Driving along the Miaoli section of the Formosa Freeway (Freeway No. 3) and looking seaward, one can see the only two offshore wind turbines developed in Taiwan financially, technically and in terms of design.

“The two turbines were built by Swancor over the past seven years, and while the project caused headaches, fear and helplessness, we wanted to build up the local supply chain for the wind turbines,” company president Robert Tsai (蔡朝陽) said.

“We sought collaboration with domestic companies throughout the process, including design, financing, user interface management, electrical equipment and cable-laying,” he added.

Photo provided by Robert Tsai

To ensure that the foundations and turbines would meet legal standards, the company hired a ship with specific gear from Europe, and the daily cost of the lease and the wages for the 60 professionals on board totaled NT$12 million (US$410,467) each day, Tsai said.

“We did not anticipate the expenses incurred when a latch needed to be replaced on the ship, which cost an astounding NT$1 billion and 90 days in additional delays, which of course cost the company more,” Tsai said.

Since the ship reached Taiwanese waters in June last year, the company has lost hundreds of millions of New Taiwan dollars, as it has been forced to relocate it from the Port of Taipei to the Port of Taichung, and then to the Port of Kaohsiung due to typhoons and tropical storms, Tsai said.

With multiple typhoons and the northeastern monsoon coming right after the typhoon season, Tsai said the company would have lost NT$50 million if it had been unable to work for the entire winter season.

“I remember crying silently as I left the ship, after we had established that conditions on the water were not suitable for the work,” Tsai said.

The company was 60 percent in debt and without any further funds, as the company had invested NT$1 billion, Tsai said, adding that the delay in laying the foundations affected the company’s talks with foreign investors.

Swancor was able to lay the foundations when weather conditions turned favorable for an hour, he said, adding that it was a crucial moment that helped him pull through.

Power generation by both units has exceeded expectations and bolstered the government’s confidence in offshore wind power generation, Tsai said.

Macquerie Capital has offered to acquire a 50 percent stake in the project, Tsai said, adding that Cathay United Bank has also said it would be willing provide an accommodation loan.

However, the Ching Fu case last year has once again made publicly listed banks hesitant to take risks, Tsai said.

Ching Fu had been accused of fraudulent activities involving nine banks that agreed to grant the shipbuilder a NT$20.5 billion syndicated loan led by state-run First Commercial Bank (第一銀行). Ching Fu defaulted on the loan, causing the banks to lose up to NT$20.1 billion.

There have been many reappointments in the banks’ top management and they have also reduced their lines of credit to Swancor, Tsai said.

To avoid transfer of benefits, the Bureau of Energy has established Off-shore Wind Power Generation Companies Selection Standards (離岸風電遴選辦法), he said.

Tsai said he is unsure whether Swancor could hold up against foreign companies that might be joining the bid.

However, “I believe the government will be wise and not leave us out,” he said.

“It would not be fair if companies that have supported government policies to establish locally developed wind power generation capacity are sacrificed in the end,” Tsai said.

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

FLU SEASON: Twenty-six severe cases were reported from Tuesday last week to Monday, including a seven-year-old girl diagnosed with influenza-associated encephalopathy Nearly 140,000 people sought medical assistance for diarrhea last week, the Centers for Disease Control (CDC) said on Tuesday. From April 7 to Saturday last week, 139,848 people sought medical help for diarrhea-related illness, a 15.7 percent increase from last week’s 120,868 reports, CDC Epidemic Intelligence Center Deputy Director Lee Chia-lin (李佳琳) said. The number of people who reported diarrhea-related illness last week was the fourth highest in the same time period over the past decade, Lee said. Over the past four weeks, 203 mass illness cases had been reported, nearly four times higher than the 54 cases documented in the same period

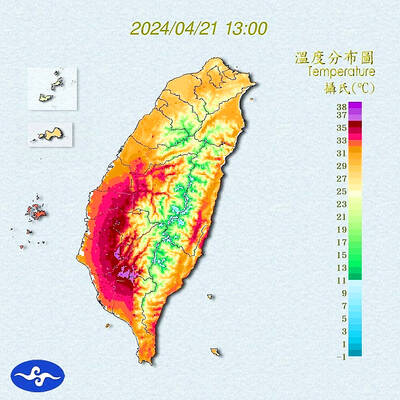

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read: