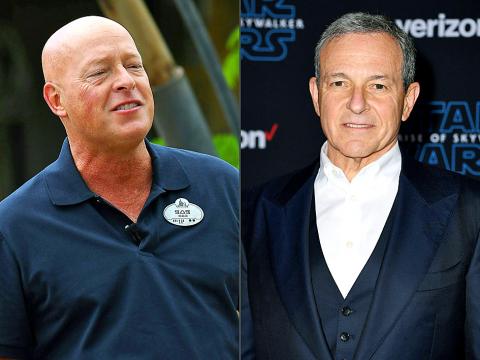

Walt Disney Co on Tuesday said that chief executive officer Bob Iger was handing off the top executive post after building the media-entertainment powerhouse into the undisputed Hollywood leader.

Disney’s board named Bob Chapek, a 27-year Disney veteran, the new CEO, effective immediately.

Iger, who has been CEO for 15 years, is to assume the role of executive chairman and “will direct the company’s creative endeavors,” a Disney statement said.

Photos: AFP

Iger, 69, said on a call with analysts that his top priority now is the creative content on which Disney’s streaming services and box office revenue depend.

The idea behind handing off the CEO position two years early is to let Iger focus on the creation of winning Disney content while Chapek handles day-to-day operations of the Magic Kingdom’s complex entertainment operation.

“It was really that simple,” Iger said while explaining the decision to surrender the CEO chair to Chapek.

“With everything else falling in place, the time seemed right,” he added.

The move also allows two years for Iger to coach Chapek on aspects of Disney that he is less familiar with. Iger’s contract ends at the end of next year.

Iger engineered a massive deal to take over much of the television and film assets of Rupert Murdoch’s 21st Century Fox Inc to become the Hollywood box office leader, and then launched a new direct-to-consumer streaming television service which aims to position Disney against rivals such as Netflix Inc in the new media landscape featuring on-demand platforms.

Iger oversaw deals for Pixar Animation Studios Inc in 2006 for US$7.4 billion, Marvel Entertainment Inc in 2009 for US$4 billion, Lucasfilm Ltd in 2012 for US$4 billion and 21st Century Fox last year for US$71 billion.

“With the successful launch of Disney’s direct-to-consumer businesses and the integration of 21st Century Fox well underway, I believe this is the optimal time to transition to a new CEO,” Iger said.

Disney, which is the leading force in Hollywood and also has major theme parks and television operations, has been betting heavily on its move to streaming as it takes on Netflix and Amazon Prime Video.

Disney is intent on bulking up its original streaming content, taking advantage of beloved franchises such as Star Wars and the Marvel superhero movies.

Chapek takes the top spot after heading Disney Parks, Experiences and Products.

“Bob Iger has built Disney into the most admired and successful media and entertainment company, and I have been lucky to enjoy a front-row seat as a member of his leadership team,” Chapek said.

“I share his commitment to creative excellence, technological innovation and international expansion, and I will continue to embrace these same strategic pillars going forward,” he said.

In Disney’s latest quarterly update, the company announced it had signed up more than 28 million customers for its Disney+ streaming service.

It also reported strong results from its latest Star Wars and Frozen films.

The company’s total global theater box office topped US$11 billion dollars, “shattering” a film industry record set by Disney four years ago.

“We will continue to pursue bold innovation, thoughtful risk-taking and the creative storytelling that is the lifeblood of our company,” Chapek said on the call with analysts.

“Our achievements to date will serve as the foundation for the future,” he added.

The demise of the coal industry left the US’ Appalachian region in tatters, with lost jobs, spoiled water and countless kilometers of abandoned underground mines. Now entrepreneurs are eyeing the rural region with ambitious visions to rebuild its economy by converting old mines into solar power systems and data centers that could help fuel the increasing power demands of the artificial intelligence (AI) boom. One such project is underway by a non-profit team calling itself Energy DELTA (Discovery, Education, Learning and Technology Accelerator) Lab, which is looking to develop energy sources on about 26,305 hectares of old coal land in

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

Netflix on Friday faced fierce criticism over its blockbuster deal to acquire Warner Bros Discovery. The streaming giant is already viewed as a pariah in some Hollywood circles, largely due to its reluctance to release content in theaters and its disruption of traditional industry practices. As Netflix emerged as the likely winning bidder for Warner Bros — the studio behind Casablanca, the Harry Potter movies and Friends — Hollywood’s elite launched an aggressive campaign against the acquisition. Titanic director James Cameron called the buyout a “disaster,” while a group of prominent producers are lobbying US Congress to oppose the deal,

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia