Bank of East Asia Ltd (東亞銀行), Hong Kong’s third-biggest lender by market value, said first-half profit rose 49 percent as a stock market recovery spurred trading revenue.

Net income in the six months ended June 30 rose to HK$1.17 billion (US$151 million), or HK$0.64 a share, from a restated HK$785 million, or HK$0.43 a share, a year earlier, the bank said in a statement yesterday. Profit beat the HK$1 billion median estimate of seven analysts surveyed by Bloomberg.

Chairman David Li (李國寶), 70, vowed in March to rein in spending to help the bank recover from its first loss in four decades, caused by HK$1 billion in impairment charges and a 23 percent jump in expenses. Operating costs were little changed from the previous six months at HK$3.04 billion, the bank said.

Bank of East Asia “has controlled costs in a difficult economic environment,” said Nick Lord, an analyst at Macquarie Securities Ltd who has an “outperform” rating on Bank of East Asia, before the announcement.

The bank’s shares reversed earlier losses and gained 2.2 percent at 2:36pm after falling in morning trading. The stock has risen 77 percent this year, the third-best performance among 11 Hong Kong-traded financial companies tracked by the Hang Seng Finance Index, which rose 42 percent over the same period.

The bank posted a HK$746 million loss in the second half of last year after bad-loan charges more than doubled. It booked HK$3.5 billion of losses last year after selling all its holdings of collateralized debt obligations (CDOs). CDOs, which repackage bonds, loans and credit-default swaps and use the income to pay investors, plunged as lending froze after the collapse of Lehman Brothers Holdings Inc.

Year-earlier figures were restated because of “unauthorized manipulation” of the valuation of equity derivatives held by the bank, the statement said.

Bank of East Asia yesterday predicted a “continued recovery” in the global economy in the second half as the US starts to emerge from a housing-led slump.

The bank said impairment losses rose to HK$493 million from HK$315 million a year earlier. It made a gain of HK$874 million from trading, compared with a loss of HK$213 million. Net interest income fell to HK$3.23 billion in the first half from HK$3.48 billion a year earlier, while net fee and commission income dropped to HK$1.01 billion from HK$1.19 billion.

Operating profit from the bank’s mainland Chinese operation fell to HK$731 million from HK$842 million as non-interest income declined 35 percent to HK$184 million.

The bank and rivals such as HSBC Holdings Plc have been expanding in China in the past two years as the nation’s booming economy drove demand for loans and investment products.

Bank of East Asia, the first foreign lender to issue debit cards in China, last month raised 4 billion yuan (US$586 million) in Hong Kong selling bonds denominated in the currency for the first time. It also aims to sell shares in Shanghai by the second half of next year, deputy chief executive officer Brian Li (李民斌) said this month.

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

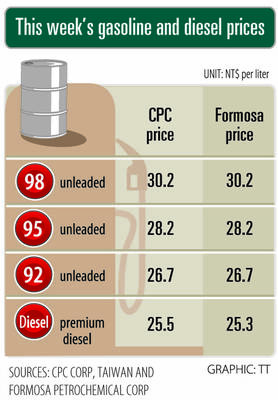

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01