The Cabinet yesterday approved a change to health insurance that would result in premiums being calculated on the basis of annual household income as opposed to the current system, which is based on registered insurance subscriptions — a rough equivalent of an employee’s monthly salary.

“About half the people in large or low-income households will see premiums decrease, while the other half will have to pay more,” Department of Health (DOH) Minister Yaung Chih-liang (楊志良) told a press conference following the meeting.

If the amendment to the National Health Insurance Act (全民健康保險法) passes the legislature, the premium will be calculated by multiplying an as yet undetermined premium rate by an individual’s annual household income and then dividing the figure by the number of family members.

Currently, the premium for an insured employee is set at 30 percent of 4.55 percent of the insurer’s registered insurance subscription, with the government shouldering 10 percent of the cost and employers paying the remaining 60 percent.

Annual household income in the new system, dubbed “the second-generation national health insurance system,” is the same as taxable income defined by the Income Tax Act (所得稅法), which includes wages, interest income, income from professional practices, dividends and other profit-seeking practices, leases, royalties and property transactions, among others.

With the expansion of the premium base, the new premium rate is expected to be between 3 percent and 3.5 percent.

As an example, Yaung said the current premium for a single person in the NT$50,000 insurance bracket is about NT$700 per month and NT$3,000 if the person needs to provide for three dependents. Under the proposed system, a person whose salary is the only source of annual household income would pay NT$1,600 — no matter if they are single or have dependents.

“Although the change will increase the burden on single people, for a family of four for example, premiums will be significantly reduced,” Yaung said.

Yaung called on the public not to consider the new premium system a “punishment” for people who are not married.

“[Being able to pay more to the system] is a form of charity,” he said.

The spirit of the new system that “bigger earners help lower earners, the employed help the jobless, healthy people help sick people and those who have fewer family members help those with more” is in line with the basic principles of social insurance systems adopted universally,” Yaung said.

Premier Wu Den-yih (吳敦義), who was also present at the press conference, said that he felt “sorry” for asking single people to pay more.

Wu said the government has other measures in place to help single people such as offering partial mortgage interest relief for first-time buyers.

When asked whether that proposal wasn’t restricted to married people, Wu said: “We encourage people to get married.”

The current system, introduced in 1995, has been fraught with inequality as those whose income comes from sources other than salary pay the same as those whose salary is their only source of income.

If the legislature passes the proposed amendment before the end of the current session in June, the new system could come into effect as early as 2012.

Hong Kong singer Eason Chan’s (陳奕迅) concerts in Kaohsiung this weekend have been postponed after he was diagnosed with Covid-19 this morning, the organizer said today. Chan’s “FEAR and DREAMS” concert which was scheduled to be held in the coming three days at the Kaohsiung Arena would be rescheduled to May 29, 30 and 31, while the three shows scheduled over the next weekend, from May 23 to 25, would be held as usual, Universal Music said in a statement. Ticket holders can apply for a full refund or attend the postponed concerts with the same seating, the organizer said. Refund arrangements would

Former president Tsai Ing-wen (蔡英文) on Monday called for greater cooperation between Taiwan, Lithuania and the EU to counter threats to information security, including attacks on undersea cables and other critical infrastructure. In a speech at Vilnius University in the Lithuanian capital, Tsai highlighted recent incidents in which vital undersea cables — essential for cross-border data transmission — were severed in the Taiwan Strait and the Baltic Sea over the past year. Taiwanese authorities suspect Chinese sabotage in the incidents near Taiwan’s waters, while EU leaders have said Russia is the likely culprit behind similar breaches in the Baltic. “Taiwan and our European

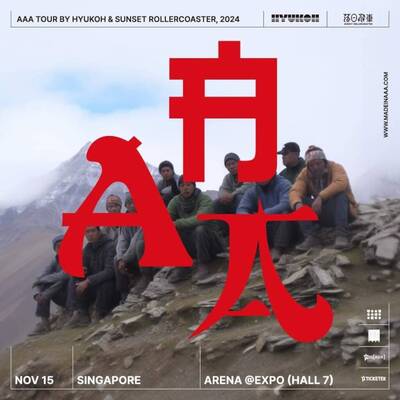

Taiwanese indie band Sunset Rollercoaster and South Korean outfit Hyukoh collectively received the most nominations at this year’s Golden Melody Awards, earning a total of seven nods from the jury on Wednesday. The bands collaborated on their 2024 album AAA, which received nominations for best band, best album producer, best album design and best vocal album recording. “Young Man,” a single from the album, earned nominations for song of the year and best music video, while another track, “Antenna,” also received a best music video nomination. Late Hong Kong-American singer Khalil Fong (方大同) was named the jury award winner for his 2024 album

The US Department of State on Monday reaffirmed that US policy on Taiwan remains unchanged, following US President Donald Trump’s use of the term “unification” while commenting on recent trade talks with China. Speaking at a wide-ranging press conference, Trump described what he viewed as progress in trade negotiations with China held in Geneva, Switzerland, over the weekend. “They’ve agreed to open China — fully open China, and I think it’s going to be fantastic for China. I think it’s going to be fantastic for us,” Trump said. “I think it’s going to be great for unification and peace.” Trump’s use of the