A Chinese industrialist has completed the landmark purchase of Chateau Bellefont-Belcier, a leading estate in France’s prestigious Saint Emilion wine-making area, sources involved in the sale said on Thursday.

The property is the first of its rank — Grand Cru Classe (classified great growth) — to be acquired in what has been a wave of Chinese investment in the Bordeaux region.

The new owner is a 45-year-old industrialist with assets in the iron sector who has already diversified into the wine importing business. He met the chateau’s employees on Friday and has since returned to China.

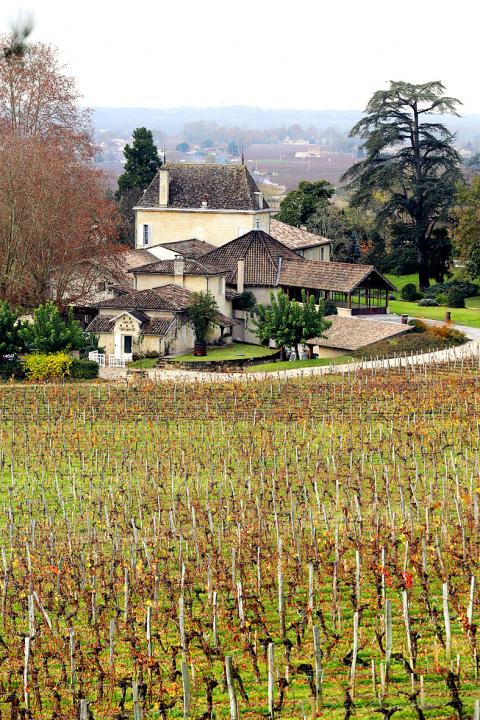

Photo: AFP

Chinese investors have acquired about 30 lower-ranked properties in Bordeaux (the larger region that includes Saint Emilion) in the last two years, and this year has seen China become the region’s biggest export market in terms of volume.

So far, Chinese investment has not been controversial in a region with a long tradition of foreign ownership of wine estates.

In contrast, the acquisition by a Chinese buyer of Chateau Gevrey-Chambertin in Burgundy earlier this year triggered a major row, with local winemakers and far-right politicians claiming the country’s heritage was being sold.

“This is a first [for Bordeaux]. We’ll see how people react,” said Herve Olivier, regional director of SAFER, the government agency that oversees rural land development.

Bordeax Wine Council president Georges Haushalter does not expect a backlash.

“We have the Japanese at Chateau Beychevelle and Chateau Lagrange and no one reacts against them,” he said. “They have done a very good job.”

Bellefont-Belcier, which had been on the market for a number of years, has 13 hectares of vines and total land of 20 hectares. A source close to the transaction said the final price was between 1.5 million and 2 million euros (US$1.95 million to US$2.6 million) per hectare of vines.

The sale had been in negotiation for a number of months, but the price was not finalized until after the announcement in September of a once-in-a-decade reclassification of Saint Emilion wines, which confirmed the estate’s Grand Cru status.

“The classification played an enormous role,” said a spokesman from Franck Lagorce Conseil, the agency which negotiated the deal.

Without the classification, “the price would not have been the same,” he said.

Olivier said another 10 chateaux could be sold to Chinese buyers by the end of the year if bureaucratic obstacles can be overcome.

“These are dossiers that are lagging. Since this past summer, there is manifestly a difficulty for the Chinese ... to get their money out of China. So there are plenty of dossiers that are pushed back,” he said.

Chinese investors in Bordeaux are primarily industrialists with diverse business interests, including real estate and tourism, Olivier said.

“They do business in everything,” Olivier said. “Some are already in the wine business, some are in the restaurant business. Sometimes they are just wine lovers who do it for their own pleasure and they buy a chateau in Bordeaux.”

Until now, Chinese investors have focused on relatively obscure chateaux in modest appellations, the properties frequently having languished on the market for some time with little chance of a bidding war.

For this reason, Chinese investors have not put pressure on vineyard land prices, he said.

“They don’t make the prices shoot up like in Gevrey Chambertin,” he said. “Prices have remained stable.”

The controversy in Burgundy was fueled by the fact that Macau gambling executive Louis Ng outbid a group of local investors. Inflation in land prices is a sensitive issue because of the impact it has on inheritance tax and, as a consequence, the ability of families to pass vineyards down to the next generation.

“Bordeaux vineyards have always been open to foreign investors,” Olivier said. “There have been trends — the English, Belgians, Americans, Japanese, insurance companies, banks, which have purchased chateaux. Today, it’s the Chinese.”

“What is different is that it’s in such a short period. They’ve purchased 30 estates in two years. That’s something,” he said.

AI BOOST: Although Taiwan’s reliance on Chinese rare earth elements is limited, it could face indirect impacts from supply issues and price volatility, an economist said DBS Bank Ltd (星展銀行) has sharply raised its forecast for Taiwan’s economic growth this year to 5.6 percent, citing stronger-than-expected exports and investment linked to artificial intelligence (AI), as it said that the current momentum could peak soon. The acceleration of the global AI race has fueled a surge in Taiwan’s AI-related capital spending and exports of information and communications technology (ICT) products, which have been key drivers of growth this year. “We have revised our GDP forecast for Taiwan upward to 5.6 percent from 4 percent, an upgrade that mainly reflects stronger-than-expected AI-related exports and investment in the third

Mercuries Life Insurance Co (三商美邦人壽) shares surged to a seven-month high this week after local media reported that E.Sun Financial Holding Co (玉山金控) had outbid CTBC Financial Holding Co (中信金控) in the financially strained insurer’s ongoing sale process. Shares of the mid-sized life insurer climbed 5.8 percent this week to NT$6.72, extending a nearly 18 percent rally over the past month, as investors bet on the likelihood of an impending takeover. The final round of bidding closed on Thursday, marking a critical step in the 32-year-old insurer’s search for a buyer after years of struggling to meet capital adequacy requirements. Local media reports

TECHNOLOGICAL RIVALRY: The artificial intelligence chip competition among multiple players would likely intensify over the next two years, a Quanta official said Quanta Computer Inc (廣達), which makes servers and laptops on a contract basis, yesterday said its shipments of artificial intelligence (AI) servers powered by Nvidia Corp’s GB300 chips have increased steadily since last month, should surpass those of the GB200 models this quarter. The production of GB300 servers has gone much more smoothly than that of the GB200, with shipments projected to increase sharply next month, Quanta executive vice president Mike Yang (楊麒令) said on the sidelines of a technology forum in Taipei. While orders for GB200 servers gradually decrease, the production transition between the two server models has been

ASE Technology Holding Co (日月光投控), the world’s largest integrated circuit (IC) packaging and testing supplier, yesterday announced a strategic collaboration with Analog Devices Inc (ADI), coupled with the signing of a binding memorandum of understanding. Under the agreement, ASE intends to purchase 100 percent shares of Analog Devices Sdn Bhd and acquire its manufacturing facility in Penang, Malaysia, a press release showed. The ADI Penang facility is located in the prime industrial hub of Bayan Lepas, with an area of over 680,000 square feet, it said. In addition, the two sides intend to enter into a long-term supply agreement for ASE to