Asia's economic growth prospects will get a strong boost from the US Federal Reserve's hefty cut in interest rates, Asian Development Bank president Haruhiko Kuroda said yesterday.

"The latest decision by the US Federal Reserve would be welcomed by many in the region because that would first of all reduce the financial sector turmoil," he told a news conference on the sidelines of an aid conference in Manila.

"It would definitely improve the prospect of sustained strong economic growth in the US and would also be beneficial particularly for the emerging economies of Asia," he said.

"I would say that the decision would be greatly appreciated by many economies and the financial sector in the region," Kuroda said.

The US central bank on Tuesday cut the federal funds rate, which banks charge each other for overnight loans, by a hefty half point to 4.75 percent, the first reduction in four years. The move was cheered by financial markets across much of Asia.

Asian stocks soared yesterday in the wake of Wall Street's overnight surge spurred by the Fed's larger-than-expected interest rate cut.

Japan's benchmark Nikkei 225 stock index jumped 579.74 points, or 3.7 percent, to close at 16,381.54 points. Hong Kong's Hang Seng index was up a stunning 1,004 points, or 4.1 percent, at 25,581.13 in afternoon trading.

Stock markets in South Korea, India, Australia, Singapore, Taiwan and the Philippines also advanced, although Chinese shares faltered.

Japan on yesterday hailed the Fed's hefty cut in interest rates, saying it was prompt action to ease distress in financial markets.

"I think they are responding promptly to the current situation," Chief Cabinet Secretary Kaoru Yosano said.

The Fed "made the decision by considering every single element, including the psychological impact of a slump in the housing industry and concerns about the financial market," the government's top spokesman told a news conference.

After the Fed's move, the Hong Kong Monetary Authority cut its benchmark base interest rate half a percentage point to 6.25 percent. Hong Kong's currency is pegged to the US dollar and the HKMA usually follows in lockstep any US interest rate adjustments.

Later yesterday, the Bank of Japan decided to leave its key interest rate unchanged at 0.5 percent, as widely expected. The bank's policy board voted eight to one to keep the overnight call rate at 0.5 percent, with Atsushi Mizuno, who has a reputation for being a policy hawk, again opposing the decision to stand pat.

Oil prices rose yesterday above the previous session's record close, lifted by expectations the interest rate cut by the US Federal Reserve would accelerate growth and increase demand for already tight crude and gasoline supplies.

Light, sweet crude for next month delivery added US$0.66 to US$82.17 a barrel in Asian electronic trading on the New York Mercantile Exchange by midafternoon in Singapore.

"The oil market has taken confidence from the cut in the federal funds rate," said David Moore, commodity strategist with the Commonwealth Bank of Australia in Sydney.

"There had been concerns that US economic growth may slow and the US is the largest oil consumer, so it would potentially impact on oil demand," Moore said. "The Fed's rate cut has at least reduced the risks of a severe slowing in the US economy," he said.

Manila-based ADB, downplaying the chances of a US recession, on Monday raised its economic growth forecasts for developing Asia this year to 8.3 percent from 7.6 percent in March.

Next year's growth should be 8.2 percent, up from the earlier forecast of 7.7 percent, it said.

Kuroda also said yesterday that the fallout from Britain's Northern Rock crisis is unlikely to hit Asia.

He said the bank's problems, which was bailed out by the British government after suffering a run of withdrawals of about three billion pounds, was "not directly related to the subprime mortgage problem" that had earlier unsettled Asian financial markets.

"The British authorities have dealt with the case professionally and so I expect that particular event would stabilize and calm down quite soon," Kuroda said.

He said that "so far financial markets and credit markets in the region had not particularly been strongly affected."

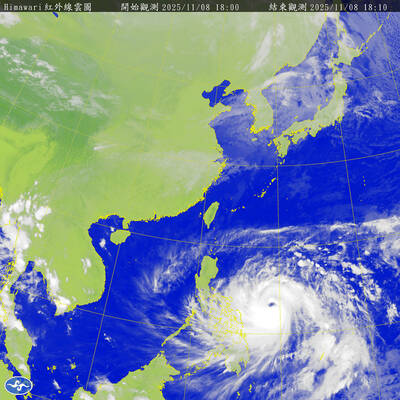

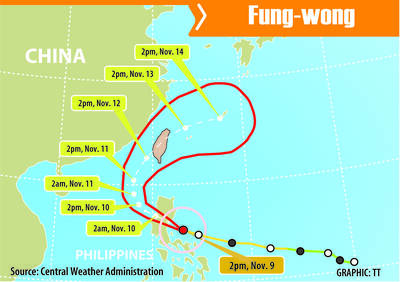

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city