At the bank-run summer schools for heirs of some of Asia’s wealthiest families, visits to factories and shipyards are out; crash-courses in start-ups and impact investing are in.

In July, the Bank of Singapore, one of Asia’s largest private banks, hosted the children of some of its top clients at its GenINFINITY Program. Over five days at the Four Seasons Hotel they were taught the fundamentals of staying rich — from the ABC’s of private equity to the rudiments of hedge fund investing. Evenings were spent networking at Michelin-starred restaurants and the city’s most exclusive bars.

But while expensive camps for ultra-rich kids are a time-honored client perk, the new-age demands of millennial heirs are forcing institutions to change and personalize the programs. Rather than focus entirely on the old-economy industries behind most Asian family fortunes, much of Generation Next is interested in carving their own path and making a difference at the same time.

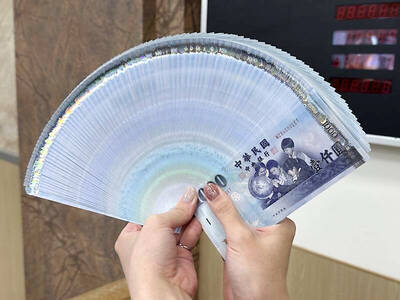

Photo: Bloomberg

“Going out to fellow entrepreneurs who are also trying to get something started and change the world a little bit, networking with them was great,” said Byron Lim, 26, who participated in GenINFINITY and now helps run a socially aware startup called Quarter Life Coffee — a far cry from the insurance broking that made his father wealthy. “We want to do something we love and get paid for it.”

For Bank of Singapore, and others like UBS Group AG and HSBC Holdings, adapting the courses are vital for locking in their next generation of clients at a critical time. Asian wealth is relatively young, and the first generation of tycoons is only just starting to relinquish control to their successors. This will result in the biggest wealth transfer event in over a century, according to UBS.

“If you look at millennials and Gen Z, the way they think, the way they operate and the way they’ve grown up is very different to, say, the way I grew up,” said Bank of Singapore Global Chief Operating Officer Sonjoy Phukan, who has worked in private wealth for almost 20 years.

SHARK TANK

Many are interested in topics that were far less important even a decade ago; from artificial intelligence to personal brands. “There’s been a move away from pure finance and investment into leadership, communications, culture and other topics, and based on the feedback we’ll adapt next year’s program as well,” he said.

At GenINFINITY, the wealthy heirs did a mix of old-school studies and activities their parents would have balked at. For 2 1/2-hours they worked with a consultant in the hotel’s penthouse on building their personal brand. Then they visited Block71 — a startup incubator near Alphabet’s regional headquarters — and attended an expert discussion on how AI will affect traditional industries.

The last two days were given over to a Shark Tank-style competition where participants were split into three groups to create and present startup ideas before a panel of judges. The challenge was heightened by the tender headaches some sported after a raucous night of networking.

As one team brainstormed potential businesses, they repeatedly hit roadblocks; a dozen ideas were born and culled on discarded sheets of butcher’s paper. For a while the half-joking fallback idea was an app that involved escorts, but it too was dumped for one glaring problem: prostitution is illegal in much of the world.

ESG FOCUS

Investments with a positive environmental, social or governance impact are another hot topic. HSBC Private Banking’s Global Head of Marketing Jennifer Ting has experienced this first-hand, recently guiding a Nextgen group through the rainforests of Borneo.

For the past three years, the HSBC Private Banking Sustainability Leadership Program has taken 10 participants to eastern Malaysia to learn about sustainability and how to influence their families to become more environmentally friendly, all beneath the curious gaze of endangered orangutans and macaques.

Flights to Kota Kinabulu aren’t covered by the bank, but everything else is. Much of the time is spent hiking through the undergrowth to learn about the area and plant trees; despite the scorching heat, the popular course is fully booked every trip.

“I picked a leech off one of our participants earlier,” Ting said as rain clouds gathered in the skies above. “But there’s a misconception of our audience. Just because you’re wealthy and born to privilege doesn’t mean that you need to be treated with kid gloves.”

For some heirs there are even more immersive experiences available.

