Are you a green investor? You've never had it so good. Shares in windpower companies, carbon trading exchanges and clean energy providers are soaring as green fever grips the City of London.

Take the example of Clipper Windpower, a California-based turbine maker whose shares are listed in London. They have tripled from ?3 (US$5.90) a year ago, to around ?9.25 this week, giving the company a market value close to ?1 billion. And it is confident it can continue to grow in a global market for windpower that is already worth ?4.5 billion a year and is expanding at 15 percent to 25 percent per annum.

Or look at Climate Exchange. Shares in this carbon trading platform could be bought for around ?3 each in September last year. Recently they were changing hands for ?16.30 — valuing the company, which has only just turned a profit, at nearly ?680 million.

Virtually every week a new clean energy company is listed on the London Stock Exchange's Aim market, which has elbowed aside New York's NASDAQ to become the predominant global trading place for green-themed, often high-tech, company launches.

Critics warn of a green bubble akin to the dot.com blow-out seven years ago. Only this week, one alternative energy company, Biofuels, saw its shares crash amid a battle to stave off bankruptcy. But speak to some of the most hard-nosed investors in the country, and you hear a different story.

Neil Woodford runs Invesco Perpetual's ?14 in income funds. He's probably the most revered fund manager in Britain today — and he's far from your typical green investor. In the past he has taken big stakes in tobacco companies, investments that have earned him the wrath of ethics campaigners.

Yet three years ago, he started buying shares in climate-change related stocks — and thinks we are still at just the start of a long green business cycle.

He owns a 21 percent stake in Climate Exchange, and is not planning to sell out despite the stunning rise in its share price.

"I believe the volume of carbon traded [on exchanges such as Climate Exchange] will, in the future, dwarf bond and equity markets. It will be the single biggest commodity market in the world," he said.

He accepts that lots of clean energy concepts "will burn bright then disintegrate very quickly" but pick the right one, and you could make a fortune.

He has bought a stake in Clean Energy Brazil, a producer of bioethanol from sugar cane.

"There are all sorts of distortions in the ethanol market, such as government subsidies. But one thing for sure is that ethanol from sugar cane is climatically more sensible, and economically more viable, than making it from corn in the northern hemisphere," said Woodford, who himself owns a farm in the west of England.

But if investors want to profit from climate change, they have to think laterally, he said.

"It's wrong just to look at explicit green vehicles. Climate change is now impacting our investment view even of companies such as [supermarket giant] Tesco. It's likely that climate change will raise the price of goods and services, so, for example, out-of-season strawberries in Tesco will have to reflect the carbon cost of bringing them in from abroad," he said.

Jamie Allsopp, who runs New Star's Hidden Value fund, is another manager from outside the traditional ethical investing community who has been filling his boots with climate-change related shares. A tenth of his fund is now in green stocks such as Trading Emissions (up 28 percent since March), Camco (up 50 percent) and Ecosecurities (up 47 percent).

He also likes Renewable Power & Light, a New York utility which is currently converting two gas-fired stations into biodiesel.

Like many clean energy companies, they operate outside the UK but are beating a path to the door of the London stock exchange to be listed in Britain, which has a lighter regulatory regime and an investment community which is more open to climate change ideas.

But he warned investors to be highly selective.

"Some of the wind turbine companies are looking pretty pricey," he said.

So how can the average small investor access the green boom? You can buy Aim-listed shares cheaply through virtually any online dealing service — but be warned. Aim stocks are notoriously volatile and it's easy for greenfingers to turn into burnt fingers.

A Ministry of Foreign Affairs official yesterday said that a delegation that visited China for an APEC meeting did not receive any kind of treatment that downgraded Taiwan’s sovereignty. Department of International Organizations Director-General Jonathan Sun (孫儉元) said that he and a group of ministry officials visited Shenzhen, China, to attend the APEC Informal Senior Officials’ Meeting last month. The trip went “smoothly and safely” for all Taiwanese delegates, as the Chinese side arranged the trip in accordance with long-standing practices, Sun said at the ministry’s weekly briefing. The Taiwanese group did not encounter any political suppression, he said. Sun made the remarks when

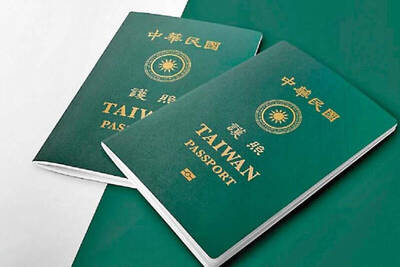

The Taiwanese passport ranked 33rd in a global listing of passports by convenience this month, rising three places from last month’s ranking, but matching its position in January last year. The Henley Passport Index, an international ranking of passports by the number of designations its holder can travel to without a visa, showed that the Taiwan passport enables holders to travel to 139 countries and territories without a visa. Singapore’s passport was ranked the most powerful with visa-free access to 192 destinations out of 227, according to the index published on Tuesday by UK-based migration investment consultancy firm Henley and Partners. Japan’s and

BROAD AGREEMENT: The two are nearing a trade deal to reduce Taiwan’s tariff to 15% and a commitment for TSMC to build five more fabs, a ‘New York Times’ report said Taiwan and the US have reached a broad consensus on a trade deal, the Executive Yuan’s Office of Trade Negotiations said yesterday, after a report said that Washington is set to reduce Taiwan’s tariff rate to 15 percent. The New York Times on Monday reported that the two nations are nearing a trade deal to reduce Taiwan’s tariff rate to 15 percent and commit Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to building at least five more facilities in the US. “The agreement, which has been under negotiation for months, is being legally scrubbed and could be announced this month,” the paper said,

Japan and the Philippines yesterday signed a defense pact that would allow the tax-free provision of ammunition, fuel, food and other necessities when their forces stage joint training to boost deterrence against China’s growing aggression in the region and to bolster their preparation for natural disasters. Japan has faced increasing political, trade and security tensions with China, which was angered by Japanese Prime Minister Sanae Takaichi’s remark that a Chinese attack on Taiwan would be a survival-threatening situation for Japan, triggering a military response. Japan and the Philippines have also had separate territorial conflicts with Beijing in the East and South China