Banks in China and Hong Kong began wiring yuan directly to each other on Monday to settle payments for imports and exports, as China took another step toward establishing the yuan as a global currency — and, eventually, an international alternative to the dollar.

China has tempered its recent calls for a global reserve currency other than the dollar going into a meeting of the world’s major industrialized countries and biggest emerging economies in Italy today. Chinese Vice Foreign Minister He Yafei (何亞非) said on Sunday that the dollar would remain the world’s dominant currency for “many years to come.”

But the Chinese government is accelerating the process of making its own currency, the yuan, more readily convertible into other currencies, which gives it the potential over the long-term to be used widely for trade and as a reserve currency.

The day that the yuan is fully convertible — more than a few years away, but perhaps less than a few decades — will most likely mark a huge shift in global economic power and a day of reckoning of sorts not just for China but also for the US, which will no longer be able to run up huge debt without economic consequences.

Despite the slow, cautious pace at which China is moving, few experts on Chinese monetary policy doubt that the long-term direction of policy is toward strengthening the yuan as an alternative to industrialized countries’ currencies.

“To many minds here in China the US dollar’s time is almost up,” wrote Stephen Green, an economist in the Shanghai offices of Standard Chartered, in a research note last Thursday. “The euro zone suffers from political paralysis and a too-conservative central bank, while two decades of economic stagnation and a shrinking population do the yen no favors.”

For decades, China has shielded the yuan behind high barriers. Authorities in Beijing prevented sizable amounts of the currency from building up beyond China’s borders to allow them to control the exchange rate and tightly regulate the financial system.

By keeping the exchange rate low, China keeps its exports competitive.

But, as a result, almost all payments for China’s imports and exports, as well as international investment in China and Chinese investment abroad, are made in dollars. Smaller sums cross China’s borders as euros and yen, but seldom yuan.

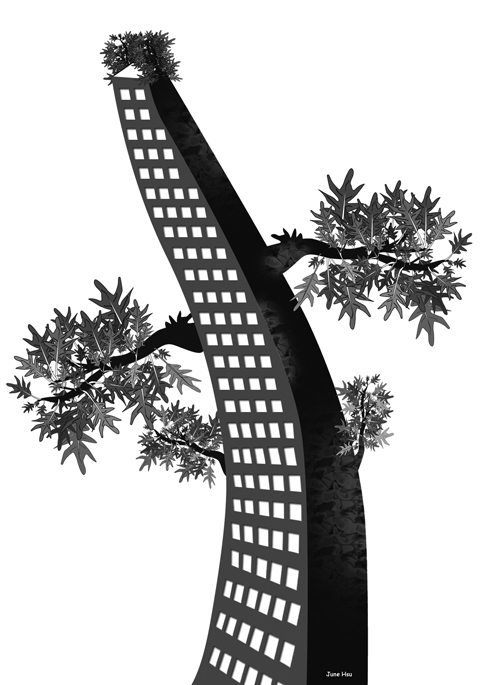

China is now starting to tear down these walls and free the yuan — a decision driven partly by recognition of China’s rising role in the world economy and partly by disenchantment with the currencies and financial systems of the industrialized world during the current downturn.

“China definitely wants to reduce its dependence on the US dollar,” said Xu Xiaonian (�?~), an economist at the China Europe International Business School. “Given the quantitative easing of the Fed and the risk of worldwide inflation, it is understandable why China would want to accelerate the convertibility of the renminbi.”

China’s leaders tend to plan far ahead, however, and full convertibility for the yuan is likely to take years, said three people who have discussed the issue with China’s central bank policymakers. All three said that China’s recently announced goal to turn Shanghai into an international financial center by 2020 meant that China probably wants a yuan that is fully convertible into other currencies by then.

Full convertibility is necessary for other countries’ central banks to hold yuan in their foreign exchange reserves instead of the dollar, but not sufficient by itself. China also needs to show long-term economic and financial stability — something it has demonstrated over the past year in greater abundance than most countries.

Specialists and economists estimate that China still holds close to three-quarters of its US$2 trillion in foreign reserves in the form of dollar-denominated assets. But these holdings have nearly stopped growing since the global financial crisis began in September, as Chinese authorities have also shifted away from the longer-maturity bonds and the securities of government-sponsored enterprises like Fannie Mae and toward shorter-dated securities, especially Treasury bills.

