Having breakfast at my hotel in Hong Kong, 60 floors up, I looked down over the harbor and counted the ships. Two dozen of them were moving, bow waves and wakes creasing the narrows between Hong Kong island and Kowloon: ferries, tugs, barges and a couple of Star Line liners returning through the mist from the overnight casino cruises that allow passengers to gamble legally outside Hong Kong's territorial waters. More ships were at anchor, awaiting their place at the container wharves.

Hong Kong is no longer the world's busiest port -- that position is held by Singapore and both ports will soon be overtaken by Shenzhen and Shanghai -- but 500 ships still call here every week, mainly to load the machine-made products of Guangdong, which has become the factory to the world.

A hundred years ago the Thames was as crowded and just as befogged: in Hong Kong, the carbon emissions from those Guangdong factories and power stations drift south and east, so that for nearly a fifth of the annual daylight hours one side of Hong Kong harbor, which takes seven minutes to cross by ferry, is invisible to the other.

But it was not Joseph Conrad's river that I thought about when I glanced at the newspapers and studied the view. At breakfast I thought about Detroit. On Wednesday, General Motors reported a loss of US$39 billion, among the biggest ever for a multinational company, while British Airways announced that after 50 years of service it would stop flying to the city that was once the automotive trade's world capital and the sixth (by some estimates, the fourth) largest city in the US. Ford is said to be on the verge of bankruptcy, more than 320,000 workers have lost their jobs in the US vehicle and auto -- parts manufacturing in the past seven years.

Detroit is a ruin to equal Grozny or Machu Picchu. From the air, you see a huddle of old skyscrapers surrounded by many hectares of scrubland where the inner suburbs once stood.

On the ground, the streets of downtown Detroit -- represented aerially by the huddle of skyscrapers -- are almost empty of cars and people. The abandoned railroad terminus rises in six stories from an open plain of vacant lots. When I went there three years ago to see Diego Rivera's famous murals of car-making in the Detroit Institute of Arts, an old man approached me on the gallery steps to ask where I was from, lone strangers being so unusual as to be welcomed.

Exemplifying the change in the world's balance of power by contrasting the fortunes of Detroit and Hong Kong is too crude a trick. Still, reading reports from the Western world in Hong Kong is rather like hearing about a bitter winter from the vantage point of a warm spring. Last week, Alibaba.com, a Web site connecting China's entrepreneurs to buyers and sellers in the rest of the world, raised US$1.5 billion in its first public offering on the Hong Kong exchange, while, thanks to feverish share-buying in Shanghai, the worth of PetroChina rose to more than US$1 trillion, the highest market capitalization of any company in history.

The soundtrack to the harbor view is the noise of tower blocks being built, often on land reclaimed from the sea.

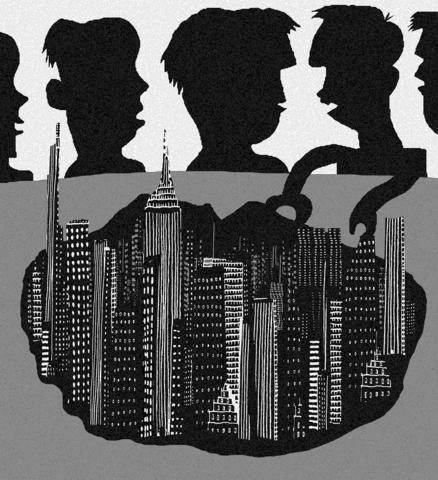

The harbor has shrunk and goes on shrinking and Hong Kong has exported most of its factories to Guangdong. What Hong Kong does more than ever is money. Turn away from the harbor and toward Hong Kong island's high ridge: the power of money rises vertically in tower after tower, sometimes topped off, retro-style, in simple versions of the Chrysler or Empire State buildings.

Lost at the feet of these money towers is a domed building from the British era, passed on the street beside it by double-deck trams of the same vintage. This is the chamber of Hong Kong's legislative council, which Chris Patten did his best to democratize in his time as the colony's last governor.

Ten years ago, the fear was that Beijing would trample all over it. In fact, the handover's "one country, two systems" solution has persisted. A proportion of the council is directly elected by public vote and Beijing has promised that the chief executive will be elected by universal suffrage from 2012. How strong, meanwhile, is the demand for democracy or the perception of Beijing oppression?

A council by-election is scheduled to take place on Dec. 2 and on Thursday I went to an election meeting at Hong Kong University's main hall. Eight candidates sat in a line across the stage, but only two of them really mattered. This is a contest between two women, Anson Chan (

They represent the argument between "democracy" (Chan) and "good governance" (Ip), which is to say between government by the popular Hong Kong vote and government according to the wishes of the Chinese Communist Party in Beijing. Ip is seen as Beijing's placewoman; Chan is the socially grander of the two and tried to have the meeting conducted in English rather than Cantonese.

The hall was packed with students and TV crews. The sparring between the two women was often applauded, though the level of discourse would strike anyone from Britain or the US as polite and brief. And it may be a mark of the absence of open argument in Hong Kong that the next day's front page headline in the South China Morning Post ran "Ip, Chan go head to head in rough-and-tumble debate."

Opinion polls have Chan and Ip running neck-and-neck, which suggests that "democracy" (and therefore Beijing disapproval) is not a popular cause.

There may be historical reasons for that. Christine Loh (陸恭蕙), who runs Civic Exchange, a think tank that produces insights and information on Hong Kong's politics and environment, says that a characteristic of former colonies is that they are accustomed to the idea that policy is decided elsewhere.

"Our bureaucratic structures are there to implement rather than make policy. We're used to commenting on policy, even criticizing policy, but we don't have a tradition of competing ideas," she said.

But the larger reason for content is surely money. By no means is everyone rich in Hong Kong. Nearly half of the population lives in public housing, and the people who shop in the many outlets of Armani, Vuitton and Marc Jacobs have often crossed from China and places such as Dongguan, where last week former British prime minister Tony Blair was paid his US$500,000 for speechifying at a new development of luxury villas (former US president Bill Clinton got only half that for a speech in Shenzhen five years ago: the "progress of capitalism" marches on in China).

Every Hong Kong resident, however, shares standards of public transport, schools, hospitals and general civic efficiency that would be unusual in China proper.

How does the government raise the money? Not from income tax with a marginal rate set to fall from 16 percent to 15 percent. The answer is land. Turn away from the sea view again and look down from another window at the white-painted cathedral of St John's. It sits on the only freehold plot in Hong Kong. The Crown claimed the rest of the colony and now the government of the Special Administrative Region owns it, taking great dollops of leasehold rent and premiums from developers.

Land is to Hong Kong what oil is to a Gulf state, which is why piles are being driven into the seashore and so much of the harbour has vanished. The revenues have sustained a long outbreak of peace.

Father’s Day, as celebrated around the world, has its roots in the early 20th century US. In 1910, the state of Washington marked the world’s first official Father’s Day. Later, in 1972, then-US president Richard Nixon signed a proclamation establishing the third Sunday of June as a national holiday honoring fathers. Many countries have since followed suit, adopting the same date. In Taiwan, the celebration takes a different form — both in timing and meaning. Taiwan’s Father’s Day falls on Aug. 8, a date chosen not for historical events, but for the beauty of language. In Mandarin, “eight eight” is pronounced

In a recent essay, “How Taiwan Lost Trump,” a former adviser to US President Donald Trump, Christian Whiton, accuses Taiwan of diplomatic incompetence — claiming Taipei failed to reach out to Trump, botched trade negotiations and mishandled its defense posture. Whiton’s narrative overlooks a fundamental truth: Taiwan was never in a position to “win” Trump’s favor in the first place. The playing field was asymmetrical from the outset, dominated by a transactional US president on one side and the looming threat of Chinese coercion on the other. From the outset of his second term, which began in January, Trump reaffirmed his

Despite calls to the contrary from their respective powerful neighbors, Taiwan and Somaliland continue to expand their relationship, endowing it with important new prospects. Fitting into this bigger picture is the historic Coast Guard Cooperation Agreement signed last month. The common goal is to move the already strong bilateral relationship toward operational cooperation, with significant and tangible mutual benefits to be observed. Essentially, the new agreement commits the parties to a course of conduct that is expressed in three fundamental activities: cooperation, intelligence sharing and technology transfer. This reflects the desire — shared by both nations — to achieve strategic results within

It is difficult not to agree with a few points stated by Christian Whiton in his article, “How Taiwan Lost Trump,” and yet the main idea is flawed. I am a Polish journalist who considers Taiwan her second home. I am conservative, and I might disagree with some social changes being promoted in Taiwan right now, especially the push for progressiveness backed by leftists from the West — we need to clean up our mess before blaming the Taiwanese. However, I would never think that those issues should dominate the West’s judgement of Taiwan’s geopolitical importance. The question is not whether