Smartphone maker HTC Corp (宏達電) yesterday announced a strategic partnership with US sportswear and accessories company Under Armour Inc in a bid to enter the wearable device market.

HTC chief executive officer Peter Chou (周永明) said the firm plans to launch an array of new products later this year.

“It’s an incredibly exciting new direction for us,” Chou said, adding that the company would work closely with Under Armour to provide consumers with a range of connected health and fitness products and services.

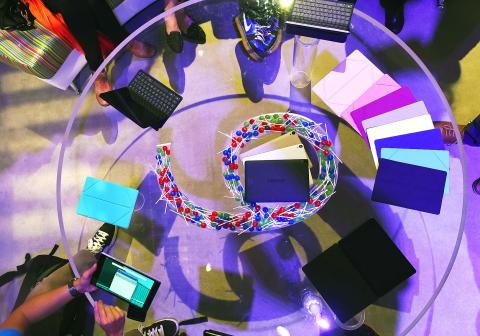

Photo: AFP

Chou said the firm is working with UA Record — a health and fitness network launched by Under Armour — to ensure the shared efforts will meet the highest expectations of athletes everywhere.

Under Armour Connected Fitness senior vice president Robin Thurston said HTC’s fearless commitment to innovation, and its attention to detail and premium design, make it an ideal partner for the US company.

“The partnership will allow athletes to take their performance to the next level in a more connected and intuitive way,” Thurston said in a press statement.

Yuanta Securities Investment Consulting Co (元大投顧) analyst Jeff Pu (蒲得宇) said that for the past year, HTC has been looking for new business opportunities outside the smartphone segment.

“HTC cannot win by relying solely on its smartphone segment because the industry is too competitive,” Pu said by telephone.

He added that most of the health and fitness wearable products in the market are simple-designed smart wristbands and HTC would face a limited market if it aims to offer more sophisticated designs.

HTC yesterday also launched its new Nexus 9 tablet with 4G long-term evolution (LTE) connectivity in Taiwan. The product will be available from Friday at HTC’s VIP stores and from local telecoms, the company said.

Pu was cautious about potential sales contributions from the Google Inc cobranded product.

With the tablet industry declining and prices falling, it will be hard for HTC to secure a position in the market, he said.

Unlike the past few years, the global tablet market is unlikely to witness explosive growth this year because of high penetration rates, Gartner said in a report on Monday.

Worldwide tablet shipments are forecast to reach 233 million units this year, an 8 percent increase from last year, when the tablet market grew 4.3 percent to 207 million units, Gartner said.

Ranjit Atwal, a research director at Gartner, attributed the slowdown in shipment growth last year to the lifetime of tablets being extended.

“They are shared out amongst family members and software upgrades, especially for iOS devices, keep the tablets current,” Atwal wrote in a report. “Another factor includes the lack of innovation in hardware which refrains consumers from upgrading.”

HTC also unveiled a new low-end smartphone, the dual SIM card Desire 620G, in Taiwan. Priced at NT$4,990 (US$156), the handset comes with a 5-megapixel front camera and 8-megapixel rear camera.

The firm has said that it aims to secure positions in all market segments — from high to low-end — in Taiwan this year.

Citigroup Global Markets praised HTC’s strategy, saying it is good for the company to tackle the low-end segment.

“We foresee smartphone shipments in this quarter to grow 36 percent year-on-year, driven by HTC’s low-end Desire line and its upcoming flagship product,” Citigroup analyst Dennis Chan (詹宗勳) said in a client note released on Tuesday.

Pu also said he expects HTC’s performance this year would be less volatile as the firm spreads its risks with better product lines.

RUN IT BACK: A succesful first project working with hyperscalers to design chips encouraged MediaTek to start a second project, aiming to hit stride in 2028 MediaTek Inc (聯發科), the world’s biggest smartphone chip supplier, yesterday said it is engaging a second hyperscaler to help design artificial intelligence (AI) accelerators used in data centers following a similar project expected to generate revenue streams soon. The first AI accelerator project is to bring in US$1 billion revenue next year and several billion US dollars more in 2027, MediaTek chief executive officer Rick Tsai (蔡力行) told a virtual investor conference yesterday. The second AI accelerator project is expected to contribute to revenue beginning in 2028, Tsai said. MediaTek yesterday raised its revenue forecast for the global AI accelerator used

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) has secured three construction permits for its plan to build a state-of-the-art A14 wafer fab in Taichung, and is likely to start construction soon, the Central Taiwan Science Park Bureau said yesterday. Speaking with CNA, Wang Chun-chieh (王俊傑), deputy director general of the science park bureau, said the world’s largest contract chipmaker has received three construction permits — one to build a fab to roll out sophisticated chips, another to build a central utility plant to provide water and electricity for the facility and the other to build three office buildings. With the three permits, TSMC

TEMPORARY TRUCE: China has made concessions to ease rare earth trade controls, among others, while Washington holds fire on a 100% tariff on all Chinese goods China is effectively suspending implementation of additional export controls on rare earth metals and terminating investigations targeting US companies in the semiconductor supply chain, the White House announced. The White House on Saturday issued a fact sheet outlining some details of the trade pact agreed to earlier in the week by US President Donald Trump and Chinese President Xi Jinping (習近平) that aimed to ease tensions between the world’s two largest economies. Under the deal, China is to issue general licenses valid for exports of rare earths, gallium, germanium, antimony and graphite “for the benefit of US end users and their suppliers

Dutch chipmaker Nexperia BV’s China unit yesterday said that it had established sufficient inventories of finished goods and works-in-progress, and that its supply chain remained secure and stable after its parent halted wafer supplies. The Dutch company suspended supplies of wafers to its Chinese assembly plant a week ago, calling it “a direct consequence of the local management’s recent failure to comply with the agreed contractual payment terms,” Reuters reported on Friday last week. Its China unit called Nexperia’s suspension “unilateral” and “extremely irresponsible,” adding that the Dutch parent’s claim about contractual payment was “misleading and highly deceptive,” according to a statement