Republicans in the US Senate on Thursday scrambled to salvage their tax plan after it hit unexpected roadblocks, leaving US President Donald Trump still waiting for a major political victory he hopes to secure before year’s end.

Trump had hoped his party would pass the controversial bill as early as Thursday night, handing the White House and Republicans their most significant legislative achievement of his young presidency.

However, after 11th-hour negotiations over how to offset the cost of dramatic tax cuts for corporations and more modest cuts for individuals, Senate Majority Leader Mitch McConnell postponed votes until midday yesterday.

A tense standoff on the Senate floor threw the bill’s fate into question, after a new projection showed the measure would add US$1 trillion to the federal deficit.

The analysis complicated Trump’s argument, shared by many Republicans, that the tax cuts would pay for themselves through additional economic growth — and left some senators mulling the addition of future tax hikes into the plan to ensure sufficient revenue.

In a dramatic move, three Republican senators refused to vote on a procedural measure until they were assured that more changes could be made to the legislation.

Republicans hold a narrow 52-48 Senate majority. Three defectors would kill the bill, and a handful were showing reservations about a measure that experts have said would benefit corporations and the wealthy.

US Senator Bob Corker, who has publicly criticized Trump in recent months, wants a “trigger” inserted to raise taxes if revenues fall short of projections.

However, the Senate parliamentarian told lawmakers that such a mechanism would not be allowed under budget rules.

Republicans ultimately voted to proceed, but the showdown highlighted the delicate balancing act in getting the tax plan across the finish line.

“It doesn’t look like the trigger is going to work,” US media quoted Republican Senator John Cornyn as saying.

One option for boosting revenue would be to raise corporate tax rates after six years, perhaps by half a percentage point per year, Cornyn said.

As it stands, the bill would reduce the corporate rate from 35 percent to 20 percent. Trump has repeatedly called for a 20 percent corporate rate.

Lawmakers were seeking new ways to circumvent the unexpected snags.

Political news site Roll Call quoted Senator Lindsey Graham as saying that he felt “confident that if there’s a shortfall in the projections that there’ll be a mechanism in the bill to deal with the deficit.”

However, Senator Ted Cruz warned that inserting automatic tax hikes would set a “bad precedent,” because they could force US families into paying higher taxes during an economic downturn.

Some conservatives have bridled at seeing their party trample the anti-deficit budget orthodoxy they preached during the Obama presidency: The bill before them would balloon the national deficit by US$1.4 trillion over the coming decade, the US Congressional Budget Office estimated.

If the legislation passes the Senate, it still must be reconciled with the recently passed US House of Representatives version. The plans differ on some points.

As Republican leaders scrambled to overcome final objections and lock down necessary votes, their essential argument was a simple one: If they fail on tax reform, they can expect major losses in midterm elections in November next year.

US Democrats, united in opposition, have argued that the plan is too expensive and would accommodate only the rich.

Senator Mazie Hirono used some salty language to get the point across.

“Rather than crafting a tax plan that would actually help middle-class families, Donald Trump and the Republican Party have decided to screw them over instead,” she told colleagues.

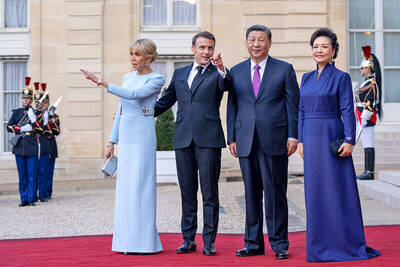

MONEY MATTERS: Xi was to highlight projects such as a new high-speed railway between Belgrade and Budapest, as Serbia is entirely open to Chinese trade and investment Serbian President Aleksandar Vucic yesterday said that “Taiwan is China” as he made a speech welcoming Chinese President Xi Jinping (習近平) to Belgrade, state broadcaster Radio Television of Serbia (RTS) said. “We have a clear and simple position regarding Chinese territorial integrity,” he told a crowd outside the government offices while Xi applauded him. “Yes, Taiwan is China.” Xi landed in Belgrade on Tuesday night on the second leg of his European tour, and was greeted by Vucic and most government ministers. Xi had just completed a two-day trip to France, where he held talks with French President Emmanuel Macron as the

With the midday sun blazing, an experimental orange and white F-16 fighter jet launched with a familiar roar that is a hallmark of US airpower, but the aerial combat that followed was unlike any other: This F-16 was controlled by artificial intelligence (AI), not a human pilot, and riding in the front seat was US Secretary of the Air Force Frank Kendall. AI marks one of the biggest advances in military aviation since the introduction of stealth in the early 1990s, and the US Air Force has aggressively leaned in. Even though the technology is not fully developed, the service is planning

INTERNATIONAL PROBE: Australian and US authorities were helping coordinate the investigation of the case, which follows the 2015 murder of Australian surfers in Mexico Three bodies were found in Mexico’s Baja California state, the FBI said on Friday, days after two Australians and an American went missing during a surfing trip in an area hit by cartel violence. Authorities used a pulley system to hoist what appeared to be lifeless bodies covered in mud from a shaft on a cliff high above the Pacific. “We confirm there were three individuals found deceased in Santo Tomas, Baja California,” a statement from the FBI’s office in San Diego, California, said without providing the identities of the victims. Australian brothers Jake and Callum Robinson and their American friend Jack Carter

CUSTOMS DUTIES: France’s cognac industry was closely watching the talks, fearing that an anti-dumping investigation opened by China is retaliation for trade tensions French President Emmanuel Macron yesterday hosted Chinese President Xi Jinping (習近平) at one of his beloved childhood haunts in the Pyrenees, seeking to press a message to Beijing not to support Russia’s war against Ukraine and to accept fairer trade. The first day of Xi’s state visit to France, his first to Europe since 2019, saw respectful, but sometimes robust exchanges between the two men during a succession of talks on Monday. Macron, joined initially by EU Commission President Ursula von der Leyen, urged Xi not to allow the export of any technology that could be used by Russia in its invasion