New Trump administration policies aimed at curbing China’s access to American innovation have all but halted Chinese investment in US technology startups, as both investors and startup founders abandon deals amid scrutiny from Washington.

Chinese venture funding in US startups crested to a record US$3 billion last year, according to New York economic research firm Rhodium Group, spurred by a rush of investors and tech companies scrambling to complete deals before a new regulatory regime was approved in August.

Since then, Chinese venture funding in US startups has slowed to a trickle, interviews with more than 35 industry players show.

Photo: AFP

US President Donald Trump signed new legislation expanding the government’s ability to block foreign investment in US companies, regardless of the investor’s country of origin. But Trump has been particularly vocal about stopping China from getting its hands on strategic US technologies.

The new rules are still being finalized, but tech industry veterans said the fallout has been swift.

“Deals involving Chinese companies and Chinese buyers and Chinese investors have virtually stopped,” said attorney Nell O’Donnell, who has represented US tech companies in transactions with foreign buyers.

Lawyers say they are feverishly rewriting deal terms to help ensure investments get the stamp of approval from Washington. Chinese investors, including big family offices, have walked away from transactions and stopped taking meetings with US startups. Some entrepreneurs, meanwhile, are eschewing Chinese money, fearful of lengthy government reviews that could sap their resources and momentum in an arena where speed to market is critical.

Volley Labs, a San Francisco-based company that uses artificial intelligence to build corporate training materials, is playing it safe. It declined offers from Chinese investors last year after accepting cash from Beijing-based TAL Education Group as part of a financing round in 2017.

“We decided for optical reasons it just wouldn’t make sense to expose ourselves further to investors coming from a country where there is now so much by way of trade tensions and IP tensions,” said Carson Kahn, Volley’s CEO.

A Silicon Valley venture capitalist said he is aware of at least 10 deals, some involving companies in his own portfolio, that fell apart because they would need approval from the interagency group known as the Committee on Foreign Investment in the US (CFIUS). He declined to be named for fear of bringing negative attention to his portfolio companies.

CFIUS is the government group tasked with reviewing foreign investment for potential national security and competitive risks. The new legislation expands its powers. Among them: the ability to probe transactions previously excluded from its purview, including attempts by foreigners to purchase minority stakes in US startups.

China is in the crosshairs. The Asian giant has been an aggressive investor in technology deemed critical to its global competitiveness and military prowess. Chinese investors have bought stakes in ride-hailing firms Uber and Lyft, as well as companies with more sensitive technologies including data center networking firm Barefoot Networks, autonomous driving startup Zoox and speech recognition startup AISense.

A dearth of Chinese money is unlikely to spell doomsday for Silicon Valley. Investors worldwide poured more than US$84 billion into US startups for the first three quarters of last year, exceeding any prior full-year funding, according to data provider PitchBook.

Still, Chinese funders are critical to helping US companies gain access to the world’s second-largest economy. Volley’s Kahn acknowledged that rejecting Chinese investment may make his startup’s overseas expansion more difficult.

“Those of us who are operators and entrepreneurs feel the brunt of these tensions,” Kahn said.

It is a radical shift for Silicon Valley. Money has historically flowed in from every corner of the globe, including from geopolitical rivals such as China and Russia, largely uninhibited by US government scrutiny or regulation.

Reid Whitten, an attorney with Sheppard Mullin, said that of the six companies he recently advised to get CFIUS approval for their investment offers, only two have opted to file the paperwork. The others abandoned their deals or are still considering whether to proceed.

“It is a generational change in the way we look at foreign investment in the United States,” Whitten said.

CRITICAL TECHNOLOGIES

The decline in Chinese investment comes amid heightened tensions between Beijing and Washington. Trump has blasted China for its enormous trade surplus and for what he claims are its underhanded strategies to obtain leading-edge American technology.

The nations have already levied billions in tariffs on each other’s goods. And Trump is considering an executive order to bar US companies from using telecommunications equipment made by China’s Huawei and ZTE, which the US government has accused of spying.

CFIUS is emerging as another powerful cudgel. Led by the US Treasury, it includes members from eight other government entities, including the departments of Defense, State and Homeland Security. The secretive committee does not disclose much about the deals it reviews. But its most recent annual report said Chinese investors made 74 CFIUS filings from 2013 to 2015, the most of any nation. The president has the authority to make the final decision, but a thumbs-down from CFIUS is usually enough to doom a deal.

Washington demonstrated its tougher stance even before the new law was passed, when Trump in March blocked a US$117 billion hostile bid by Singapore-based Broadcom to acquire Qualcomm of San Diego. CFIUS said the takeover would weaken the US in the race to develop next-generation wireless technology.

A White House spokeswoman did not respond to a request for comment.

In November, CFIUS rolled out a pilot program mandating that foreign investors notify the committee of any size investment in certain “critical technologies.” The scope of that term is still being defined, but a working list includes artificial intelligence, logistics technology, robotics and data analytics — the bread and butter of Silicon Valley.

