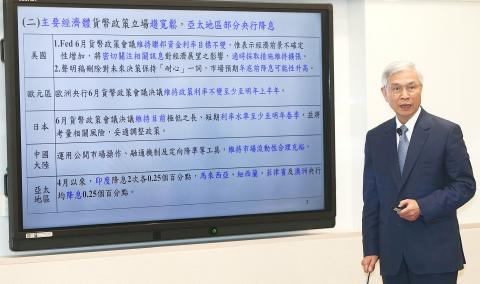

The central bank yesterday kept its rediscount rate unchanged at 1.375 percent for the 12th consecutive quarter, as the global economy and trade flows slow, warranting a continued accommodative monetary policy.

The bank cut its GDP growth forecast for this year from 2.13 percent to 2.06 percent, as exports and private consumption have fared poorly, central bank Governor Yang Chin-long (楊金龍) told a news conference in Taipei after a quarterly board meeting.

The projection did not factor in US tariff hikes that are likely to be imposed on US$300 billion of Chinese goods if US President Donald Trump and Chinese President Xi Jinping (習近平) fail to end the trade dispute between the two countries at the G20 summit in Japan next week, Yang said.

Photo: CNA

“Downside risks have increased, with the US-China trade talks playing a critical role in shaping the economic landscape,” Yang said.

The tariff hikes would extend to consumer electronics and hurt Taiwan’s export-reliant economy, Yang said.

The negative output gap widened to 0.63 percent, from 0.55 percent three months earlier, indicating that there is greater room for the domestic economy to improve, Yang said.

The central bank’s decision to keep the rediscount rate unchanged was in line with that of its Japanese and US peers, but Yang said that Taiwan is not taking cues from the US Federal Reserve.

Global funds move rapidly to seek higher yields, increasing currency and capital market volatility around the world, he said.

“I believe the recent appreciation in the local currency has much to do with expectations that the Fed will cut rates,” the governor said.

The New Taiwan dollar gained 1.13 percent this week against the greenback.

The central bank also trimmed its inflation forecast for this year from 0.91 percent to 0.87 percent, due to concern that the global economic slowdown is reducing demand for oil products and raw materials.

Capital repatriation is feeding expectations that the price of industrial land would increase, Yang said, adding that the central bank would pay close attention and rein in a potential property fever.

“We care more about residential housing, which is currently driven by real demand,” he said.

Yang also said that Facebook’s stablecoin, the Libra, would have a bigger influence on global payments than existing cryptocurrencies, because of the US social media giant’s vast membership.

“I don’t think it will develop into a real currency... The attitude of global central banks will decide the coin’s fate,” Yang said, adding that most are open-minded, but share the need for regulation.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth