The People's Bank of China and the Bank of Japan -- as well as other central banks in Asia -- are in trouble. They have accumulated vast foreign exchange reserves, estimated at more than US$2 trillion. The problem is that almost all of it is in US dollars -- a currency that is rapidly losing its value.

All policy options for Asia's central banks appear equally unattractive. If they do nothing and simply hold onto the dollars, their losses will only increase. But if they buy more, in an attempt to prop up the dollar, they will only have a bigger version of the same problem. If, on the contrary, they try to diversify into other currencies, they will drive down the dollar faster and create greater losses. They are also likely to encounter the same sort of problem with other possible reserve currencies.

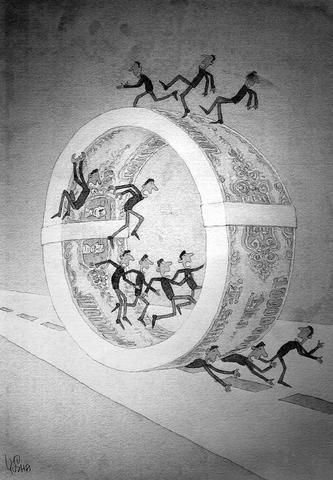

ILLUSTRATION: YU SHA

The euro has been touted as the replacement for or alternative to the dollar. Some enthusiastic Europeans encouraged Asians to diversify their reserve holdings. But the same scenario might well be repeated with the euro in a few years. Large fiscal deficits and slow growth might convince foreign exchange markets that there is little future in the euro, fueling a wave of selling -- and hence losses for central bank holders.

There is a historical parallel to today's concern about the world's major reserve currency. The interwar economy, shattered by the Great Depression of the early 1930s, offers a whole series of painful, but important, lessons for the present.

In the 1920s, the world economy was reconstructed around a fixed exchange rate regime in which many countries held their reserves not in gold (as was the practice before World War II) but in foreign exchange, especially in British sterling. During the course of the 1920s, some of the official holders of pounds grew nervous about Britain's weak foreign trade performance, which suggested that, like today's dollar, the currency was over-valued and would inevitably decline.

Foreign central banks asked whether the Bank of England was contemplating changing its view of the pound's exchange rate. Of course they were told that there was no intention of abandoning Britain's link to gold, and that the strong pound represented a deep and long commitment (in the same way that US Treasury Secretary John Snow today affirms the idea of a "strong dollar"). Only France ignored British statements and substantially sold off its sterling holdings.

When the inevitable British devaluation came on Sept. 20-21, 1931, many foreign central banks were badly hit and were blamed for mismanaging their reserves. Many were stripped of their responsibilities, and the persons involved were discredited. The Dutch central banker Gerard Vissering resigned and eventually killed himself as a result of the destruction wrought on his institution's balance sheet by the pound's collapse.

Some countries that traded a great deal with Britain, or were in the orbit of British imperial rule, continued to hold reserves in pounds after 1931. During World War II, Britain took advantage of this, and Argentina, Egypt, and India, in particular, built up huge claims on sterling, although it was an unattractive currency. At the war's end, they thought of a new way of using their reserves: spend them.

Consequently, these reserves provided the fuel for economic populism. Large holders of sterling balances -- India, Egypt and Argentina -- all embarked on major nationalizations and a public sector spending spree: they built railways, dams, steel works. The sterling balances proved to be the starting point of vast and inefficient state planning regimes that did long-term harm to growth prospects in all the countries that took this course.

Could something similar be in store for today's holders of large reserves? The most explicit call for the use of dollar reserves to finance a major program of infrastructure modernization has come from India, which has a similar problem to the one facing China and Japan. It will be similarly tempting elsewhere.

This temptation needs to be removed before the tempted yield to it. Reserve holdings represent an outdated concept, and the world should contemplate some way of making them less central to the operation of the international financial system.

To be sure, reserves are important to smooth out imbalances in a fixed exchange rate regime. But the world has moved since the 1970s in the direction of greater exchange rate flexibility.

Reserves are also clearly important for countries that produce only a few goods -- especially commodity producers -- and thus face big and unpredictable swings in world market prices. Dependency on coffee or cocoa exports requires a build-up of precautionary reserves. But this does not apply to China, Japan, or India, whose exports are diversified.

Today's big surplus countries do not need large reserves. They should reduce their holdings as quickly as possible, before they do something really stupid with the accumulated treasure.

Harold James is professor of history at Princeton University and author of The End of Globalization: Lessons from the Great Depression.

Copyright: Project Syndicate

Jan. 1 marks a decade since China repealed its one-child policy. Just 10 days before, Peng Peiyun (彭珮雲), who long oversaw the often-brutal enforcement of China’s family-planning rules, died at the age of 96, having never been held accountable for her actions. Obituaries praised Peng for being “reform-minded,” even though, in practice, she only perpetuated an utterly inhumane policy, whose consequences have barely begun to materialize. It was Vice Premier Chen Muhua (陳慕華) who first proposed the one-child policy in 1979, with the endorsement of China’s then-top leaders, Chen Yun (陳雲) and Deng Xiaoping (鄧小平), as a means of avoiding the

The last foreign delegation Nicolas Maduro met before he went to bed Friday night (January 2) was led by China’s top Latin America diplomat. “I had a pleasant meeting with Qiu Xiaoqi (邱小琪), Special Envoy of President Xi Jinping (習近平),” Venezuela’s soon-to-be ex-president tweeted on Telegram, “and we reaffirmed our commitment to the strategic relationship that is progressing and strengthening in various areas for building a multipolar world of development and peace.” Judging by how minutely the Central Intelligence Agency was monitoring Maduro’s every move on Friday, President Trump himself was certainly aware of Maduro’s felicitations to his Chinese guest. Just

A recent piece of international news has drawn surprisingly little attention, yet it deserves far closer scrutiny. German industrial heavyweight Siemens Mobility has reportedly outmaneuvered long-entrenched Chinese competitors in Southeast Asian infrastructure to secure a strategic partnership with Vietnam’s largest private conglomerate, Vingroup. The agreement positions Siemens to participate in the construction of a high-speed rail link between Hanoi and Ha Long Bay. German media were blunt in their assessment: This was not merely a commercial win, but has symbolic significance in “reshaping geopolitical influence.” At first glance, this might look like a routine outcome of corporate bidding. However, placed in

China often describes itself as the natural leader of the global south: a power that respects sovereignty, rejects coercion and offers developing countries an alternative to Western pressure. For years, Venezuela was held up — implicitly and sometimes explicitly — as proof that this model worked. Today, Venezuela is exposing the limits of that claim. Beijing’s response to the latest crisis in Venezuela has been striking not only for its content, but for its tone. Chinese officials have abandoned their usual restrained diplomatic phrasing and adopted language that is unusually direct by Beijing’s standards. The Chinese Ministry of Foreign Affairs described the