Gold prices, trading at record highs, are likely to trend higher, to between US$1,300 and US$1,500 per ounce in the second half of this year, Bank of Taiwan (BOT, 臺灣銀行) analysts said yesterday.

“Worries over the credit crisis in Europe have given gold prices a boost, as many see it as a tool for hedging risks,” Chang Wu-ren (張武仁), general manager of the bank’s department of precious metals, said on the sidelines of the bank’s launch of US dollar-denominated gold passbooks yesterday.

The bank has 300,000 account holders of New Taiwan dollar-denominated gold passbooks, bank president Chang Ming-daw (張明道) told a media briefing.

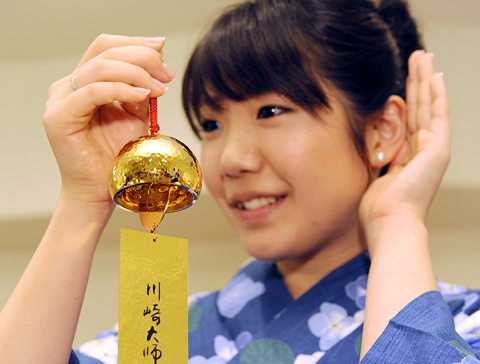

PHOTO: AFP

Its newly launched US dollar-denominated accounts will provide an alternative for gold investors to hedge currency fluctuations, Chang said.

If the European crisis worsens and drags the global economy into a second dip, some specialists at the London-based GFMS Ltd have even predicted that gold prices could skyrocket to US$2,000 per ounce, Chang said.

Nervous high net worth European buyers, who sold their euro assets for gold, were the main driver behind the surge in gold prices last month, he said.

In the short term, however, gold prices could see a correction, as the recent rally was mostly liquidity driven, he said.

Bloomberg reported yesterday that gold for immediate delivery lost US$1.30, or 0.1 percent, to US$1,235.25 an ounce at 10:29am London time, down from its record close of US$1,252.11 on Tuesday.

However, the metal’s downside risk may be limited amid speculation that the several emerging countries’ central banks were secretly pushing up their gold reserves to hedge against inflation and asset bubbles, which has been keeping the gold price firm, Chang added.

Risk-averse investors are thus advised to add gold to their investment portfolios — 10 to 20 percent of which could be put in gold, Chang Terry Yang (楊天立), deputy manager of BOT’s precious metals department.

He also advised investors to average down their costs to benefit from the metal’s long-term rally.

A double-digit return is almost assured since gold prices are forecast to average at around US$1,200 per ounce this year, up from last year’s US$982 and US$690 in 2008, Yang said.

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new