Harris, chief US economist at Lehman Brothers Holdings Inc in New York, who used to work at the New York Fed.

"We've already seen the downside of not having the regime in place," Harris said. "There's all this silly speculation that Bernanke isn't serious about inflation."

A falling dollar and rising energy and commodity prices could push up consumer prices, Fed officials have acknowledged. Inflation expectations, as measured by the difference in yields between 10-year Treasuries and notes indexed to inflation, have risen. The spread reached 2.44 percentage points on Nov. 6, the widest since June.

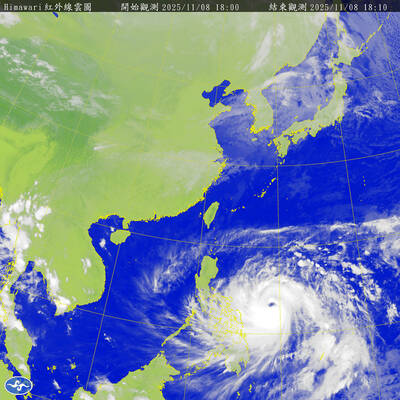

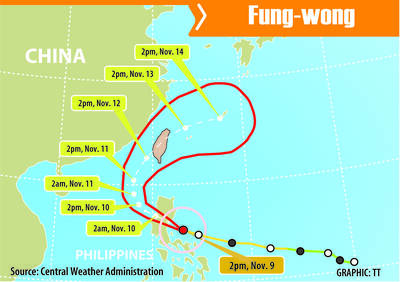

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city