Technology entrepreneurs are having a devil of a time finding angels.

Angel investors are the optimistic financiers who give entrepreneurs their crucial first infusion of cash to bring their ideas to life. Now, in the midst of a punishing economic downturn that is sparing few companies, these patrons are cutting back on their bets and threatening the very foundation of the technology economy.

Unlike venture capitalists, angels invest small amounts of their own money — as little as US$10,000 and usually less than US$1 million — in very young companies. But like all investors, many angels suffered deep losses when the market plunged last fall.

PHOTO: NY TIMES NEWS SERVICE

That has left them skittish, investing in fewer technology start-ups and demanding more of those they do consider, leaving founders struggling to find money.

Half of the investors surveyed in November by the Angel Capital Association, the industry’s trade group, said they invested less than they had predicted last year, and one-third said the number of deals and dollar amounts they invest would decrease again this year.

“Crashes make liquidity vanish, and venture investing — especially angel investing — runs on liquidity,” said Steven McGeady, an angel investor and former executive at Intel. “When the markets go wonky, everyone sits on cash until the situation resolves itself. This makes capital hard to find, and if a company is caught unprepared or at the wrong time, that can be the end.”

Many professional angels — those who invest as a full-time job, rather than as a side project — are still financing start-ups, if at a slower pace. They say the best opportunities come during downturns, as companies’ valuations fall significantly. The median valuation of start-ups seeking angel financing fell 25 percent, to US$3 million, from the third to the fourth quarter of last year, according to Angelsoft, a Web service for angel investors and entrepreneurs.

“It’s getting tougher for companies to raise money, but I think the good ones are still getting it done,” said Ron Conway, a prominent professional angel investor in Silicon Valley who has invested in companies including Google and Facebook.

Yet unlike Conway, most angel investors are hobbyists — wealthy friends and relatives of entrepreneurs who invest as a way to diversify their portfolios — and they have been hit the hardest.

Dan Martin, an angel investor based in San Francisco who made millions when his family sold its aerospace contracting business in 2003, has invested several hundred thousand dollars in start-ups.

Last year the Martin family’s stock holdings lost close to 30 percent of their value. Now the Martins are shying away from risky angel investments and looking elsewhere for returns, including in undervalued public companies.

Investing in the stock market “smells to me like a much better opportunity than investing in the friend of a friend who wants to open a green Chuck E. Cheese restaurant or software to let people choose their dental implants,” Martin said. “Those could be great ideas. But that versus Pfizer stock is an easy choice for us right now.”

Some angels are considering only low-cost companies that could become profitable without venture financing. Others are acting less like angels and more like venture capitalists, spending more time than is typical advising companies, including taking seats on boards.

Some angels are putting less of their own money on the line by finding other people to invest with them. Co-investments increased last year, according to the Center for Venture Research, and half of those surveyed by the Angel Capital Association said they would increase co-investing with other angels this year.

Since Drew Smith retired as a venture capitalist three years ago, he has invested around US$25,000 in each of four firms, including a market research software start-up and one that makes technology to play Web videos on phones.

Now, he said: “I’m cutting back. For me to make an individual investment on the order of US$25,000, it would have to be a really great opportunity.”

Instead, he is investing smaller portions alongside other investors.

“I can reduce my bite size a little bit in terms of what goes into each investment, but still stay active,” he said.

LIMITS: While China increases military pressure on Taiwan and expands its use of cognitive warfare, it is unwilling to target tech supply chains, the report said US and Taiwan military officials have warned that the Chinese People’s Liberation Army (PLA) could implement a blockade within “a matter of hours” and need only “minimal conversion time” prior to an attack on Taiwan, a report released on Tuesday by the US Senate’s China Economic and Security Review Commission said. “While there is no indication that China is planning an imminent attack, the United States and its allies and partners can no longer assume that a Taiwan contingency is a distant possibility for which they would have ample time to prepare,” it said. The commission made the comments in its annual

DETERMINATION: Beijing’s actions toward Tokyo have drawn international attention, but would likely bolster regional coordination and defense networks, the report said Japanese Prime Minister Sanae Takaichi’s administration is likely to prioritize security reforms and deterrence in the face of recent “hybrid” threats from China, the National Security Bureau (NSB) said. The bureau made the assessment in a written report to the Legislative Yuan ahead of an oral report and questions-and-answers session at the legislature’s Foreign Affairs and National Defense Committee tomorrow. The key points of Japan’s security reforms would be to reinforce security cooperation with the US, including enhancing defense deployment in the first island chain, pushing forward the integrated command and operations of the Japan Self-Defense Forces and US Forces Japan, as

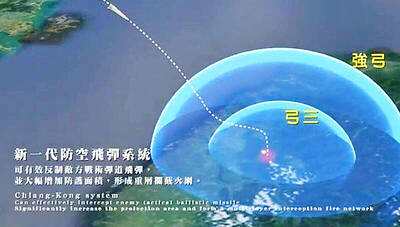

INTERCEPTION: The 30km test ceiling shows that the CSIST is capable of producing missiles that could stop inbound missiles as they re-enter the atmosphere Recent missile tests by the Chungshan Institute of Science and Technology (CSIST) show that Taiwan’s missiles are capable of intercepting ballistic missiles as they re-enter the atmosphere and pose a significant deterrent to Chinese missile threats, former Hsiung Feng III missile development project chief engineer Chang Cheng (張誠) said yesterday. The military-affiliated institute has been conducting missile tests, believed to be related to Project Chiang Kung (強弓) at Pingtung County’s Jiupeng Military Base, with many tests deviating from past practices of setting restriction zones at “unlimited” and instead clearly stating a 30.48km range, Chang said. “Unlimited” restrictions zones for missile tests is

PUBLIC SAFETY: The nationwide distribution campaign aims to enhance society’s overall understanding of threats and bolster defense awareness, an official said The latest edition of the National Public Safety Guide is being mailed to all citizens starting today to foster public awareness of self-defense in the event of war or natural disasters, the Ministry of National Defense said yesterday. “The guides will be disseminated to the public to enhance society’s overall understanding of threats and bolster defense awareness, demonstrating the government’s emphasis on people’s safety and its determination to pursue self-defense,” All-out Defense Mobilization Agency Director Shen Wei-chih (沈威志) said at the ministry’s news conference. The nationwide distribution campaign was planned according to President Lai William’s (賴清德) Sept. 20 directive, he said, adding