The EasyCard is to become the first electronic ticket in the nation to allow automated value adding via bank-wired transfers, saving people the trouble of having to insert banknotes into value-adding machines when their balances are low, EasyCard Corp said yesterday.

Starting next year, cardholders will be able to link their bank accounts with their EasyCards and set the amount they want their banks to automatically wire into their EasyCards every time the balance on their cards is insufficient, EasyCard spokeswoman Chen Ching-fang (陳靜芳) said.

The corporation submitted its proposal on the service to the Financial Supervisory Commission, which in May promulgated guidelines on managing the risks associated with automated transfers to electronic tickets and gave the service the green light, she said, adding that the guidelines also apply to other electronic ticket service providers,

According to the guidelines, a cap of NT$1,000 will be set on each transfer, while a daily limit of NT$3,000 will be put in place for users whose cards are linked to the accounts of close family members.

Those whose cards that are linked to their own accounts will not be subject to such restrictions, she said.

As some parents give their children their allowances via EasyCards, parents will be able to monitor their children’s spending by linking their children’s cards to their bank accounts, while people whose parents are 65 or older and hold concession cards can wire money to their parents’ cards from their bank accounts, the corporation said.

The service is to be available to students, senior residents and disabled people holding concession cards, the firm said, adding that cardholders must have their cards registered before they can use the service.

Hong Kong singer Eason Chan’s (陳奕迅) concerts in Kaohsiung this weekend have been postponed after he was diagnosed with Covid-19 this morning, the organizer said today. Chan’s “FEAR and DREAMS” concert which was scheduled to be held in the coming three days at the Kaohsiung Arena would be rescheduled to May 29, 30 and 31, while the three shows scheduled over the next weekend, from May 23 to 25, would be held as usual, Universal Music said in a statement. Ticket holders can apply for a full refund or attend the postponed concerts with the same seating, the organizer said. Refund arrangements would

Former president Tsai Ing-wen (蔡英文) on Monday called for greater cooperation between Taiwan, Lithuania and the EU to counter threats to information security, including attacks on undersea cables and other critical infrastructure. In a speech at Vilnius University in the Lithuanian capital, Tsai highlighted recent incidents in which vital undersea cables — essential for cross-border data transmission — were severed in the Taiwan Strait and the Baltic Sea over the past year. Taiwanese authorities suspect Chinese sabotage in the incidents near Taiwan’s waters, while EU leaders have said Russia is the likely culprit behind similar breaches in the Baltic. “Taiwan and our European

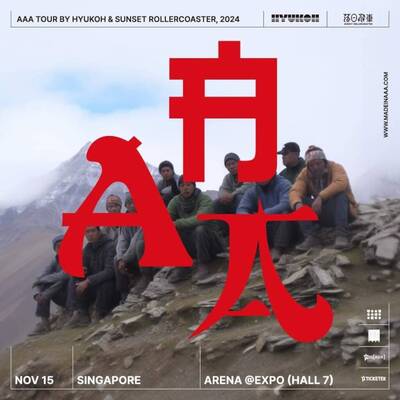

Taiwanese indie band Sunset Rollercoaster and South Korean outfit Hyukoh collectively received the most nominations at this year’s Golden Melody Awards, earning a total of seven nods from the jury on Wednesday. The bands collaborated on their 2024 album AAA, which received nominations for best band, best album producer, best album design and best vocal album recording. “Young Man,” a single from the album, earned nominations for song of the year and best music video, while another track, “Antenna,” also received a best music video nomination. Late Hong Kong-American singer Khalil Fong (方大同) was named the jury award winner for his 2024 album

The US Department of State on Monday reaffirmed that US policy on Taiwan remains unchanged, following US President Donald Trump’s use of the term “unification” while commenting on recent trade talks with China. Speaking at a wide-ranging press conference, Trump described what he viewed as progress in trade negotiations with China held in Geneva, Switzerland, over the weekend. “They’ve agreed to open China — fully open China, and I think it’s going to be fantastic for China. I think it’s going to be fantastic for us,” Trump said. “I think it’s going to be great for unification and peace.” Trump’s use of the