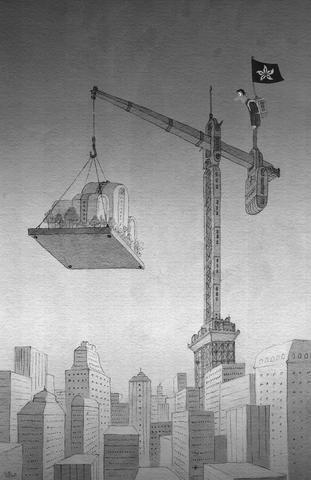

Ten years after its return to Chinese rule, Hong Kong ranks again among the world's most expensive cities to live in after a traumatic rollercoaster ride that has left many home owners still feeling the pain.

Rebecca Leung's tiny 46m2 flat in the busy but grimy North Point area of Hong Kong Island cost the mother of two an exorbitant HK$2 million (US$256,000) at the height of the property boom in 1996.

Today it is worth just 60 percent of that and Leung, 56, can neither keep up the mortgage payments nor afford to sell at such a loss.

She is just one of the city's 6,700 homeowners still heavily in debt as their property's value tumbled when the real estate bubble burst following the 1997-1998 Asian financial crisis.

Then came the dotcom boom and bust, and finally the 2003 outbreak of SARS, shattering consumer confidence as property prices collapsed about 70 percent from their peak.

"I wanted our own home because I thought I wouldn't have to worry about living if I get older because I would still have my flat," Leung said.

"I never imagined to be like this now. For a long time, property prices were rising. I bought it because I saw it as a safe investment and expected the value to go up, not down," she said.

During the mid-1990s boom, property was believed to be a sure-fire bet for a quick and reliable profit in the then British colony, which boasted some of the most expensive houses anywhere in the world.

"A lot of people would buy a property and sell a month later and still could make 10 to 20 percent profit," said Jason Ng (

People often bought several properties, hoping to trade them on quickly, but when the Asian crisis hit, the market collapsed, leaving them saddled with expensive debt on homes whose prices kept on falling, Ng said.

At its worst in 2003, one in five mortgagees was in a negative equity position, a term used to describe people with properties worth less than their mortgages and one virtually unheard of before the financial turmoil.

The impact was felt everywhere, for as the property market goes, so does Hong Kong, with land sales an important revenue source for the government and a key barometer of the territory's financial well-being.

The turning point came in early 2003, although it was initially masked by the SARS outbreak, which traumatized the city and seemed to point to even worse to come.

Instead, helped in no small part by the emergence of China as the world's manufacturing dynamo, money began flowing through Hong Kong again, drawing in bankers and businessmen anxious to get their share of the mainland growth story.

As demand grew, confidence returned, bringing with it some of the speculative exuberance of the mid-1990s to the point where last year a luxury residential site on the world-famous Peak fetched a record per-square-meter price of HK$454,194.

But if the luxury end has done best, it has still not yet fully recovered to pre-1997 levels, with a recent research report by CB Richard Ellis showing average prices still 23 percent below the 1997 high.

Property agent Centaline says Hong Kong's overall housing market plunged from an all-time high of 100 points in July 1997 to a low of 31.34 points in May 2003 and only managed to rise to 55.20 last month.

Wong Leung-sing (黃良昇), associate research director at Centaline, said on fundamentals of supply and demand the market should return to 1997 levels, but buyers have been too hurt by the downturn to take too many risks.

"A lot of people have been scarred by the Asian financial crisis and SARS; it was like a nightmare to them. Hong Kong's fundamentals are very good but people are too worried to buy," Wong said.

Others say Hong Kong's now strong economic recovery, a record-breaking performance on the stock market and plenty of cash should bode well.

"The stock market keeps attracting fund inflows, Hong Kong and China's economic prospects are very good, the number of people in negative equity is getting smaller," Ng said.

For the luxury market, Rick Santos, managing director of CB Richard Ellis, is optimistic, partly because of an influx of mainland Chinese buyers.

"There are a lot of very wealthy individuals here. Some of them are buying their homes with a lot of cash. They belong to the super-wealthy class," he said.

"The economy is growing, employee incomes are on the rise, the stock market is performing well. Only properties have lagged behind, but there's plenty of room for upside, so the future is very good," Wong said.

"I don't know when we will return to the 1997 level. I predict it will be very quick and when it does, it will definitely surpass it," he said.

US President Donald Trump and Chinese President Xi Jinping (習近平) were born under the sign of Gemini. Geminis are known for their intelligence, creativity, adaptability and flexibility. It is unlikely, then, that the trade conflict between the US and China would escalate into a catastrophic collision. It is more probable that both sides would seek a way to de-escalate, paving the way for a Trump-Xi summit that allows the global economy some breathing room. Practically speaking, China and the US have vulnerabilities, and a prolonged trade war would be damaging for both. In the US, the electoral system means that public opinion

In their recent op-ed “Trump Should Rein In Taiwan” in Foreign Policy magazine, Christopher Chivvis and Stephen Wertheim argued that the US should pressure President William Lai (賴清德) to “tone it down” to de-escalate tensions in the Taiwan Strait — as if Taiwan’s words are more of a threat to peace than Beijing’s actions. It is an old argument dressed up in new concern: that Washington must rein in Taipei to avoid war. However, this narrative gets it backward. Taiwan is not the problem; China is. Calls for a so-called “grand bargain” with Beijing — where the US pressures Taiwan into concessions

The term “assassin’s mace” originates from Chinese folklore, describing a concealed weapon used by a weaker hero to defeat a stronger adversary with an unexpected strike. In more general military parlance, the concept refers to an asymmetric capability that targets a critical vulnerability of an adversary. China has found its modern equivalent of the assassin’s mace with its high-altitude electromagnetic pulse (HEMP) weapons, which are nuclear warheads detonated at a high altitude, emitting intense electromagnetic radiation capable of disabling and destroying electronics. An assassin’s mace weapon possesses two essential characteristics: strategic surprise and the ability to neutralize a core dependency.

Chinese President and Chinese Communist Party (CCP) Chairman Xi Jinping (習近平) said in a politburo speech late last month that his party must protect the “bottom line” to prevent systemic threats. The tone of his address was grave, revealing deep anxieties about China’s current state of affairs. Essentially, what he worries most about is systemic threats to China’s normal development as a country. The US-China trade war has turned white hot: China’s export orders have plummeted, Chinese firms and enterprises are shutting up shop, and local debt risks are mounting daily, causing China’s economy to flag externally and hemorrhage internally. China’s