Goh Shi Hui’s family was wealthy enough that UBS, DBS Group Holdings and BNP Paribas SA all enrolled her into their courses. She mingled with the well-to-do, consuming cocktails and business know-how from Singapore to California. The DBS entourage partied so hard that many risked missing class, but as everyone was staying at the W Hotel, truants were quickly rounded up by marketing staff.

Even so, the networking has proven useful, with all three groups staying in touch via social media.

But none can compare to the almost three years she spent working at Golden Equator Wealth, a Singapore-based multifamily office with US$600 million in assets under management that looked after part of her family’s property fortune. There, she undertook key projects from evaluating deals and writing industry reports to streamlining her own family’s finances, including culling private bank accounts started by her father that were deemed to deliver poor returns.

“Unlike a lot of the banks’ courses that last for four to five days, this program is tailored and customized depending on your learning curve,” Goh said. “The banks can’t afford to be teachers.”

Golden Equator Chief Executive Officer Shirley Crystal Chua personally caught up with Goh every six months during her time at the firm to offer guidance and mentoring.

Participants rotate through asset classes from stocks and bonds to foreign exchange, hedge funds and private deals.

For Chua, it’s a response to demand for programs that move away from ‘perks’ and help prepare young charges for a rapidly changing world — a simplified three-month leadership course is also being planned.

Because of the intensive nature of the course, Golden Equator takes on just six people at a time. And to make sure graduates are ready for the lifestyle of the crazy rich, they get lessons on art, philanthropy and networking.

Another perk: access to Door XXV — a hidden, private whiskey bar for next-gen heirs to host events and mingle with founders and investors away from prying eyes.

But with the number of heirs growing exponentially, it’s impossible for banks to replicate Golden Equator’s model. And the adaptation of short-courses like the Bank of Singapore’s means invitations remain as coveted as ever.

Back at GenINFINITY, the same team that briefly pondered the escort app pulls off a pivot worthy of Silicon Valley and wins by pitching an augmented reality app to help shoppers find the right sized clothes and see what they’d look like in different outfits — an idea made more realistic because one of the group is a computer science student and some others are self-confessed shopaholics.

Dissident artist Ai Weiwei’s (艾未未) famous return to the People’s Republic of China (PRC) has been overshadowed by the astonishing news of the latest arrests of senior military figures for “corruption,” but it is an interesting piece of news in its own right, though more for what Ai does not understand than for what he does. Ai simply lacks the reflective understanding that the loneliness and isolation he imagines are “European” are simply the joys of life as an expat. That goes both ways: “I love Taiwan!” say many still wet-behind-the-ears expats here, not realizing what they love is being an

Google unveiled an artificial intelligence tool Wednesday that its scientists said would help unravel the mysteries of the human genome — and could one day lead to new treatments for diseases. The deep learning model AlphaGenome was hailed by outside researchers as a “breakthrough” that would let scientists study and even simulate the roots of difficult-to-treat genetic diseases. While the first complete map of the human genome in 2003 “gave us the book of life, reading it remained a challenge,” Pushmeet Kohli, vice president of research at Google DeepMind, told journalists. “We have the text,” he said, which is a sequence of

Every now and then, even hardcore hikers like to sleep in, leave the heavy gear at home and just enjoy a relaxed half-day stroll in the mountains: no cold, no steep uphills, no pressure to walk a certain distance in a day. In the winter, the mild climate and lower elevations of the forests in Taiwan’s far south offer a number of easy escapes like this. A prime example is the river above Mudan Reservoir (牡丹水庫): with shallow water, gentle current, abundant wildlife and a complete lack of tourists, this walk is accessible to nearly everyone but still feels quite remote.

It’s a bold filmmaking choice to have a countdown clock on the screen for most of your movie. In the best-case scenario for a movie like Mercy, in which a Los Angeles detective has to prove his innocence to an artificial intelligence judge within said time limit, it heightens the tension. Who hasn’t gotten sweaty palms in, say, a Mission: Impossible movie when the bomb is ticking down and Tom Cruise still hasn’t cleared the building? Why not just extend it for the duration? Perhaps in a better movie it might have worked. Sadly in Mercy, it’s an ever-present reminder of just