The Bank of Korea raised its key interest rate yesterday for a second straight month, bringing the benchmark to its highest level in more than six years as the bank voiced concern about strengthening economic growth.

The central bank said it raised its overnight call rate target for loans to commercial banks by 25 basis points to 5 percent. The increase followed one last month that was the first since last August.

"The domestic economy seems likely to maintain its upward trend," the bank said in a statement.

"While exports continue to post robust growth, investment and private consumption are increasing steadily," it said.

The increase in the call rate was unexpected. All 12 economists surveyed by Dow Jones Newswires had predicted the central bank would keep the rate unchanged. South Korea's KOSPI pared early gains to end just 0.3 percent higher after the rate hike.

The hike came after South Korea's economy grew sharply in the second quarter, expanding at its fastest rate in a year, fueled by strong production of semiconductors, ships and automobiles.

The call rate target was last at 5 percent in July of 2001, when the bank cut the rate to 4.75 percent.

South Korea grew 4.9 percent in the three months ended June 30 from the same period last year, the highest since growth of 5.1 percent in the second quarter last year.

Increased lending to smaller companies has sparked concern about inflation.

Also yesterday the bank raised its aggregate credit ceiling rate for a second month for special, low-interest loans it can offer to commercial banks to 3.25 percent from 3 percent. Those loans are primarily channeled to small companies.

Still, it seemed less concerned about inflation.

"Consumer price inflation remains stable despite the rise in international oil prices," it said, adding that rising real estate prices appeared under control.

Separately, Standard & Poor's Ratings Services yesterday cautioned about the sustainability of the country's economic growth.

"Though sentiment on [South] Korea's macroeconomy is becoming bullish, structural problems remain that could hamper medium-to-long term growth," it said in a report.

S&P credit analyst Takahira Ogawa cited among other factors South Korea's low investment growth, characterized by large exporters in the automobile and electronics industries increasingly moving production abroad.

In contrast, he said that smaller South Korean companies "lack global competitiveness, with low profits and weak financial strength."

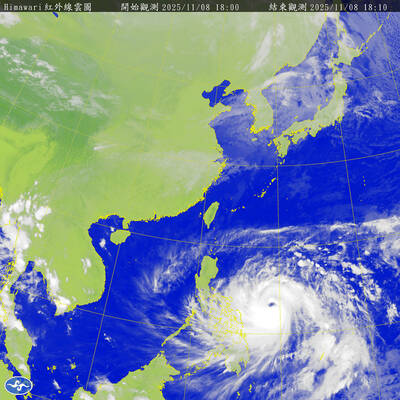

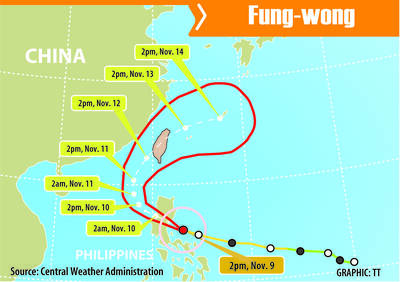

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had

The Central Weather Administration (CWA) yesterday issued a sea alert for Typhoon Fung-wong (鳳凰) as it threatened vessels operating in waters off the Pratas Islands (Dongsha Islands, 東沙群島), the Bashi Channel and south of the Taiwan Strait. A land alert is expected to be announced some time between late last night and early this morning, the CWA said. As of press time last night, Taoyuan, as well as Yilan, Hualien and Penghu counties had declared today a typhoon day, canceling work and classes. Except for a few select districts in Taipei and New Taipei City, all other areas and city