Research firm Rhodium predicted that up to three-quarters of Chinese venture investments would be subject to CFIUS review under the new rules.

Just the threat of that scrutiny has caused some Chinese investors to reconsider.

Peter Kuo, whose firm, Silicon Valley Global, connects Chinese investors with US startups, said his business has slumped dramatically. He said not a single Chinese investor took a stake last year in the companies he shopped to them.

“CFIUS didn’t kill our organization, but it hampered a lot of startups, and most of them are American startups,” Kuo said.

SAFE SIDE OF THE FENCE

Some security experts applaud what they call long-overdue protections for US startups.

“What we are concerned about is a limited number of bad actors who are phenomenally clever about how they can access our intellectual property,” said Bob Ackerman, founder of AllegisCyber, a venture capital firm based in San Francisco and Maryland that backs cyber security startups.

Rhodium calculates that, on average, 21 percent of Chinese venture investment in the US from 2000 through 2017 came from state-owned funds, which are controlled at least in part by the Chinese government. That figure surged last year to 41 percent.

But some tech industry players say Washington is casting too wide a net in its zeal to check Beijing.

“A lot of innocent business people are getting” caught up in the administration’s spat with China, said Wei Guo, the China-born founding partner of Silicon Valley firm UpHonest Capital, whose funding comes mostly from foreign investors with ties to China.

Adding to Silicon Valley’s anxiety, the FBI has taken a more active role in policing Chinese investment.

Two industry veterans, a startup adviser and a venture capitalist who declined to be identified because of the sensitivity of the matter, said they were recently cautioned by the FBI not to pursue deals with Chinese investors. The two people did not name the Chinese entities of interest to the FBI, but said the deals concerned US companies building artificial intelligence and autonomous driving technologies.

Whether any of this deters China from reaching its goal of dominating advanced technologies remains to be seen. China can still invest in US technology through layers of funds that obscure the money source. And Chinese investors are redirecting funds to promising companies in Southeast Asia and Latin America. US startups, meanwhile, are rewriting deal terms to avoid a CFIUS review. Strategies include adding provisions to prevent foreign investors from obtaining proprietary technical information, and denying them board rights, veto rights or additional equity in future rounds, attorneys told Reuters.

“People are rightfully concerned about making sure they are on the safe side of the fence,” said Jeff Farrah, general counsel of the National Venture Capital Association.

Jan. 5 to Jan. 11 Of the more than 3,000km of sugar railway that once criss-crossed central and southern Taiwan, just 16.1km remain in operation today. By the time Dafydd Fell began photographing the network in earnest in 1994, it was already well past its heyday. The system had been significantly cut back, leaving behind abandoned stations, rusting rolling stock and crumbling facilities. This reduction continued during the five years of his documentation, adding urgency to his task. As passenger services had already ceased by then, Fell had to wait for the sugarcane harvest season each year, which typically ran from

It’s a good thing that 2025 is over. Yes, I fully expect we will look back on the year with nostalgia, once we have experienced this year and 2027. Traditionally at New Years much discourse is devoted to discussing what happened the previous year. Let’s have a look at what didn’t happen. Many bad things did not happen. The People’s Republic of China (PRC) did not attack Taiwan. We didn’t have a massive, destructive earthquake or drought. We didn’t have a major human pandemic. No widespread unemployment or other destructive social events. Nothing serious was done about Taiwan’s swelling birth rate catastrophe.

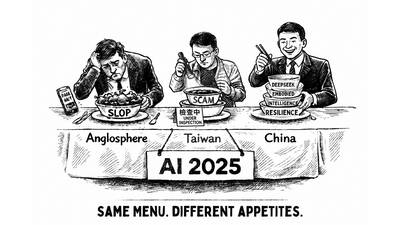

Words of the Year are not just interesting, they are telling. They are language and attitude barometers that measure what a country sees as important. The trending vocabulary around AI last year reveals a stark divergence in what each society notices and responds to the technological shift. For the Anglosphere it’s fatigue. For China it’s ambition. For Taiwan, it’s pragmatic vigilance. In Taiwan’s annual “representative character” vote, “recall” (罷) took the top spot with over 15,000 votes, followed closely by “scam” (詐). While “recall” speaks to the island’s partisan deadlock — a year defined by legislative recall campaigns and a public exhausted

In the 2010s, the Communist Party of China (CCP) began cracking down on Christian churches. Media reports said at the time that various versions of Protestant Christianity were likely the fastest growing religions in the People’s Republic of China (PRC). The crackdown was part of a campaign that in turn was part of a larger movement to bring religion under party control. For the Protestant churches, “the government’s aim has been to force all churches into the state-controlled organization,” according to a 2023 article in Christianity Today. That piece was centered on Wang Yi (王怡), the fiery, charismatic pastor of the