Zhou Xiaochuan (周小川), the governor of the People’s Bank of China, called this spring for a greater role in the global financial system for special drawing rights, a unit of account used in dealings with the IMF. But He, the vice foreign minister, said on Sunday that such discussions were an academic exercise.

Eswar Prasad, the former head of the IMF’s China division, said that senior Chinese central bankers had told him that Zhou’s suggestions about using special drawing rights as a kind of global currency were intended to stimulate debate and that China’s main goal is to enhance the role of its own currency.

“The Chinese authorities see full convertibility as a long-term objective, recognizing this is essential for the renminbi to become an international reserve currency,” Prasad said.

Full convertibility of the yuan is not an unalloyed benefit for China, because it would be harder, although not impossible, for China’s central bank to continue controlling the currency’s value in terms of the dollar. A sharp rise in the yuan could drive thousands of export factories out of business and cause large-scale layoffs, which the Chinese Communist Party fears as potentially destabilizing. A more volatile currency would also require Chinese businesses to develop more sophistication in managing risk and most likely involve losses along the way among those that fail to do so.

In the last several months, Beijing authorities have begun moving to let central banks from Argentina to Malaysia settle payments in yuan with China’s central bank. On Monday, the government moved gingerly toward allowing the private sector to handle more yuan beyond China’s borders.

The new program is restricted to companies in Shanghai and in the biggest cities of Guangdong Province, a center of exports next door to Hong Kong. Companies in these cities are now eligible to send or receive payments in yuan with customers or suppliers in Hong Kong, Macau and Southeast Asia.

Chinese exporters have been eager to see the yuan used more widely for trade — particularly after many suffered losses a year ago, when the Chinese authorities allowed the yuan to rise 8 percent against the dollar from December, 2007, until the exchange rate was frozen through market interventions in late July last year. That rise in the yuan hurt Chinese companies that had signed contracts to export goods for payments in dollars, only to find that those dollars did not go as far as they hoped in covering expenses incurred in yuan.

“Expanding the renminbi usage area and making it more flexible is great news as we sell a lot to various countries overseas — this should also remove the risks associated with currency fluctuations,” said Wang Yapeng, a sales manager at Shanghai Electric International Economic and Trading Co Ltd, which exports a wide range of machine parts.

Father’s Day, as celebrated around the world, has its roots in the early 20th century US. In 1910, the state of Washington marked the world’s first official Father’s Day. Later, in 1972, then-US president Richard Nixon signed a proclamation establishing the third Sunday of June as a national holiday honoring fathers. Many countries have since followed suit, adopting the same date. In Taiwan, the celebration takes a different form — both in timing and meaning. Taiwan’s Father’s Day falls on Aug. 8, a date chosen not for historical events, but for the beauty of language. In Mandarin, “eight eight” is pronounced

In a recent essay, “How Taiwan Lost Trump,” a former adviser to US President Donald Trump, Christian Whiton, accuses Taiwan of diplomatic incompetence — claiming Taipei failed to reach out to Trump, botched trade negotiations and mishandled its defense posture. Whiton’s narrative overlooks a fundamental truth: Taiwan was never in a position to “win” Trump’s favor in the first place. The playing field was asymmetrical from the outset, dominated by a transactional US president on one side and the looming threat of Chinese coercion on the other. From the outset of his second term, which began in January, Trump reaffirmed his

Despite calls to the contrary from their respective powerful neighbors, Taiwan and Somaliland continue to expand their relationship, endowing it with important new prospects. Fitting into this bigger picture is the historic Coast Guard Cooperation Agreement signed last month. The common goal is to move the already strong bilateral relationship toward operational cooperation, with significant and tangible mutual benefits to be observed. Essentially, the new agreement commits the parties to a course of conduct that is expressed in three fundamental activities: cooperation, intelligence sharing and technology transfer. This reflects the desire — shared by both nations — to achieve strategic results within

It is difficult not to agree with a few points stated by Christian Whiton in his article, “How Taiwan Lost Trump,” and yet the main idea is flawed. I am a Polish journalist who considers Taiwan her second home. I am conservative, and I might disagree with some social changes being promoted in Taiwan right now, especially the push for progressiveness backed by leftists from the West — we need to clean up our mess before blaming the Taiwanese. However, I would never think that those issues should dominate the West’s judgement of Taiwan’s geopolitical importance. The question is not whether