The government recently said it would improve public finances as the debt ratio is approaching the legal ceiling, but Moody’s said the government should be concerned that consumer spending is being crowded out by lower welfare spending and falling tax revenues.

The Cabinet last month approved a revised central government budget for next year, including a plan to borrow a record NT$516.2 billion (US$16 billion) in loans — more than NT$455.8 billion this year — to finance its economic stimulus spending and post-Typhoon Morakot reconstruction work.

Total government debt is expected to reach NT$4.635 trillion by the end of next year and Minister of Finance Lee Sush-der (李述德) said last week the government would work to prevent the level of debt, as a percentage of GDP, from reaching the 40 percent ceiling.

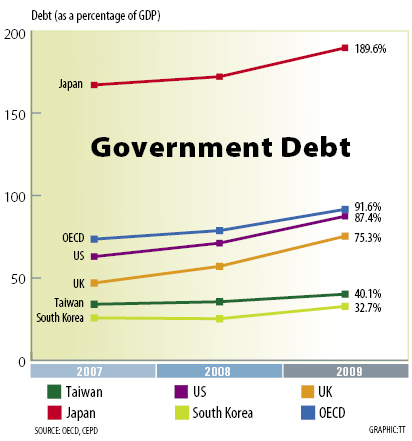

The debt ratio, however, could reach 40.1 percent by the end of this year from 35.5 percent last year, the Council for Economic Planning and Development said in a statement on Sept. 29.

That is higher than a median of 32 percent in Taiwan’s Aa-rated peers and a median of 35 percent for the A-rated sovereigns, Moody’s Investors Service said.

“The legal limit of 40 percent is conservative compared to the European Union’s 60 percent limit and the debt levels of Taiwan’s neighbors,” Tine Olsen, an economist at Moody’s Economy.com based in Sydney, said in an e-mailed statement on Friday. “Instead of worrying about a legal boundary for government debt, authorities should be concerned about the effects the higher debt has on the economy.”

Despite the government’s distribution of shopping vouchers valid until Sept. 30, consumer spending in Taiwan was still restrained by the slow economy, as retail sales in the year to August contracted 1.65 percent from a year ago, data from the Ministry of Economic Affairs showed on Sept. 22.

Meanwhile, unemployment rate reached a record high of 6.13 percent last month and nominal wages dropped 6.72 percent to NT$39,872 in July from a year ago, indicating that consumers are more inclined to increase their savings than spend money.

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new