The nation’s manufacturers and service providers turned increasingly conservative about their business prospects in the coming six months as external demand for electronic products rebounded slightly and the service sector saw business volume dipping last month, a survey by a local economic think tank showed yesterday.

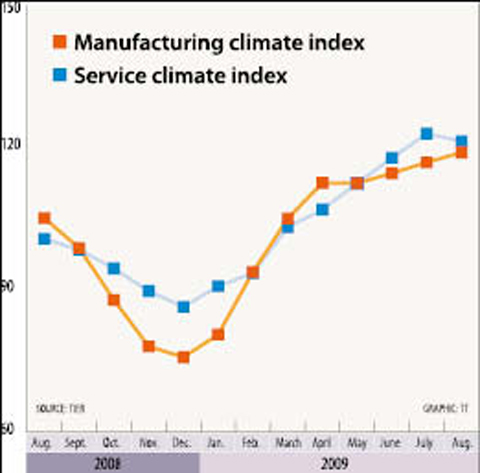

The survey, conducted by the Taiwan Institute of Economic Research (TIER, 台經院), on a monthly basis, put the climate gauge for the manufacturing sector at 118.89 points last month, up 2.09 points from 116.8 in July.

Chen Miao (陳淼), director of TIER’s macroeconomic forecasting division, said the latest data showed a modest and steady pickup in demand for electronic machines and components, although the global economy remained weak.

Trade with emerging markets gained stronger momentum when compared with major economies, the institute’s report said.

Against this backdrop, domestic makers with an upbeat sentiment about the coming six months slid to 24.6 percent last month, from 37.8 percent a month earlier, while the number of their pessimistic counterparts climbed to 17.5 percent, from 17 percent, the survey said.

The number of firms with neutral sentiment increased from 45.2 percent to 57.8 percent during the same period, the survey said.

Chen said the change in sentiment fell in line with poor visibility of the economic landscape at home and overseas.

The business climate for the service sector shed 1.62 points to 121.22 last month as the recession continued to check consumer spending, the survey said.

Although the aggregate retail, wholesale and dining turnover edged up 0.26 percent last month, rising food costs caused by Typhoon Morakot weakened profitability for restaurants and cast a shadow on their business outlook, the survey said.

Also, the TAIEX dropped 3.56 percent last month, while daily trade volume slumped 23.76 percent, significantly dampening profits for brokerages, the survey said.

While banks reported improving wealth management revenues, the decline in interest and fee incomes persisted because of a low-interest policy, the survey said.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

Nvidia Corp’s negotiations to invest as much as US$100 billion in OpenAI have broken down, the Wall Street Journal (WSJ) reported, exposing a potential rift between two of the most powerful companies in the artificial intelligence (AI) industry. The discussions stalled after some inside Nvidia expressed concerns about the transaction, the WSJ reported, citing unidentified people familiar with the deliberations. OpenAI makes the popular chatbot ChatGPT, while Nvidia dominates the market for AI processors that help develop such software. The companies announced the agreement in September last year, saying at the time that they had signed a letter of intent for a strategic